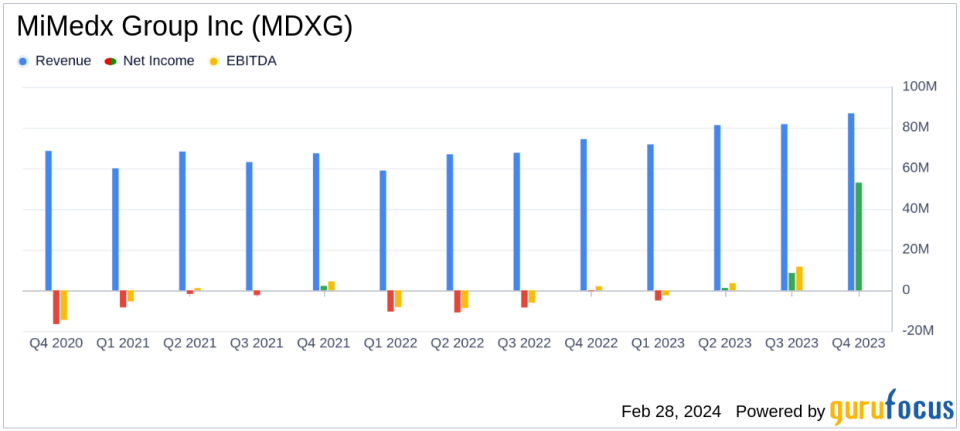

MiMedx Group Inc (MDXG) Reports Strong Year-Over-Year Sales Growth and Net Income Surge in Q4 ...

Net Sales: Increased by 17% in Q4 and 20% for the full year 2023.

Net Income: Reported at $53 million in Q4, including a $40 million one-time tax benefit.

Adjusted EBITDA: Reached $21 million in Q4, representing 24% of net sales.

Gross Margin: Improved to 84.1% in Q4 from 80.7% in the previous year.

Operating Expenses: SG&A expenses increased slightly due to higher sales volumes and commissions.

Cash and Cash Equivalents: Grew to $82 million as of December 31, 2023, from $66 million the previous year.

Financial Outlook: Anticipates low double-digit net sales percentage growth and Adjusted EBITDA margin above 20% for 2024.

On February 28, 2024, MiMedx Group Inc (NASDAQ:MDXG) released its 8-K filing, disclosing its fourth quarter and full year 2023 operating and financial results. The company, known for its regenerative biomaterial products and bioimplants derived from human tissues, has shown a remarkable performance in terms of sales growth and profitability.

Company Overview

MiMedx Group Inc develops and markets regenerative biomaterial products and bioimplants made from human amniotic membrane, birth tissues, and human skin & bone. Its products, including EpiFix and AmnioFix, are primarily targeted towards the wound-care, burn, surgical, sports medicine, and orthopedics markets. The company also sells allografts for ophthalmic surgery and dental applications through licenses to third parties.

Financial Performance and Challenges

The company's net sales for the fourth quarter of 2023 were $87 million, a 17% increase from the same period in 2022. For the full year, net sales reached $321 million, marking a 20% growth. This growth was attributed to solid contributions in both the Wound & Surgical end markets and across various sites of service. The impressive top-line growth and profitability have been driven by improved alignment and focus within the company, according to CEO Joseph H. Capper.

Despite these achievements, MiMedx Group Inc faces the ongoing challenge of maintaining its growth trajectory in a competitive and dynamic market. The company's ability to continue innovating and effectively managing its resources will be crucial for sustaining its financial health and market position.

Key Financial Metrics

Gross profit for Q4 2023 was $73 million, with a gross margin of 84.1%, reflecting an improvement from the previous year's 80.7%. This increase was driven by favorable product mix and execution on yield improvement projects. Adjusted EBITDA for the quarter was $21 million, or 24% of net sales, showcasing the company's ability to manage its earnings before interest, taxes, depreciation, and amortization effectively.

Operating expenses, including selling, general, and administrative expenses, totaled $54 million for Q4 2023, a slight increase from the previous year due to higher sales volumes and commissions. Research and development expenses remained flat at $13 million for the full year, indicating a consistent investment in product innovation.

Net income from continuing operations for Q4 and the full year ended December 31, 2023, were significantly higher than the previous year, mainly due to a $37 million income tax provision benefit. This benefit was a result of a non-cash reversal of a valuation allowance previously recorded against the deferred tax asset balance.

The company's cash and cash equivalents as of December 31, 2023, stood at $82 million, an increase from $66 million at the end of 2022. This improvement in liquidity positions MiMedx Group Inc well for future investments and growth initiatives.

Management Commentary

"We are once again pleased to report on another impressive quarter of top-line growth, profitability and cash flow generation as we closed out a transformative 2023, driven by the improved alignment and focus of the Company. Moreover, the 20% top-line growth we achieved for the full-year 2023 exceeded expectations and provides solid momentum going forward. Additionally, in a very short period of time, the team has successfully unlocked robust cash flow generation that should continue to improve with scale over time." - Joseph H. Capper, MIMEDX Chief Executive Officer.

Financial Tables and Analysis

The financial tables provided in the earnings report give a detailed view of MiMedx Group Inc's balance sheet, income statement, and cash flow statement. The data indicates a strong financial position with increased net sales, net income, and cash reserves. The company's strategic focus on its core business areas and effective cost management has contributed to its financial success.

Looking ahead, MiMedx Group Inc anticipates another year of growth with low double-digit net sales percentage growth and an Adjusted EBITDA margin above 20% for 2024. The company's improved cash flow generation and balance sheet enhancements are expected to support its growth plan and capitalize on market opportunities.

For a more detailed analysis and to stay updated on MiMedx Group Inc's financial performance, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from MiMedx Group Inc for further details.

This article first appeared on GuruFocus.