Mirati's (MRTX) Q3 Loss Narrows, Sales Miss Expectations

Mirati Therapeutics MRTX reported a loss of $2.49 per share for third-quarter 2023, which was narrower than the Zacks Consensus Estimate of a loss of $2.92 as well as the year-ago quarter’s loss of $3.09 per share.

Mirati reported $16.4 million in revenues for the third quarter, missing the Zacks Consensus Estimate of $19.02 million. Mirati had recorded revenues of $5.4 million in the year-ago quarter.

Quarter in Detail

Third-quarter revenues comprised $16.4 million as product revenues from Krazati/adagrasib, Mirati’s new cancer drug, compared with $13.4 million in the previous quarter. The FDA approved Krazati, a KRAS G12C inhibitor, to treat adult patients with KRASG12C-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC) in December 2022. No product revenues were recorded in the year-ago quarter.

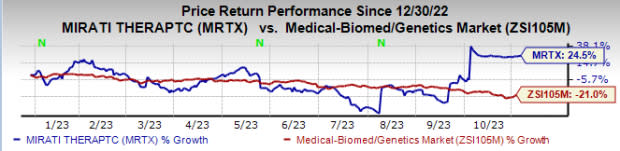

So far this year, the stock price of Mirati has risen 24.5% against the industry’s 21% decline.

Image Source: Zacks Investment Research

There were no license and collaboration revenues in the quarter compared with $5.4 million in the year-ago quarter.

Research and development expenses declined 12.4% from the prior-year quarter’s level to $114.8 million. This decrease was due to a reduction in clinical development costs for sitravatinib as the company scrapped the development of the candidate, and a decline in share-based compensation.

Selling, general and administrative expenses rose 18.4% from the year-ago quarter’s level to $72.0 million due to an increase in commercial-related costs to support the marketing and sales of Krazati and higher headcount-related costs.

Cash, cash equivalents and short-term investments as of Sep 30, 2023 were $976.4 million compared with $779.4 million as of Jun 30, 2023.

In July 2023, Bristol Myers BMY offered to buy Mirati in an all-cash transaction for $58 per share, aggregating to $4.8 billion. Existing shareholders are also eligible to receive a non-tradeable contingent value right (“CVR”) per share, entitling the holder to receive an additional $12 per share. The CVR adds another $1 billion to the transaction, bringing the deal's total value up to $5.8 billion. The transaction is anticipated to close by the first half of 2024, pending approval of shareholders as well as other regulatory approvals.

Pipeline Update

A regulatory filing for Krazati is under review in Europe. In July, the European Medicine Agency’s Committee for Medicinal Products for Human Use (CHMP) gave a negative opinion regarding the granting of conditional marketing authorization to Krazati. The CHMP mentioned that though the drug has a favorable risk-benefit profile, it does not meet certain requirements for conditional approval. A re-examination of CHMP’s opinion is ongoing.

Mirati is evaluating the expanded use of adagrasib — both as monotherapy and combinations — in multiple cohorts of the phase I/II KRYSTAL-1 study across multiple solid tumors that harbor KRAS G12C mutations. These include a combination of Krazati with Merck’s MRK Keytruda in NSCLC and Krazati with Bristol-Myers’ Erbitux (cetuximab) in advanced colorectal cancer (CRC). Mirati is on track to complete the supplemental new drug application for third-line and beyond CRC in patients with a KRAS G12C mutation by year-end 2023.

A phase III registrational study is also ongoing in second-line CRC called KRYSTAL-10, which compares the efficacy of Krazati in combination with Bristol-Myers’ Erbitux (cetuximab) versus standard-of-care chemotherapy. Enrollment is complete in the KRYSTAL-10 study. However, enrollment continues in the phase III KRYSTAL-12 study, which is evaluating Krazati versus docetaxel in second-line NSCLC patients. Top-line results from these studies are expected in 2024.

Last week, Mirati announced a collaboration deal with Kura Oncology KURA to study a combination of KO-2806, Kura Oncology’s next-generation farnesyl transferase inhibitor (FTI), and adagrasib for KRAS G12C-mutated NSCLC. Some preclinical data showed that combining adagrasib with an FTI can lead to better patient outcomes. A phase I study of KO-2806 plus adagrasib is expected to begin dosing patients by mid-2024. While Kura will sponsor this phase I study, Mirati will supply Kura with adagrasib for the study.

Zacks Rank

Mirati currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Mirati Therapeutics, Inc. Price and Consensus

Mirati Therapeutics, Inc. price-consensus-chart | Mirati Therapeutics, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Mirati Therapeutics, Inc. (MRTX) : Free Stock Analysis Report

Kura Oncology, Inc. (KURA) : Free Stock Analysis Report