Mirum (MIRM) Banks on Livmarli Sales Despite Recent Setback

Mirum Pharmaceuticals, Inc. MIRM develops novel therapies for treating rare liver diseases affecting children and adults. The company’s lead product, Livmarli (maralixibat), an orally administered ileal bile acid transporter (“IBAT”) inhibitor, is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome (ALGS) worldwide.

Sales of Livmarli have been rising steadily since its approval and launch worldwide. In the first nine months of 2023, Livmarli generated sales worth $100.3 million, reflecting an increase of 112.5% on a year-over-year basis.

Earlier this month, the company outlined key strategic priorities that it looks to achieve in 2024 while also providing preliminary revenues for full-year 2023.

For full-year 2023, preliminary net product sales of Livmarli were around $141-$143 million, reflecting an increase of 89% on a year-over-year basis.

Total preliminary net product sales were $69-$71 million in the fourth quarter of 2023, including Livmarli net sales of $41-$43 million.

Mirum is currently seeking a label expansion of Livmarli for the treatment of cholestatic pruritus in progressive familial intrahepatic cholestasis (“PFIC”) patients three months of age and older. A supplemental new drug application (sNDA) for Livmarli in PFIC is currently under review in the United States, with a decision from the FDA expected on Mar 13, 2024. The company has also filed a similar application for Livmarli with the European Marketing Agency.

The company is also looking to expand the label of Livmarli in ALGS to include infants aged three months and older in the United States.

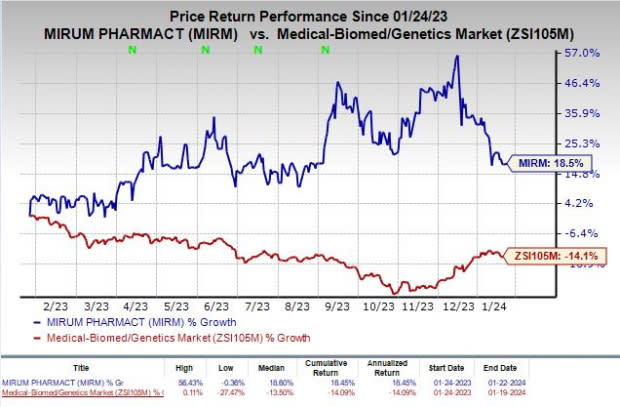

Shares of Mirum have rallied 18.5% in the past year against the industry’s decline of 14.1%.

Image Source: Zacks Investment Research

Notably, in August 2023, Mirum acquired all the assets of Travere Therapeutics’ bile acid products, which added two other products to its commercial portfolio — Cholbam (cholic acid) capsules and Chenodal (chenodiol) tablets.

Cholbam is approved for treating bile acid synthesis disorders and Zellweger spectrum disorders. While Chenodal is not currently approved for cerebrotendinous xanthomatosis (“CTX”), it has received a medical necessity medicine status from the FDA for the same.

Preliminary net product sales from these two products were approximately $28 million in the fourth quarter of 2023.

A new drug application seeking traditional approval for Chenodal in CTX is expected to be filed in the first half of 2024.

Mirum is developing volixibat, an oral IBAT inhibitor, in two separate phase IIb studies for the treatment of primary sclerosing cholangitis and primary biliary cholangitis. Interim analysis results from both studies are expected in the first half of 2024.

The continued demand for Livmarli and the addition of Cholbam and Chenodal help Mirum diversify its revenue stream and establish a leading pediatric hepatology franchise. However, in December 2023, the company faced a major setback when the phase IIb EMBARK study, which evaluated Livmarli in patients with biliary atresia, failed to meet the primary endpoint. We are also concerned about Mirum’s heavy dependence on Livmarli for revenues. Any further regulatory setback for the drug will hurt the company’s growth prospects in the days ahead.

Mirum Pharmaceuticals, Inc. Price and Consensus

Mirum Pharmaceuticals, Inc. price-consensus-chart | Mirum Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Mirum currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Regeneron Pharmaceuticals, Inc. REGN, CytomX Therapeutics, Inc. CTMX and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Regeneron’s 2024 earnings per share have improved from $41.57 to $43.97. In the past year, shares of REGN have rallied 29.5%.

Earnings of Regeneron beat estimates in each of the trailing last four quarters. REGN delivered a four-quarter average earnings surprise of 12.34%.

In the past 60 days, estimates for CytomX Therapeutics’ 2024 loss per share have narrowed from 22 cents to 6 cents. In the past year, shares of CTMX have plunged 40.7%.

CytomX Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. CTMX delivered a four-quarter earnings surprise of 45.44%, on average.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have risen 9.2%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Mirum Pharmaceuticals, Inc. (MIRM) : Free Stock Analysis Report