Mission Produce Inc (AVO) Reports Record First Quarter Fiscal 2024 Results

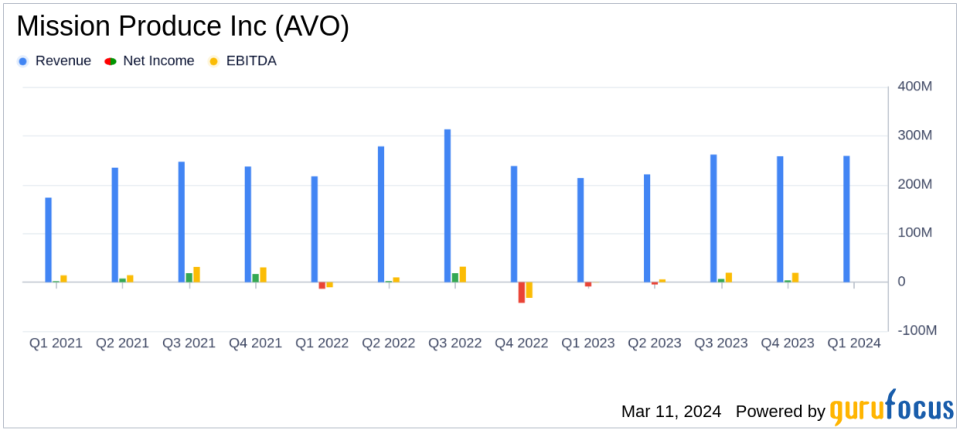

Total Revenue: Increased by 21% to $258.7 million year-over-year.

Net Income: Achieved breakeven compared to a net loss of $(8.8) million in the same period last year.

Adjusted Net Income: Improved to $6.7 million, or $0.09 per diluted share.

Adjusted EBITDA: Grew substantially to $19.2 million from $2.3 million year-over-year.

Gross Margin: Expanded by 690 basis points to 11.1% of revenue.

Segment Performance: Marketing & Distribution and Blueberries segments drove profitability.

On March 11, 2024, Mission Produce Inc (NASDAQ:AVO) released its 8-K filing, announcing a strong start to fiscal 2024 with record first quarter financial results. The company, a global leader in sourcing, producing, and distributing fresh Hass avocados, with additional offerings in mangos and blueberries, reported significant growth in revenue and a remarkable improvement in profitability.

Mission Produce Inc's operating segments include Marketing and Distribution and International Farming and Blueberries, with the former being the primary revenue driver. The company's comprehensive services, including ripening, bagging, custom packing, and logistical management, cater to a diverse customer base across retail, wholesale, and foodservice sectors.

Fiscal First Quarter 2024 Performance

The company's total revenue for the quarter saw a 21% increase to $258.7 million, primarily driven by a 23% rise in average per-unit avocado selling prices, despite flat avocado volumes. The gross profit surged by $19.7 million to $28.7 million, with the gross profit percentage reaching 11.1% of revenue, up by 690 basis points compared to the same period last year. This improvement was spurred by strength in avocado margins in the Marketing & Distribution segment and record quarterly revenues in the Blueberries segment due to favorable pricing conditions.

Steve Barnard, CEO of Mission, highlighted the company's solid execution across all business facets, leading to a significant improvement in adjusted EBITDA performance year-over-year. He also noted the focus on cost savings measures within the company's farming and packing operations, particularly in the International Farming segment, which is expected to benefit the second half of the fiscal year.

Our improved overall performance is a direct result of the actions we are taking to optimize our business and enhance profitability, and it is expected to result in a meaningful step-up in free cash flow generation in 2024."

Financial Highlights and Challenges

Despite the impressive revenue growth, Mission Produce Inc faced challenges such as industry supply constraints, which, however, contributed to higher average sales prices for mangos and blueberries. The company's net income reached a breakeven point, a significant improvement from the net loss of $(8.8) million in the same period last year. Adjusted net income stood at $6.7 million, or $0.09 per diluted share, compared to an adjusted net loss of $(5.0) million, or $(0.07) per diluted share, for the same period last year.

From a balance sheet perspective, cash and cash equivalents were $39.9 million as of January 31, 2024, slightly down from $42.9 million as of October 31, 2023. The company's capital expenditures were $9.9 million for the fiscal quarter, a decrease from $17.6 million last year, reflecting a disciplined approach to capital allocation.

Outlook and Industry Trends

Looking ahead, Mission Produce anticipates avocado volumes to remain relatively flat in the fiscal 2024 second quarter versus the prior year period. However, avocado pricing is expected to be slightly higher sequentially and be approximately 10-15% higher than the $1.30 per pound average experienced in the second quarter of fiscal 2023. The company also expects a decline in sales pricing for blueberries in the fiscal second quarter due to increased industry volume.

The company's performance is a testament to its strategic positioning and operational efficiency in the Retail - Defensive industry. The ability to navigate supply constraints and optimize margins is crucial for companies like Mission Produce Inc, as it directly impacts profitability and cash flow generation, which are key metrics for value investors.

For more detailed information on Mission Produce Inc's financial results and future expectations, investors and interested parties are encouraged to review the full earnings release and listen to the conference call and webcast.

For further insights and analysis on Mission Produce Inc (NASDAQ:AVO) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Mission Produce Inc for further details.

This article first appeared on GuruFocus.