MISTRAS Group Inc Reports Mixed Results for Q4 and Full Year 2023

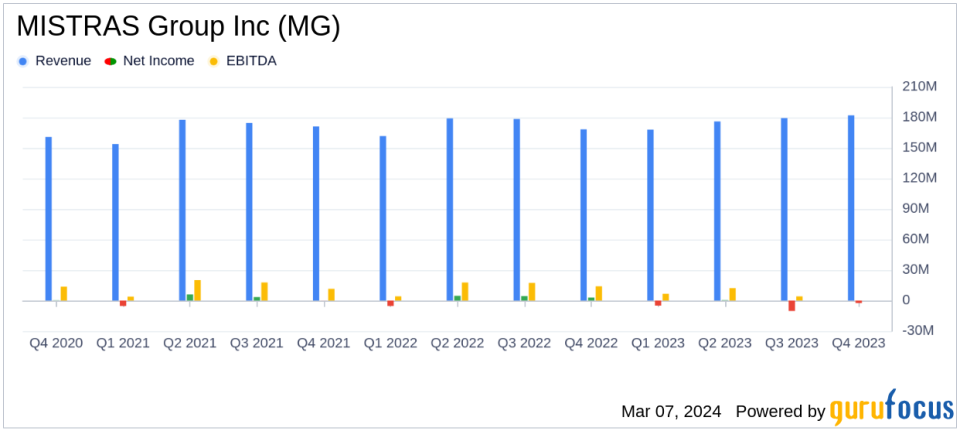

Revenue Growth: Q4 2023 revenue increased by 8.2% to $182.1 million, and full-year revenue rose by 2.6% to $705.5 million.

Net Loss: Q4 2023 reported a net loss of $2.5 million, and full-year net loss totaled $17.5 million, primarily due to reorganization costs and a non-cash goodwill impairment charge.

Adjusted EBITDA: Q4 2023 Adjusted EBITDA grew by 22.0% to $19.2 million, while full-year Adjusted EBITDA increased by 13.2% to $65.8 million.

Free Cash Flow: Full-year Free Cash Flow was $3.1 million, a decrease from the previous year's $13.0 million, reflecting increased capital expenditures for strategic growth.

Debt Position: Gross debt slightly decreased to $190.4 million as of December 31, 2023, from $191.3 million the previous year.

On March 6, 2024, MISTRAS Group Inc (NYSE:MG) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading provider of asset protection solutions, reported an increase in revenue but faced a net loss due to significant reorganization and other costs.

MISTRAS Group Inc operates in the Business Services industry, focusing on evaluating the structural integrity and reliability of critical energy, industrial, and public infrastructure. The company's key revenue is derived from its Services segment, which provides non-destructive testing and inspection primarily in North America.

Financial Performance and Challenges

The company's revenue growth was led by increases in the Oil & Gas, Aerospace and Defense, and Industrials industries. However, the gross profit margin decreased by 80 basis points to 29.5% due to an unfavorable sales mix and higher employee benefit credits in the prior year. Selling, general and administrative expenses rose marginally by 1.7% due to higher foreign currency exchange losses and other discrete items.

The net loss for Q4 2023 was impacted by reorganization and related costs of $6.3 million, along with $1.2 million of foreign currency exchange losses. The full-year net loss was primarily due to these reorganization costs and a $13.8 million non-cash goodwill impairment charge.

Strategic Initiatives and Outlook

The company's management expressed confidence in the effectiveness of Project Phoenix initiatives to improve profitability and Adjusted EBITDA. Edward Prajzner, Senior Executive Vice President and Chief Financial Officer, stated:

"Fourth quarter results clearly demonstrate that we can drive significant bottom line growth by leveraging improved sales efficiency and enhanced operational productivity."

For 2024, MISTRAS Group Inc anticipates revenue between $725-$750 million and Adjusted EBITDA between $84-$89 million, with Free Cash Flow expected to be between $34-$38 million.

Conclusion

While MISTRAS Group Inc faces challenges, including a net loss and decreased gross profit margin, the company's strategic initiatives and focus on operational efficiency provide a positive outlook for 2024. The company's commitment to asset protection solutions and its ability to adapt to industry demands will continue to be critical for its success.

Investors and potential GuruFocus.com members interested in the Business Services sector may find MISTRAS Group Inc's journey through strategic reorganization and its future prospects worth following.

Explore the complete 8-K earnings release (here) from MISTRAS Group Inc for further details.

This article first appeared on GuruFocus.