Mitek Systems Inc (MITK) Reports Record Revenue and Earnings for Fiscal 2023

Total Revenue: Increased by 19% to a record $172.6 million for fiscal 2023.

GAAP Net Income: Surged by 117% to $8.0 million, or $0.17 per diluted share.

Non-GAAP Operating Margin: Rose to 31%, reflecting efficient operations.

Cash Flow from Operations: Grew by 50% to $31.6 million, indicating strong liquidity.

Q4 Performance: Experienced a 5% year-over-year decrease in total revenue, with a GAAP net loss of $1.4 million.

Fiscal 2024 Guidance: Reiterated with expected revenue growth and a non-GAAP operating margin between 30.0% and 31.0%.

On March 19, 2024, Mitek Systems Inc (NASDAQ:MITK) released its 8-K filing, announcing its financial results for the fourth quarter and full fiscal year ended September 30, 2023. The company, a global leader in digital identity and fraud prevention, reported a significant increase in revenue and earnings, underscoring its successful fiscal year.

Mitek Systems Inc is known for its innovative software solutions in mobile imaging, artificial intelligence, and machine learning. Serving over 7,800 financial services organizations and leading brands, Mitek's products like Mobile Deposit and Mobile Verify have become essential tools in the digital financial landscape.

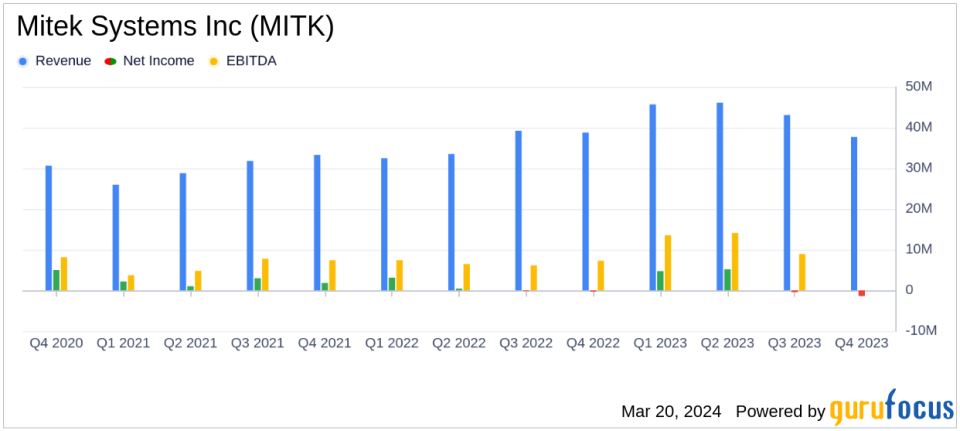

Fiscal Year 2023 Financial Overview

The company's total revenue for fiscal 2023 reached a record high of $172.6 million, marking a 19% increase year over year. This growth was driven by a 20% increase in Deposit revenue and a 17% increase in Identity revenue. Mitek's GAAP operating income also saw a substantial rise of 28% to $15.6 million, reflecting an operating margin of 9%. The GAAP net income soared by 117% to $8.0 million, or $0.17 per diluted share, demonstrating the company's profitability.

Non-GAAP figures were equally impressive, with operating income climbing 20% to $53.2 million and net income up 10% to a record $44.4 million, or $0.95 per diluted share. The company's cash flow from operations increased by 50% to $31.6 million, and total cash and investments grew by 34% to $134.9 million at the end of the fiscal year.

Challenges and Q4 Performance

Despite the overall strong performance, Mitek faced challenges in the fourth quarter of 2023. Total revenue decreased by 5% year over year to $37.7 million. The GAAP operating loss was $3.3 million, compared to an operating income of $3.8 million in the same quarter of the previous year. The GAAP net loss for the quarter was $1.4 million, or $0.03 per diluted share, a decline from a net income of $0.4 million, or $0.01 per diluted share, in fiscal fourth quarter 2022.

Non-GAAP figures for the quarter also reflected a downturn, with operating income at $5.3 million and net income decreasing by 30% year over year to $6.9 million, or $0.15 per diluted share. The cash flow from operations for the quarter decreased by 32% year over year to $3.5 million.

Looking Forward to Fiscal 2024

CEO Max Carnecchia commented on the results, emphasizing the record revenue and profitability driven by innovation and strong cash flow that has bolstered the balance sheet. The net revenue retention rate was approximately 117% for the fiscal year, indicating customer satisfaction and loyalty.

"In fiscal 2023, we delivered record revenue and profitability, driven by our commitment to innovation. With Deposit revenue up 20% and Identity revenue up 17% year over year, we've achieved remarkable growth. Our strong cash flow has further bolstered our balance sheet, while our net revenue retention rate was approximately 117% for the fiscal year, showcasing the value of our solutions and dedication to customer success."

For fiscal 2024, Mitek reiterates its guidance, expecting full-year revenue to be in the range of $180.0 million to $185.0 million. The company also anticipates a non-GAAP operating margin for fiscal 2024 to be between 30.0% and 31.0%.

The company's balance sheet remains robust with an increase in cash and cash equivalents, and investments. The focus on innovation and customer success positions Mitek for continued growth in the evolving digital landscape.

Investors and analysts are encouraged to join the conference call and live webcast hosted by Mitek management to discuss the financial results and future outlook.

For a detailed understanding of Mitek's financial position, readers are invited to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Mitek Systems Inc for further details.

This article first appeared on GuruFocus.