Mitsui & Co Ltd's Dividend Analysis

Understanding the Dividend Prospects of Mitsui & Co Ltd

Mitsui & Co Ltd (MITSF) recently announced a dividend of $85 per share, payable on an undisclosed future date, with the ex-dividend date set for 2024-03-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Mitsui & Co Ltd's dividend performance and assess its sustainability.

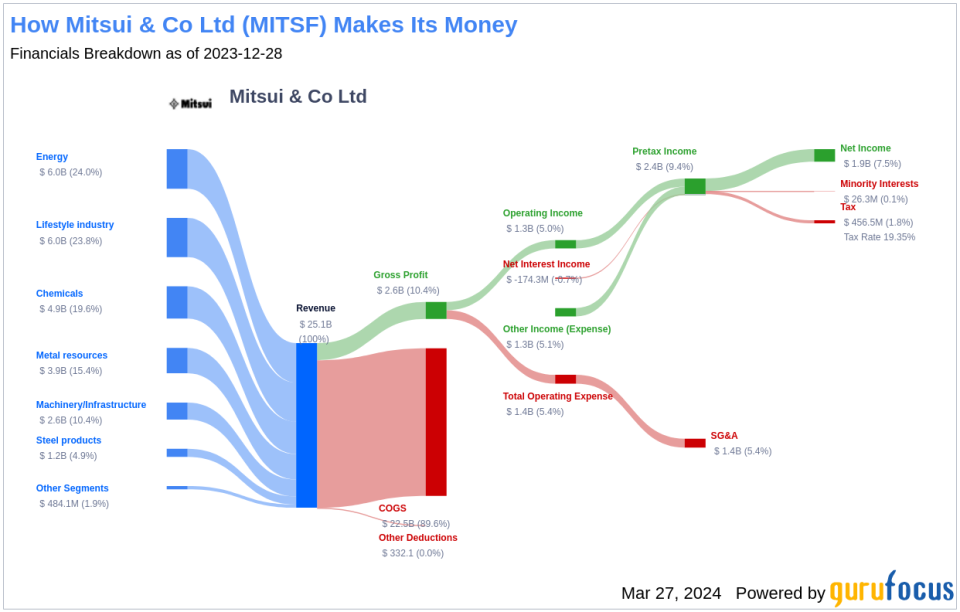

What Does Mitsui & Co Ltd Do?

Warning! GuruFocus has detected 10 Warning Signs with MITSF.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Mitsui & Co Ltd is a diversified corporation with a global presence in various sectors such as iron and steel, mineral and metal resources, machinery and infrastructure, chemicals, energy, lifestyle, and innovation. The company is involved in resource development, holding minority interests in several key projects around the world. These projects encompass a broad spectrum of resources, including iron ore and coal in Australia, copper in Chile, and oil and gas across Asia, the Middle East, and the United States.

A Glimpse at Mitsui & Co Ltd's Dividend History

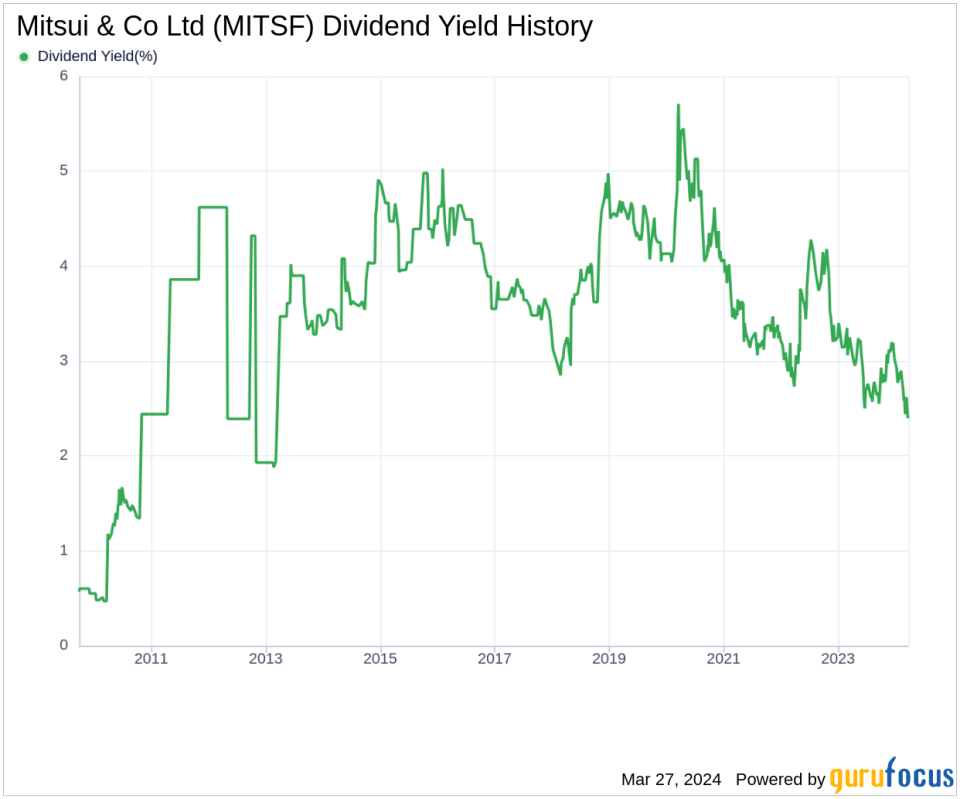

Mitsui & Co Ltd has upheld a steady track record of dividend payments since 2007, with disbursements occurring bi-annually. This consistent payout history is a vital indicator of the company's commitment to returning value to shareholders. Below is a chart depicting the annual Dividends Per Share to track historical trends.

Breaking Down Mitsui & Co Ltd's Dividend Yield and Growth

As of today, Mitsui & Co Ltd boasts a 12-month trailing dividend yield of 2.35% and a 12-month forward dividend yield of 2.64%, indicating anticipated growth in dividend payments over the next year. Over the past three years, Mitsui & Co Ltd has experienced an annual dividend growth rate of 20.50%, which moderates to 13.00% over a five-year span. Looking at the past decade, the growth rate of annual dividends per share is a solid 9.20%.

Considering Mitsui & Co Ltd's dividend yield and five-year growth rate, the 5-year yield on cost is approximately 4.33%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a crucial metric in evaluating dividend sustainability. Mitsui & Co Ltd's ratio of 0.27 suggests a healthy balance between distributing earnings and retaining capital for future investments. The company's profitability rank of 7 out of 10, as of 2023-12-31, reflects its strong earnings potential in comparison to industry peers, further supporting the reliability of its dividend payments.

Growth Metrics: The Future Outlook

For dividends to be maintained, a company must demonstrate solid growth prospects. Mitsui & Co Ltd's growth rank of 7 out of 10 signals a favorable growth trajectory. The company's revenue per share and 3-year revenue growth rate of 23.10% per year surpasses 82.81% of global competitors, indicating a robust revenue model. Furthermore, Mitsui & Co Ltd's 3-year EPS growth rate of 38.80% per year outperforms 75.27% of global competitors, and its 5-year EBITDA growth rate of 26.40% outperforms 80.95% of global peers.

Next Steps

In conclusion, Mitsui & Co Ltd's upcoming dividend payment, robust dividend growth rate, conservative payout ratio, and solid profitability and growth metrics paint a promising picture for investors seeking reliable income streams. As the company continues to navigate the complexities of the global market, these financial health indicators suggest that Mitsui & Co Ltd is well-positioned to sustain its dividend payments. Value investors may find Mitsui & Co Ltd an attractive option for their portfolios, considering the company's commitment to shareholder returns and its potential for continued growth. For those looking to expand their income-generating investments, GuruFocus Premium users can utilize the High Dividend Yield Screener to discover more high-dividend yield opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.