MiX Telematics Reports Growth in Revenue and Subscriber Base in Q3 FY2024

Net Subscriber Additions: 52,400 new subscribers, total base now exceeds 1.1 million.

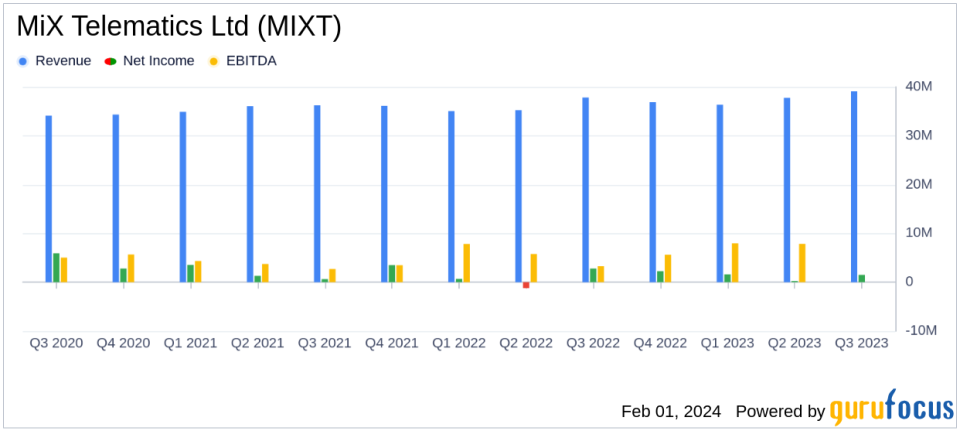

Total Revenue: $39.1 million, a 6% year-over-year increase on a constant currency basis.

Subscription Revenue: $33.7 million, representing a 6% year-over-year rise on a constant currency basis.

Net Income: Reported at $1.5 million for the quarter.

Adjusted EBITDA: Increased by 13% year-over-year to $9.5 million, with an adjusted EBITDA margin of 24.4%.

Cash Position: Cash and cash equivalents stood at $25.4 million at the end of the quarter.

On February 1, 2024, MiX Telematics Ltd (NYSE:MIXT), a global leader in connected fleet management solutions, announced its financial results for the third quarter of fiscal year 2024, which ended December 31, 2023. The company, which offers a suite of fleet and mobile asset management solutions delivered as Software-as-a-Service (SaaS), saw a significant increase in its subscriber base and steady revenue growth. MiX Telematics primarily generates its revenue from Africa and has a strong presence in the Americas, Middle East, Australasia, Europe, Brazil, and through its Central Services Organization (CSO). The company's latest financial performance can be reviewed in detail through its 8-K filing.

Performance and Challenges

MiX Telematics experienced robust growth in its subscriber base, adding 52,400 net subscribers, which CEO Stefan Joselowitz attributed to strong performance in the Africa segment and global demand for the company's solutions. This growth is critical as it indicates the company's expanding market presence and potential for recurring revenue. However, the company faced challenges due to currency fluctuations, particularly the weakening of the South African Rand against the U.S. Dollar, which negatively impacted reported revenue figures.

Financial Achievements

The company's financial achievements, including a 6% year-over-year increase in total revenue and subscription revenue on a constant currency basis, are significant indicators of its solid business model and market demand for SaaS-based fleet management solutions. The adjusted EBITDA margin improvement to 24.4% reflects MiX Telematics' ability to scale efficiently and maintain cost discipline.

Financial Metrics and Importance

Key financial metrics from the earnings report include a net income of $1.5 million and earnings per diluted ordinary share of 0.3 U.S. cents. The adjusted EBITDA of $9.5 million, up 13% year-over-year, demonstrates the company's profitability and operational efficiency. These metrics are important as they provide insight into the company's financial health and its ability to generate profit while managing expenses.

"We delivered a strong third quarter and added a record number of net subscribers, bringing our total base to over 1.1 million," said MiX Telematics CEO Stefan Joselowitz. "Our Africa segment was the primary subscription-growth driver, while continued demand for our solutions globally also resulted in strong hardware revenues. We maintained strict cost discipline throughout our organization, driving further expansion of our adjusted EBITDA margin."

Analysis of Company's Performance

MiX Telematics' performance in the third quarter of fiscal year 2024 reflects a company that is successfully expanding its subscriber base and growing its top-line revenue. The increase in subscription revenue is particularly encouraging as it suggests a stable and predictable revenue stream. The company's focus on cost control has also paid off, as evidenced by the improved adjusted EBITDA margin. However, the company must continue to navigate currency risks and competitive pressures in the SaaS industry.

For more detailed financial analysis and investment insights, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from MiX Telematics Ltd for further details.

This article first appeared on GuruFocus.