MKS Instruments Inc (MKSI) Exceeds Q4 Revenue Expectations Despite Net Loss

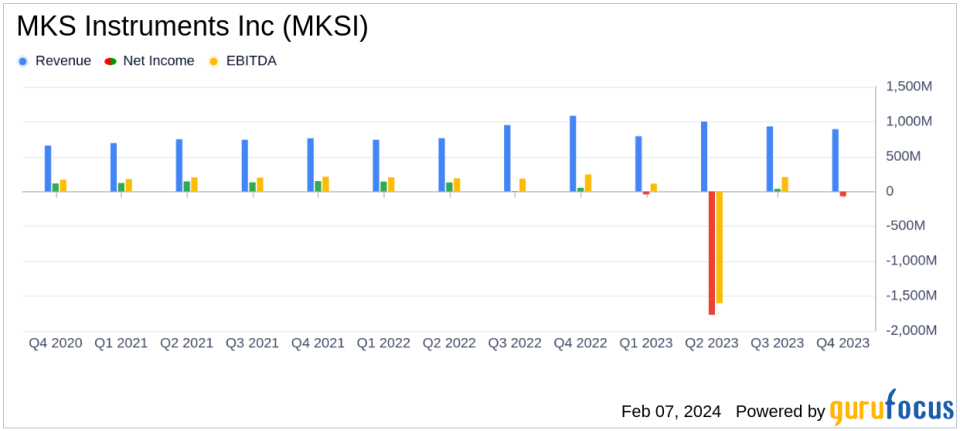

Quarterly Revenue: $893 million, surpassing guidance.

Quarterly GAAP Net Loss: $68 million, with a net loss per share of $1.02.

Non-GAAP Net Earnings Per Diluted Share: $1.17, with Adjusted EBITDA of $218 million.

Debt Management: Over 80% of free cash flow allocated for debt paydown.

Q1 2024 Outlook: Anticipates revenue of $840 million, plus or minus $40 million.

MKS Instruments Inc (NASDAQ:MKSI), a global provider of technologies essential for advanced manufacturing processes, released its 8-K filing on February 7, 2024, detailing its financial performance for the fourth quarter and the full year of 2023. The company's revenue for the quarter reached $893 million, exceeding the high-end of its guidance, despite reporting a GAAP net loss of $68 million, attributed to goodwill and intangible asset impairments. The Non-GAAP net earnings per diluted share stood at $1.17, with Adjusted EBITDA at $218 million, also exceeding expectations.

Company Overview

MKS Instruments Inc is engaged in providing instruments, subsystems, and process control systems crucial for manufacturing processes. The company's diverse product portfolio supports the production of flat panel displays, medical devices, and electronic materials, catering to industrial technologies, semiconductor, life and health sciences, and research and defense markets. MKS operates through three business segments: Vacuum Solutions, Photonics Solutions, and Materials Solutions, with Vacuum Solutions accounting for approximately half of the company's revenue, primarily generated in the United States.

Financial Performance and Challenges

The company's performance in Q4 reflects resilience in a challenging market, with revenue outperforming guidance. However, the reported GAAP net loss, including significant goodwill and intangible asset impairments, underscores the ongoing challenges faced by MKS Instruments. These challenges, such as market demand fluctuations and integration costs from recent acquisitions, may pose problems for future profitability and market position.

Financial Achievements and Industry Significance

MKS Instruments' ability to exceed revenue expectations is a testament to its operational efficiency and the strategic management of its broad portfolio. The company's focus on factory efficiency, operating expense management, and proactive debt management, including a successful refinancing of its term loan A and a voluntary debt prepayment, are particularly noteworthy in the context of the hardware industry, where managing costs and leveraging technological advancements are crucial for maintaining competitive edge.

Key Financial Metrics

The company's financial achievements are further highlighted by key metrics from its financial statements. MKS Instruments reported a gross margin of 46.0% for Q4 2023, with an operating margin of 20.3% on a Non-GAAP basis. The balance sheet shows a strong cash and short-term investments position of $875 million as of December 31, 2023. The company's effective management of its debt is evident, with a significant portion of its free cash flow dedicated to debt reduction.

Management Commentary

We closed the year on a solid note with revenue and Adjusted EBITDA exceeding the high-end of our guidance range, said John T.C. Lee, President and Chief Executive Officer. He further expressed confidence in the company's portfolio and its potential for shareholder value creation in the coming years. Seth H. Bagshaw, Executive Vice President and Chief Financial Officer, highlighted the company's execution on controllable levers, including debt management and cash flow allocation.

Analysis of Company Performance

The company's performance in the fourth quarter, particularly the strong revenue and Adjusted EBITDA, indicates effective strategic management and the ability to navigate a complex market landscape. The Non-GAAP measures, which exclude certain one-time costs and impairments, suggest that the underlying business remains healthy and capable of generating profits. However, the GAAP net loss points to the need for continued vigilance in managing integration and operational efficiencies.

MKS Instruments' outlook for the first quarter of 2024, with expected revenue of $840 million and Non-GAAP net earnings per diluted share of $0.72, reflects cautious optimism amid market uncertainties. The company's strategic focus on debt management and operational efficiency positions it to capitalize on market opportunities as conditions improve.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications of MKS Instruments' financial results on their investment decisions.

Explore the complete 8-K earnings release (here) from MKS Instruments Inc for further details.

This article first appeared on GuruFocus.