Mobileye Global Inc (MBLY) Reports Strong Q4 and Full-Year 2023 Results Amid Inventory Challenges

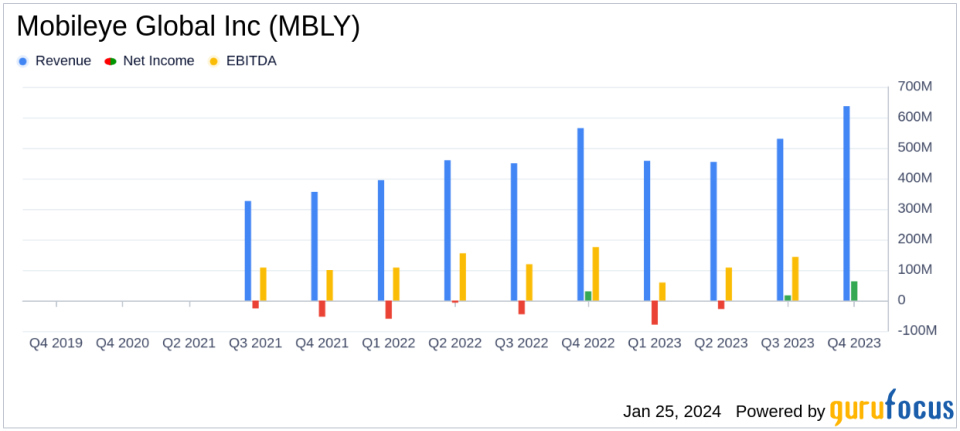

Revenue Growth: Q4 revenue increased by 13% year-over-year to $637 million, with full-year revenue up to $2,079 million.

Gross Profit and Margin: Q4 gross profit rose to $344 million, with a gross margin improvement of 91 basis points to 54.0%.

Operating Efficiency: Operating income for Q4 surged by 204% to $73 million, with operating margin expanding significantly by 721 basis points.

Net Income and EPS: Net income doubled to $63 million in Q4, with both basic and diluted EPS increasing by 105% to $0.08.

Adjusted Financials: Adjusted operating income for Q4 grew by 14% to $247 million, with a slight increase in adjusted operating margin.

2024 Outlook: Mobileye provides 2024 fiscal year guidance with revenue expected between $1,830 million and $1,960 million.

On January 25, 2024, Mobileye Global Inc (NASDAQ:MBLY) released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 30, 2023. The company, a leader in the development and deployment of ADAS and autonomous driving technologies, reported a strong finish to the year despite facing inventory build-up challenges at customer sites, which are expected to impact growth in 2024.

Company Overview

Mobileye Global Inc engages in pioneering technologies for autonomous driving and driver-assistance systems. With a comprehensive suite of software and hardware technologies, including Driver Assist, Mobileye SuperVision, and Chauffeur, the company is at the forefront of the mobility revolution. Mobileye's solutions are integral to the future of autonomous driving, providing capabilities for self-driving systems and vehicles, and leveraging AI-powered road survey technology for data services.

Financial Performance and Challenges

Mobileye's fourth-quarter performance showcased a robust 13% year-over-year increase in revenue to $637 million, with a full-year revenue of $2,079 million. The company's gross profit for Q4 rose to $344 million, marking a 15% increase, while the gross margin improved by 91 basis points to 54.0%. Operating income for the quarter surged by 204% to $73 million, with the operating margin expanding by 721 basis points to 11.5%. Net income for Q4 doubled to $63 million, and both basic and diluted EPS increased by 105% to $0.08.

Despite these strong results, Mobileye's CEO, Prof. Amnon Shashua, acknowledged the overshadowing effect of inventory build-up at customer sites. The company anticipates a very meaningful improvement in Q2 revenue and a normalization of revenue in the second half of 2024. Mobileye remains focused on executing its strategy amidst these challenges.

Strategic Achievements and Industry Importance

Mobileye's financial achievements are significant for the Vehicles & Parts industry, where technological advancements and market leadership are critical. The company secured design wins projected at $7 billion of incremental future estimated revenue for the second consecutive year, with elevated Average System Prices (ASP). The expansion of the vehicle model pipeline for SuperVision and Chauffeur from 9 to approximately 30 models, and significant advanced product program wins, underscore Mobileye's competitive edge and innovation.

Financial Guidance for 2024

Looking ahead, Mobileye provided financial guidance for the 2024 fiscal year, with revenue expected to be between $1,830 million and $1,960 million. The company anticipates an operating loss between $468 million and $378 million, with adjusted operating income projected to be between $270 million and $360 million.

Investor and Analyst Information

Mobileye will host a conference call to review its results and provide a business update. The call will be accessible via a webcast on Mobileye's investor relations site, with a replay available shortly after the event's conclusion.

For a detailed understanding of Mobileye's financial health, the company's balance sheet as of December 30, 2023, shows total assets of $15,577 million and total liabilities of $653 million, with a strong cash and cash equivalents position of $1,212 million. The consolidated cash flows indicate a net cash provided by operating activities of $394 million for the year ended December 30, 2023.

Conclusion

Mobileye's performance in 2023 demonstrates its resilience and strategic prowess in the autonomous driving industry. While inventory challenges pose a near-term hurdle, the company's robust design wins and projected revenue normalization in the latter half of 2024 provide a positive outlook for investors and industry observers alike.

For more detailed information, including reconciliations of GAAP to non-GAAP financial measures, readers are encouraged to review the full 8-K filing.

Stay tuned to GuruFocus.com for the latest financial news and expert analysis on Mobileye Global Inc (NASDAQ:MBLY) and other leading companies.

Explore the complete 8-K earnings release (here) from Mobileye Global Inc for further details.

This article first appeared on GuruFocus.