Mobileye (MBLY) Q4 Earnings & Revenues Surpass Estimates

Mobileye Global Inc. MBLY registered fourth-quarter 2023 adjusted earnings per share of 28 cents, outpacing the Zacks Consensus Estimate and the year-ago quarter’s figure of 27 cents. Total revenues amounted to $637 million, up 13% year over year, beating the Zacks Consensus Estimate of $636 million.

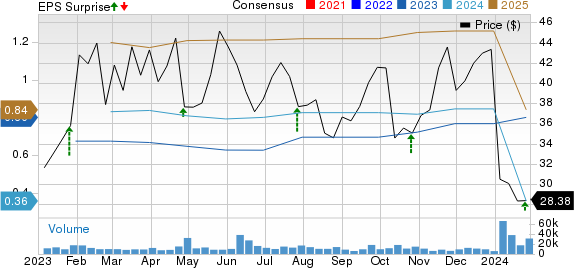

Mobileye Global Inc. Price, Consensus and EPS Surprise

Mobileye Global Inc. price-consensus-eps-surprise-chart | Mobileye Global Inc. Quote

Financials

Mobileye’s gross margin in the fourth quarter of 2023 increased 91 basis points from the prior-year period, driven by reduced costs related to the amortization of intangible assets as a percentage of revenues, partly offset by higher expenses associated with the EyeQ chip. However, adjusted gross margin declined 5 percentage points year over year due to the increased cost of the EyeQ chip.

Adjusted operating margin increased 33 basis points year over year amid revenue growth and decreasing operating expenses as a percentage of revenues.

Mobileye had cash and cash equivalents of $1,212 million as of Dec 30, 2023, up from $1,024 million as of Dec 31, 2022. Operating cash flow for the year (ended Dec 30, 2023) was $394 million. Capex was $98 million during the same timeframe.

2024 Guidance

For the full year of 2024, Mobileye estimates revenues to be in the range of $1,830-$1,960 million. It expects operating loss in the band of $468-$378 million. Amortization of acquired intangible assets is estimated to be around $444 million. Share-based compensation expenses are projected in the range of $294 million. Adjusted operating income is estimated in the band of $270-$360 million.

Zacks Rank & Key Picks

MBLY currently carries a Zacks Rank #4 (Sell).

Some better-ranked players in the auto space are Honda Motor Co., Ltd. HMC, BYD Company Limited BYDDY and Mercedes-Benz Group AG MBGAF. HMC and BYDDY sport a Zacks Rank #1 (Strong Buy) each, while MBGAF carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HMC’s 2024 sales and earnings implies year-over-year growth of 14.8% and 37.3%, respectively. The EPS estimates for 2024 and 2025 have moved up by 7 cents and 3 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for BYDDY’s 2023 sales and earnings suggests year-over-year growth of 36.5% and 70.6%, respectively. The EPS estimate for 2024 has improved by 30 cents in the past seven days.

The Zacks Consensus Estimate for MBGAF’s 2023 sales suggests year-over-year growth of 5.8%. The EPS estimates for 2023 and 2024 have improved by a penny and 30 cents, respectively, in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Mobileye Global Inc. (MBLY) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report