Model N Inc (MODN) Posts Strong Q1 Fiscal 2024 Results with Subscription Revenue Up 8%

Total Revenue: Increased by 7% year-over-year to $63.5 million.

Subscription Revenue: Grew by 8% year-over-year to $47.7 million.

Non-GAAP Net Income: Rose by 26% year-over-year to $10.9 million.

Adjusted EBITDA: Improved by 8% year-over-year to $9.9 million.

SaaS ARR: Achieved a 16% year-over-year growth, reaching $134.8 million.

Gross Margin: Remained stable at 56%, with a non-GAAP gross margin of 60%.

Guidance: Provided for Q2 and full fiscal year 2024, with total revenues expected to be between $260.5 and $263.5 million.

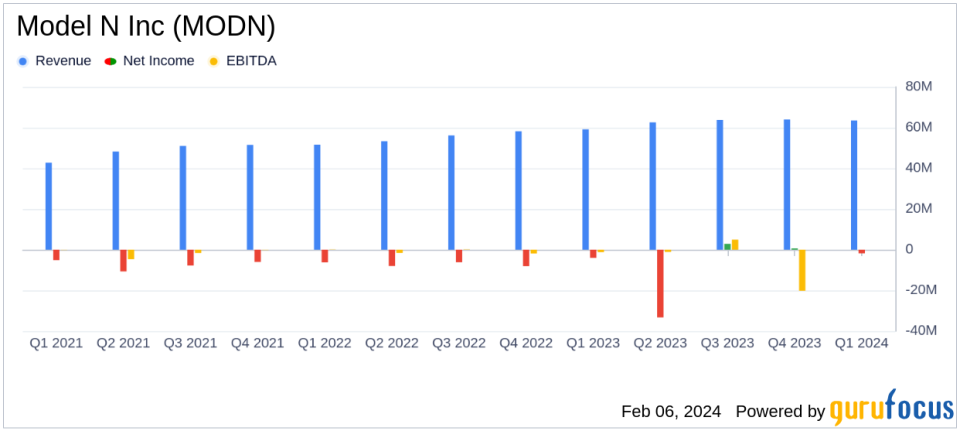

On February 6, 2024, Model N Inc (NYSE:MODN), a leading provider of cloud revenue management solutions, released its 8-K filing, announcing financial results for the first quarter of fiscal year 2024 ended December 31, 2023. The company reported a significant increase in subscription revenue and SaaS Annual Recurring Revenue (ARR), indicating a strong start to the fiscal year.

Model N Inc specializes in delivering cloud-based solutions that help life sciences and technology companies manage revenue and adhere to regulations. The company's comprehensive suite of products supports the entire revenue lifecycle, ensuring efficient contract execution and compliance. With a primary focus on the United States, Model N Inc's global presence caters to a diverse client base across various countries.

Financial Performance and Highlights

Model N Inc's first-quarter results showcased a solid financial performance, with total revenues reaching $63.5 million, marking a 7% increase from the same quarter in the previous fiscal year. Subscription revenues, a critical metric for the company's growth, saw an 8% year-over-year increase to $47.7 million. This growth is a testament to the company's robust business model and its ability to attract and retain customers in the competitive software industry.

The company's gross profit also saw an uptick, rising to $35.6 million, an 8% increase from the first quarter of fiscal year 2023. The gross margin remained consistent at 56%, demonstrating the company's ability to maintain profitability while scaling its operations. Non-GAAP measures, which exclude certain expenses such as stock-based compensation and amortization of intangible assets, presented a gross profit of $38.3 million and a non-GAAP net income of $10.9 million, up by 26% from the previous year.

Adjusted EBITDA, another key indicator of financial health, increased by 8% to $9.9 million, with the margin improving to 16%. The SaaS ARR growth of 16% year-over-year, reaching $134.8 million, along with a trailing 12-month SaaS net dollar retention rate of 115%, underscores the company's strong recurring revenue base and customer satisfaction.

Operational and Strategic Developments

Jason Blessing, president and CEO of Model N Inc, highlighted the company's operational success, stating:

Our first quarter results beat expectations. We exceeded guidance for total revenue, subscription revenue, professional services revenue and adjusted EBITDA. Our strong performance in Q1 was driven by a healthy contribution from all areas of the business. We signed new logos, closed one of our few remaining SaaS transition, saw numerous customer base expansions, and we also enjoyed solid renewals. As we look ahead, we continue to remain focused on driving profitable growth and Im optimistic about the year ahead.

The company also launched Price Management, a new solution designed to enhance price execution across sales teams globally, further expanding its product offerings. Additionally, the release of the sixth annual State of Revenue Report provided insights into the challenges and opportunities within the pharmaceutical, medtech, and high-tech manufacturing sectors.

Looking Forward

Model N Inc provided guidance for the second quarter and the full fiscal year 2024, projecting total revenues to be in the range of $260.5 to $263.5 million, with subscription revenues expected to be between $193.5 and $195.5 million. The company's focus on driving profitable growth and its optimistic outlook for the year ahead suggest a continued trajectory of financial success and market leadership.

Investors and stakeholders can expect Model N Inc to continue leveraging its innovative solutions to meet the evolving needs of the life sciences and technology sectors, while maintaining a strong commitment to revenue growth and operational efficiency.

For more detailed information, Model N Inc will host a conference call to discuss the first quarter fiscal year 2024 results and provide further insights into the company's performance and strategy.

Value investors and potential GuruFocus.com members interested in following Model N Inc's progress can find additional financial details and company information on GuruFocus.com, where comprehensive analysis and stock valuation metrics are available.

Explore the complete 8-K earnings release (here) from Model N Inc for further details.

This article first appeared on GuruFocus.