Model N (MODN) Launches Global Price Management Solution

Model N MODN introduced Price Management, which is a solution tailored for semiconductor, electronic component, and high-tech manufacturers to streamline price management across direct and channel sales teams globally.

The new solution is integrated with Model N Deal Management, which simplifies pricing updates and ensures consistency across sales teams and channels. The company further added that manual approaches lack efficiency and real-time updates as well as hinder deal approvals in today's fast-paced markets.

The new Price Management solution addresses the rising demand for flexible price management tools by offering an end-to-end pricing system that facilitates rapid and coordinated price changes while meeting audit and regulatory requirements.

Model N, Inc. Price and Consensus

Model N, Inc. price-consensus-chart | Model N, Inc. Quote

It is also equipped with a robust pricing engine that provides real-time data alignment and automated workflows. This, in turn, enables companies to focus on strategy rather than manual tasks, ultimately optimizing revenue and profitability.

Model N provides revenue management solutions for life sciences and technology companies, including applications for configure, price, quote, rebate management and regulatory compliance.

The company has significant growth opportunities in the revenue management market as it continues to replace legacy processes that were labor intensive, error prone, inflexible and costly. The company currently manages client revenues worth billions for more than 50,000 enterprises across 100 countries.

High return on investments from cloud-native revenue management solutions that efficiently plug gaps in the end-to-end revenue management process makes them ideal client options. This improves the top-line growth of the companies, in turn boosting the adoption of Model N’s solutions.

For fiscal 2024, management expects total revenues in the band of $260-$263 million. Subscription revenues are anticipated to be in the range of $193-$195 million. Non-GAAP operating income is expected to be within $46.9-$49.9 million, while non-GAAP earnings per share (EPS) are anticipated to be within $1.25-$1.32.

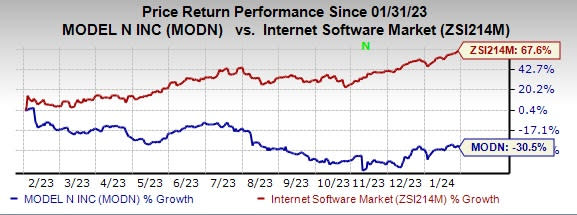

Currently, Model N sports a Zacks Rank #1 (Strong Buy). Model N’s shares have declined 30.5% in the past year against 67.6% growth of the sub-industry.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks worth considering in the broader technology space are Itron ITRI, NETGEAR NTGR and Watts Water Technologies WTS. NETGEAR and Itron sport a Zacks Rank #1, while Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Itron’s 2023 EPS has inched up 3.2% in the past 60 days to $2.88. ITRI’s long-term earnings growth rate is 23%.

Itron’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 289.3%. Shares of ITRI have gained 33.1% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days.

NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR have lost 29.5% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 3.9% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have soared 23.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report