Modine (MOD) to Report Q2 Earnings: What's in the Offing?

Modine Manufacturing Company MOD is slated to release second-quarter fiscal 2024 results on Nov 1, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at 64 cents and $612.85 million, respectively.

For the second quarter, the consensus estimate for MOD’s earnings per share has moved up by 7 cents in the past 90 days. Its bottom-line estimates imply growth of 33.3% from the year-ago reported number.

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year rise of 5.9%.

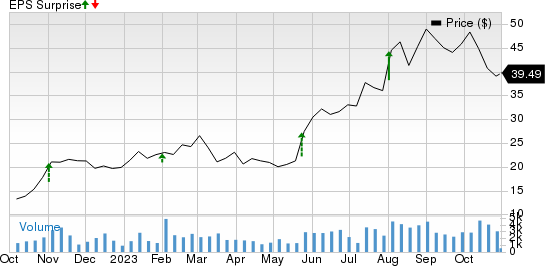

Over the trailing four quarters, MOD surpassed the consensus estimate on all occasions, the average surprise being 44.65%. This is depicted in the graph below:

Modine Manufacturing Company Price and EPS Surprise

Modine Manufacturing Company price-eps-surprise | Modine Manufacturing Company Quote

Q1 Highlights

In first-quarter fiscal 2024, Modine reported adjusted quarterly earnings of 85 cents per share, surpassing the Zacks Consensus Estimate of earnings of 43 cents. This compares to an adjusted earnings of 32 cents per share reported a year ago. Modine posted revenues of $622.4 million in the quarter, outpacing the Zacks Consensus Estimate of $563 million and rising 15% year over year.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Modine in second-quarter 2023, as it does not have the right combination of the two key ingredients. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here.

Earnings ESP: MOD has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Things to Note

In August, Modine launched a new electric infrared product line to expand its portfolio of energy-efficient and low-emissions heating solutions. The launch of the new product is likely to have fueled the company’s top-line growth in the quarter to be reported.

In the first quarter of fiscal 2024, Modine registered a total revenue of $622.4 million, up 15% from the prior year period. It reported an adjusted EBITDA of $80.4 million, up from $38.2 million recorded in the previous year’s quarter. For the full-year 2024, Modine expects net sales to rise in the range of 6% to 11% and adjusted EBITDA of $280-$295 million, an increase of 32% to 39% over the prior year. An upbeat full-year forecast is likely to have bolstered the result of Modine’s fiscal second quarter.

On the flip side, Modine is struggling with macroeconomic headwinds that include ongoing inflationary pressure in labor, materials and overhead, plus rising energy costs, supply chain shortages and the Ukrainian conflict. These headwinds are likely to have persisted in the quarter to be reported. Moreover, its SG&A increased by $5.1 million to $61.4 million in the first quarter due to higher compensation-related expenses. Rising expenses are likely to negatively impact upcoming result.

Earnings Whispers for Other Auto Stocks

Nikola NKLA is scheduled to post third-quarter 2023 earnings on Nov 2. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pegged at a loss of 15 cents per share. The company has an Earnings ESP of 0.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

NKLA surpassed earnings estimates in all of the trailing four quarters, the average surprise being 17.90%.

Lucid Group LCID is scheduled to post third-quarter 2023 earnings on Nov 7. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pinned at a loss of 27 cents per share. The company has an Earnings ESP of 0.00% and a Zacks Rank #2.

LCID missed earnings estimates in all of the trailing four quarters, the average negative surprise being 12.08%.

Rivian RIVN is scheduled to post third-quarter 2023 earnings on Nov 7. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pegged at a loss of $1.36 per share. The company has an Earnings ESP of -1.78% and a Zacks Rank #3.

RIVN surpassed earnings estimates in all of the trailing four quarters, the average surprise being 15.22%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report