MOGU Inc's Rocky Road Ahead: Unraveling the Factors Limiting Growth

Long-established in the Retail - Cyclical industry, MOGU Inc (NYSE:MOGU) has enjoyed a stellar reputation. It has recently witnessed a surge of 12.42%, juxtaposed with a three-month change of -34.93%. However, fresh insights from the GuruFocus Score Rating hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of MOGU Inc.

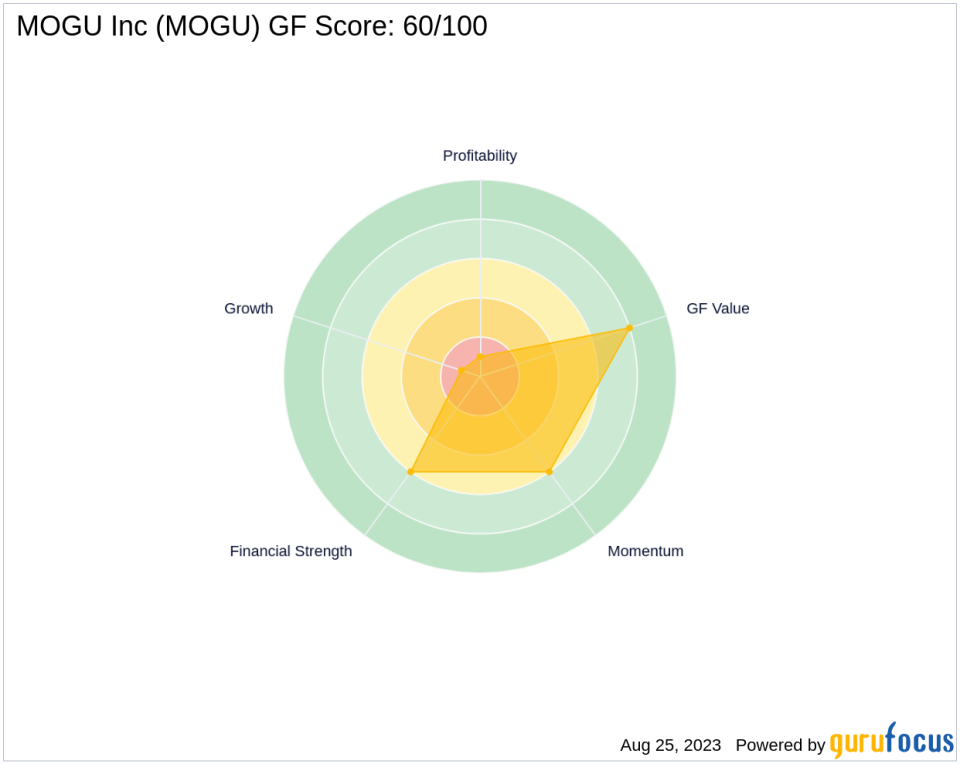

Decoding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

1. Financial strength rank: 6/10

2. Profitability rank: 1/10

3. Growth rank: 1/10

4. GF Value rank: 8/10

5. Momentum rank: 6/10

Based on the above method, GuruFocus assigned MOGU Inc the GF Score of 60 out of 100, which signals poor future outperformance potential.

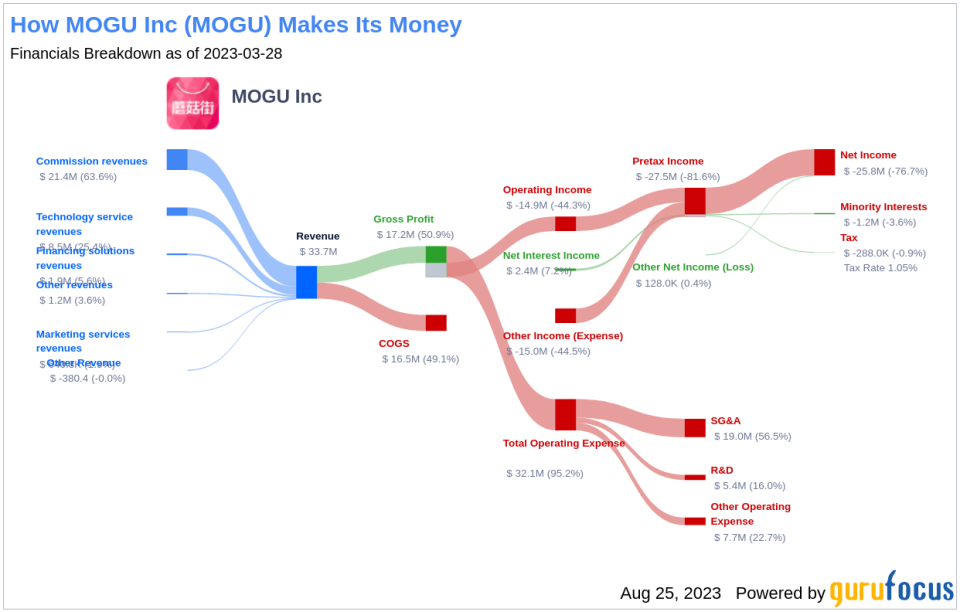

Understanding MOGU Inc's Business

MOGU Inc is an online fashion and lifestyle destination in China. The company's online platform includes Mogu.com, Mogujie.com, and Meilishuo.com. Its platform allows people to discover and share fashion trends while fully enjoying the shopping experience. The company on its platform provides content related to fashion and lifestyle guides in various multi-media formats which include Live Video Broadcasts, Short-form Videos, Photography, and Online Review Community. The company derives revenues from within China.

Profitability Breakdown

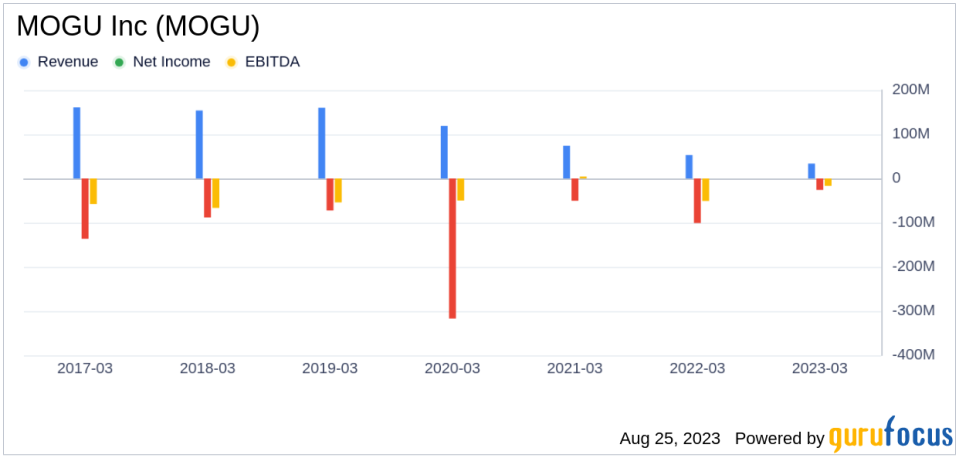

MOGU Inc's low Profitability rank can also raise warning signals. Additionally, MOGU Inc's Gross Margin has also declined over the past five years, as evidenced by the data: 2019: 70.79; 2020: 64.83; 2021: 62.04; 2022: 52.71; 2023: 50.93. This trend underscores the company's struggles to convert its revenue into profits.

With a Piotroski F-Score of 1, MOGU Inc's financial health appears concerning. This score, rooted in Joseph Piotroski's nine-point scale, evaluates a firm's profitability, liquidity, and operating efficiency. Given its rating, MOGU Inc might be facing challenges in these areas.

Growth Prospects

A lack of significant growth is another area where MOGU Inc seems to falter, as evidenced by the company's low Growth rank. The company's revenue has declined by -33 per year over the past three years, which underperforms worse than 94.46% of 1046 companies in the Retail - Cyclical industry. Stagnating revenues may pose concerns in a fast-evolving market.

Next Steps

Given the company's financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm's unparalleled position for potential underperformance. It's crucial for investors to consider these factors when making investment decisions. Will MOGU Inc overcome these challenges and outperform the market? Only time will tell.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.