Is Mohawk Industries (MHK) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

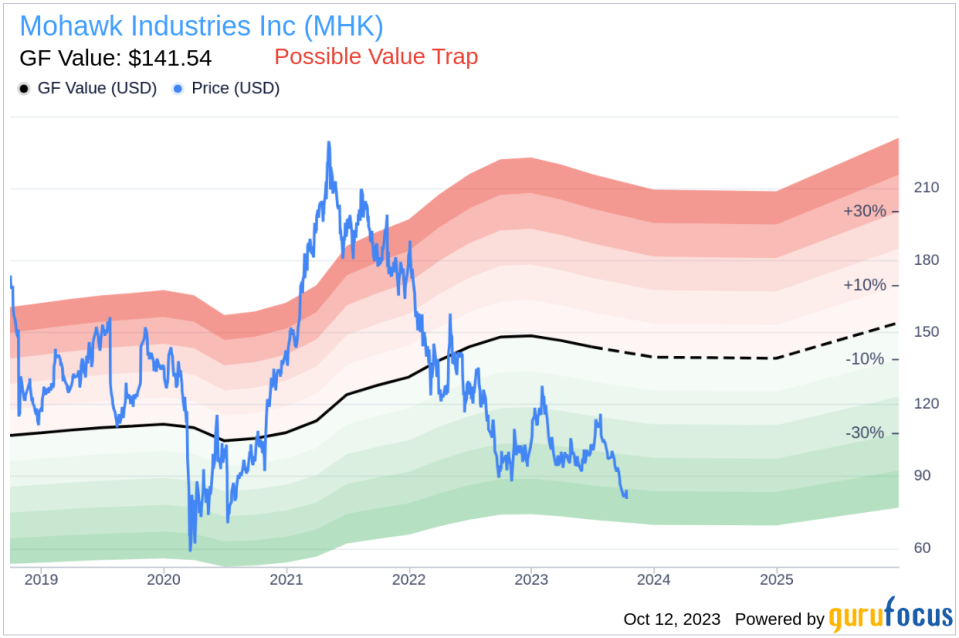

Value-focused investors are constantly on the lookout for stocks priced below their intrinsic value. One such stock that has caught attention is Mohawk Industries Inc (NYSE:MHK). Despite its current trading price of $81.12, which is significantly below its GF Value of $141.54, investors should tread carefully. The stock experienced a daily loss of 3.86% and a 3-month decrease of 23.47%, raising concerns about its potential as a value trap.

Understanding the GF Value

The GF Value is a unique metric that represents the current intrinsic value of a stock, based on GuruFocus' exclusive method. This calculation takes into account historical multiples such as PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow. It also considers the GuruFocus adjustment factor, which is based on the company's past returns and growth. Lastly, it incorporates future estimates of business performance.

The GF Value Line provides an overview of the stock's fair value. If the stock price is significantly above this line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Delving Deeper: Mohawk Industries' Potential Risks

While Mohawk Industries (NYSE:MHK) might seem attractive due to its undervaluation, investors should consider the potential risks associated with this stock. These risks are reflected through its low Piotroski F-score and Altman Z-score, suggesting that despite its apparent undervaluation, Mohawk Industries could be a potential value trap.

A Snapshot of Mohawk Industries Inc

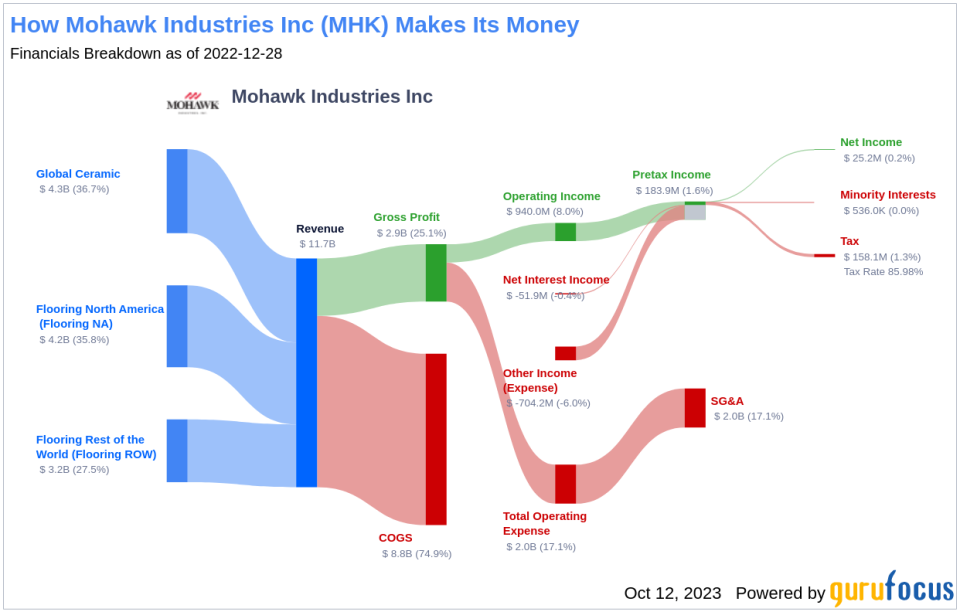

Mohawk Industries Inc is a leading manufacturer of a wide range of flooring products, including carpets, rugs, ceramic tile, laminate, wood, luxury vinyl tile, and vinyl flooring. The company operates through three segments: Global Ceramic, Flooring NA, and Flooring ROW. A majority of its revenue is generated from the United States. As of October 12, 2023, the company has a market cap of $5.20 billion and sales of $11.30 billion.

Conclusion: Navigating the Thin Line Between Value and Trap

While Mohawk Industries (NYSE:MHK) may appear to be an attractive investment opportunity based on its GF Value, the company's low Piotroski F-score and Altman Z-score cannot be ignored. These indicators suggest that despite its apparent undervaluation, Mohawk Industries could potentially be a value trap. Therefore, investors should exercise due diligence and consider both the risks and rewards before making an investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.