Mohawk Industries (NYSE:MHK) Q4: Beats On Revenue

Flooring manufacturer Mohawk Industries (NYSE:MHK) reported results ahead of analysts' expectations in Q4 FY2023, with revenue down 1.4% year on year to $2.61 billion. It made a non-GAAP profit of $1.96 per share, improving from its profit of $1.32 per share in the same quarter last year.

Is now the time to buy Mohawk Industries? Find out by accessing our full research report, it's free.

Mohawk Industries (MHK) Q4 FY2023 Highlights:

Revenue: $2.61 billion vs analyst estimates of $2.57 billion (1.8% beat)

EPS (non-GAAP): $1.96 vs analyst estimates of $1.86 (5.4% beat)

Free Cash Flow of $55.96 million, down 85.5% from the previous quarter

Gross Margin (GAAP): 24.6%, up from 22.4% in the same quarter last year

Market Capitalization: $6.94 billion

Commenting on the Company’s fourth quarter and full year results, Chairman and CEO Jeff Lorberbaum stated, “Our fourth quarter results were ahead of our expectations, with benefits from cost containment, productivity and lower input costs. The industry reduced selling prices and we passed through declining costs in energy and raw materials. Under these conditions, we focused on optimizing our revenues and reducing our costs through restructuring actions and manufacturing enhancements. We aggressively managed inventory levels, which reduced our working capital compared to prior year by more than $300 million, excluding acquisitions. We also have invested in sales resources, merchandising and new products with innovative features to inspire consumers to purchase flooring. We closed the year with a net debt to adjusted EBITDA ratio of 1.5 times, free cash flow of $716 million and available liquidity of $1.9 billion, and we are retiring a higher interest rate term loan of approximately $900 million in the first quarter of 2024. We are well positioned to manage current conditions and emerge stronger from this economic cycle when the rebound occurs.

Established in 1878, Mohawk Industries (NYSE:MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

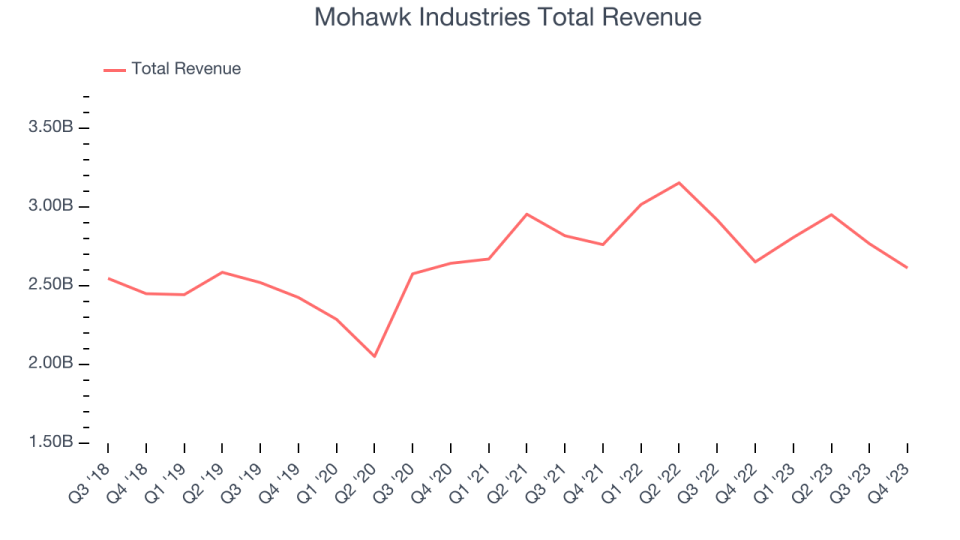

Exploring a company's long-term performance can offer valuable insights into its business quality. Any business can experience brief periods of success, but distinguished ones maintain steady growth over time. Mohawk Industries's annualized revenue growth rate of 2.2% over the last 5 years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Mohawk Industries's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years. We can understand the company's revenue dynamics even better by analyzing its organic sales, which strip out currency fluctuations and one-time events like acquisitions. Over the last 2 years, Mohawk Industries's organic sales averaged 1.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that non-fundamental factors hindered its top-line performance.

This quarter, Mohawk Industries's revenue fell 1.4% year on year to $2.61 billion but beat Wall Street's estimates by 1.8%. Looking ahead, Wall Street expects revenue to decline 2.5% over the next 12 months, a deceleration from this quarter.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Mohawk Industries has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.6%, subpar for a consumer discretionary business.

Mohawk Industries's free cash flow came in at $55.96 million in Q4, equivalent to a 2.1% margin, down 38.5% year on year. Over the next year, analysts' consensus estimates show they're expecting Mohawk Industries's LTM free cash flow margin of 6.4% to remain the same.

Key Takeaways from Mohawk Industries's Q4 Results

It was good to see Mohawk Industries beat analysts' revenue expectations this quarter. That stood out as a positive in these results. On the other hand, its EPS missed analysts' expectations. No forward guidance was given with the earnings release. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $109.61 per share.

So should you invest in Mohawk Industries right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.