Moleculin (MBRX) Up 7% on Upbeat Updates From Annamycin Studies

Moleculin Biotech, Inc. MBRX, a clinical-stage company, announced preliminary updates from its clinical programs of lead candidate, Annamycin, and other clinical candidates in its pipeline. The company reported positive interim data from its early-mid-stage studies of Annamycin in acute myeloid leukemia (AML) and soft tissue sarcoma (STS) lung metastases indications.

In a separate press release, the company also announced its third-quarter 2023 results. Moleculin incurred a loss of 19 cents per share in the reported quarter, which is narrower than the Zacks Consensus Estimate of a loss of 21 cents per share. MBRX had incurred a loss of 30 cents per share in the year-ago quarter.

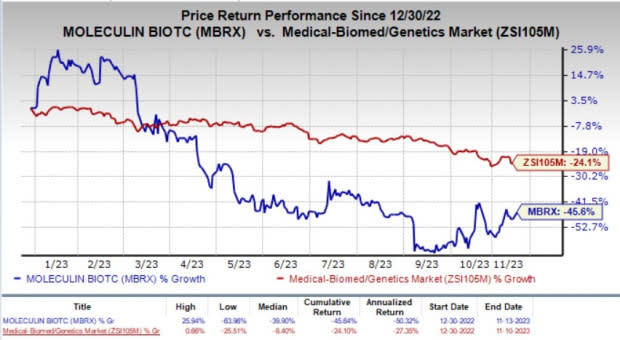

The company’s stock climbed 6.7% on Monday in response to the better-than-expected third-quarter 2023 results and pipeline progress. The stock also gained 2.2% in the after-market hours. Year to date, shares of Moleculin have plunged 45.6% compared with the industry’s 24.1% fall.

Image Source: Zacks Investment Research

The company is currently evaluating Annamycin in combination with Cytarabine in a phase IB/II MB106 study for the treatment of subjects with AML as both first-line therapy and for subjects who are refractory to or relapsed after induction therapy. MBRX has not treated any first-line subjects in the MB106 study to date.

Per the data readout, Moleculin is currently dosing patients in the phase IB portion of the early-mid-stage MB106 study, observing a complete response (CR) in two patients (33%) out of the six treated in this portion of the study. Annamycin was found to be overall well-tolerated in the phase IB portion of the study, as one patient experiencing a serious adverse event was found to be unrelated to Annamycin and definitively related to Cytarabine.

In October 2023, Moleculin enrolled, treated and evaluated three additional subjects in the phase II portion of the MB106 study. Out of the three patients, one was determined to be a CR, while another suffered death. The death was deemed not related to Annamycin. Data from the treatment of the third patient is currently being analyzed and, hence, not included in the data readout.

MBRX plans to treat up to 21 subjects in this phase II portion of the MB106 study and expects to complete enrollment by early 2024.

Overall, to date, three patients (38%) out of eight have demonstrated CRs in the MB106 study. While sufficient time has not passed to assess the durability of the latest CR observed in the phase II portion of the MB106 study, Moleculin reported that the two earlier CRs in the phase IB portion of the study have now shown durability (approximately eight and three months, respectively, to date).

Moleculin is also simultaneously evaluating Annamycin as monotherapy in a phase IB/II MB107 study to treat STS lung metastases. Patients enrolled in the phase IB dose-finding portion of the MB107 study were treated with doses of Annamycin ranging from 210 mg/m2 to 390 mg/m2. In the phase II portion of the study, the first three patients were treated with an exploratory 360 mg/m2 dose. Finally, a 330 mg/m2 dose of Annamycin was determined to be the recommended phase II dose (RP2D).

In the data readout, the company announced a median overall survival of 11 months for subjects treated in the phase IB portion of the MB107 studyfor heavily pre-treated subjects, which is noteworthy per MBRX.

Improved progression-free survival (PFS) of 3.4 months was observed for the RP2D compared with the 2.2 months observed for the maximum dose of Annamycin used in the study. Subjects who had fewer prior therapies (<2) also observed such improved PFS.

Based on the data provided, Moleculin believes that Annamycin has the potential to become a first-line alternative to the current standard of care with an anthracycline. The combination of a high patient response rate, significant improvement in overall survival and the absence of cardiotoxicity may improve patient outcomes upon treatment with Annamycin.

The company is also currently evaluating other pipeline candidates in early-stage studies to treat various cancer indications.

Moleculin Biotech, Inc. Price and Consensus

Moleculin Biotech, Inc. price-consensus-chart | Moleculin Biotech, Inc. Quote

Zacks Rank and Stocks to Consider

Moleculin currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks worth mentioning are Ligand Pharmaceuticals LGND, Apellis Pharmaceuticals APLS and Anixa Biosciences ANIX. While LGND sports a Zacks Rank #1 (Strong Buy), APLS and ANIX carry a Zacks Rank #2 (Buy) each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2023 earnings per share has remained constant at $5.10. During the same time frame, the estimate for Ligand’s 2024 earnings per share has remained constant at $4.59. Year to date, shares of LGND have lost 17.4%.

LGND’s earnings beat estimates in three of the trailing four quarters and missed the mark on one occasion, delivering an average surprise of 67.19%.

In the past 30 days, the Zacks Consensus Estimate for Apellis’ 2023 loss per share has widened from $4.38 to $4.59. During the same time frame, the estimate for Apellis’ 2024 loss per share has narrowed from $2.40 to $1.92. Year to date, shares of APLS have lost 11.5%.

APLS beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative earnings surprise of 3.91%.

In the past 30 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has remained constant at 32 cents. During the same time frame, the estimate for Anixa Biosciences’ 2024 loss per share has remained constant at 37 cents. Year to date, shares of ANIX have lost 30.1%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 26.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Moleculin Biotech, Inc. (MBRX) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report