Molina Healthcare Inc (MOH) Posts Strong Earnings Growth in Q4 and Full Year 2023

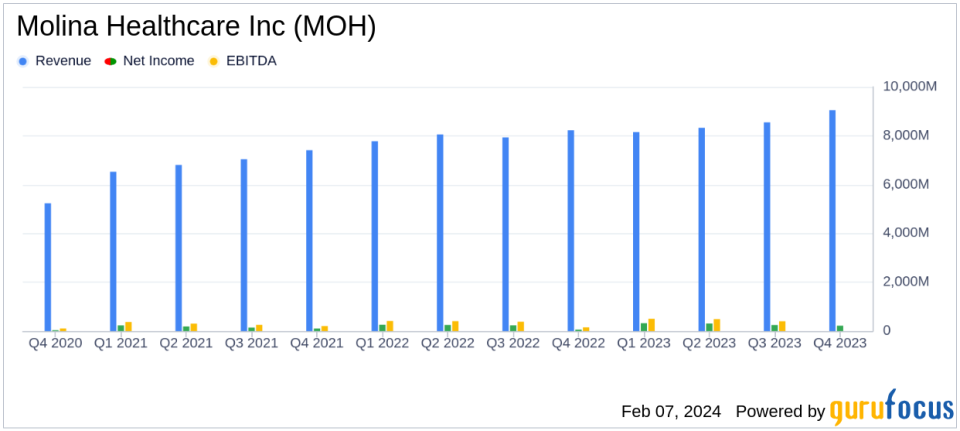

Premium Revenue: Grew to $32.5 billion in 2023, a 5% increase year over year.

Net Income: GAAP net income surged by 39% to $18.77 per diluted share for the full year 2023.

Adjusted Net Income: Rose by 17% to $20.88 per diluted share for the full year 2023.

Medical Care Ratio (MCR): Remained consistent at 88.1% for the full year 2023.

Operating Cash Flow: Increased significantly to $1.662 billion for the year ended December 31, 2023.

2024 Guidance: Projects premium revenue of approximately $38 billion and adjusted EPS of at least $23.50.

On February 7, 2024, Molina Healthcare Inc (NYSE:MOH) released its 8-K filing, detailing its financial results for the fourth quarter and the full year of 2023. The company, a leading provider of Medicaid-related solutions, reported a robust increase in both GAAP and adjusted earnings per share (EPS), reflecting the successful execution of its growth strategy.

Company Overview

Molina Healthcare Inc operates health plans through a network of subsidiaries, each licensed as a health maintenance organization (HMO). The company's health plans are designed for low-income families and individuals, with a focus on Medicaid, Medicare, and Marketplace segments. Molina's revenue is primarily derived from state government agencies on a per-member per-month basis for Medicaid plans, and from managed care plans contracting with the Centers for Medicaid and Medicare (CMS) for Medicare Advantage plans. Additionally, Molina offers plans through health insurance exchanges.

Financial Performance and Challenges

The company's premium revenue for the full year 2023 was approximately $32.5 billion, marking a 5% increase from the previous year. This growth was attributed to the impact of acquisitions and new RFP wins, which were partially offset by Medicaid redeterminations. GAAP net income for the full year 2023 stood at $18.77 per diluted share, a significant 39% increase year over year. Adjusted net income also saw a healthy rise of 17% to $20.88 per diluted share for the same period.

Despite these achievements, Molina Healthcare Inc faces challenges such as the potential for increased medical care costs and the need to maintain cost discipline amidst new business implementations. The Medical Care Ratio (MCR) for the full year was consistent with expectations at 88.1%, indicating a balance between premiums collected and medical expenses paid. However, the Medicare MCR was above the company's long-term target range, reflecting higher utilization of certain benefits and services.

Financial Highlights and Importance

The company's financial achievements, particularly the growth in net income and EPS, are critical indicators of its ability to manage costs effectively while expanding its member base. The G&A ratio for the full year 2023 was 7.2%, demonstrating continued cost discipline. Moreover, the operating cash flow for the year ended December 31, 2023, was $1.662 billion, compared to $773 million for the previous year, highlighting the company's strong operational efficiency and cash generation capabilities.

Balance Sheet and Cash Flow Statement

As of December 31, 2023, Molina Healthcare Inc had cash and investments at the parent company totaling $742 million, up from $375 million the previous year. The company's days in claims payable was 50, indicating the average number of days it takes to pay claims. This metric is essential for understanding the company's liquidity and ability to manage its cash flow effectively.

2024 Outlook

Looking ahead, Molina Healthcare Inc has issued guidance for the full year 2024, with expected premium revenue of approximately $38 billion and adjusted earnings of at least $23.50 per diluted share. This guidance suggests a continuation of the company's growth trajectory and reflects confidence in its ability to achieve sustainable and profitable growth.

Joseph Zubretsky, President and Chief Executive Officer, commented on the results, stating,

We are very pleased with our fourth quarter and full year results. Our 2023 performance reflects the successful execution of our growth strategy which positions us to achieve sustainable and profitable growth in 2024 and beyond."

In conclusion, Molina Healthcare Inc's strong financial performance in 2023 sets a positive tone for the upcoming year. The company's strategic initiatives and disciplined cost management have positioned it well to navigate the complexities of the healthcare industry and continue delivering value to its stakeholders.

Explore the complete 8-K earnings release (here) from Molina Healthcare Inc for further details.

This article first appeared on GuruFocus.