Molina Healthcare (MOH) Closes $150M My Choice Wisconsin Buyout

Molina Healthcare, Inc. MOH announced that the My Choice Wisconsin buyout closed on Sep 1, 2023, a tad before its updated scheduled time. The deal was first announced in July 2022 and was expected to close last year. However, with second quarter 2023 earnings, it said that the deal was expected to close in the fourth quarter of this year.

The acquisition is expected to have cost the company around $150 million, net of expected tax benefits and regulatory capital and add to its Medicaid and Medicare businesses’ strength. The acquiree served more than 44,000 members as of Jun 30, 2023. The buyout of the Medicaid managed care organization will boost Molina Healthcare’s footprint in the region.

This reflects the company's impressive inorganic growth strategy, which is backed by its strong financial position. Its cash and cash equivalents at the second quarter-end were $4.9 billion, significantly higher than the long-term debt of only $2.2 billion. Also, it generated ample cash. During the first half of 2023, net cash provided by operating activities surged 91.9% year over year.

Its list of latest acquired companies includes the Magellan Complete Care line of business of Magellan Health, substantially all the assets of Affinity Health Plan, Texas Medicaid and Medicare-Medicaid Plan contracts and specific operating assets of Cigna, certain assets of YourCare and Passport, and others.

There’s more on the way. MOH agreed to buy all the issued and outstanding capital stock of CA Health Plans from Bright Health Company of California, Inc. on Jun 30, 2023. The $510 million deal is expected to close by the first quarter of next year and add to its Medicare business strength.

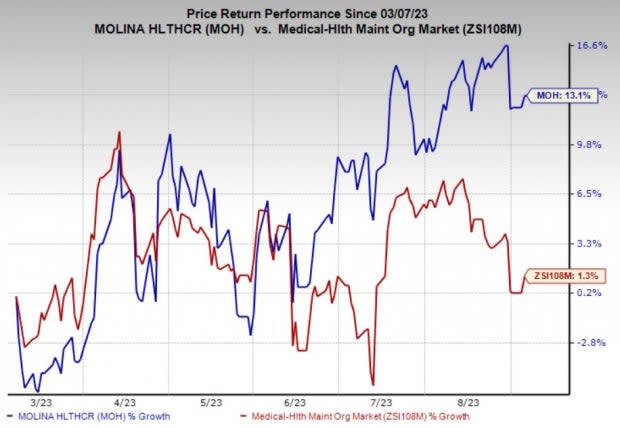

Price Performance

MOH shares have climbed 13.1% in the past six months compared with the 1.3% increase in the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Molina Healthcare currently has a Zacks Rank #2 (Buy). Some other top-ranked stocks in the broader medical space are Select Medical Holdings Corporation SEM, HCA Healthcare, Inc. HCA and Atai Life Sciences N.V. ATAI, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Select Medical’s 2023 earnings indicates a 56.9% year-over-year increase to $1.93 per share. It has witnessed one upward estimate revision over the past month against no movement in the opposite direction. The consensus mark for SEM’s 2023 revenues indicates 4.2% growth from a year ago.

The Zacks Consensus Estimate for HCA Healthcare’s 2023 bottom line suggests a 9.2% increase from the prior-year levels. HCA has witnessed two upward estimate revisions in the past month against none in the opposite direction. It beat earnings estimates in three of the last four quarters and missed once, with the average surprise being 5.4%.

The Zacks Consensus Estimate for Atai Life Sciences’ current-year earnings implies a 16.3% improvement from the year-ago reported figure. It has witnessed four upward estimate revisions over the past month against no movement in the opposite direction. ATAI beat earnings estimates in two of the last four quarters, met once and missed on one occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

atai Life Sciences N.V. (ATAI) : Free Stock Analysis Report