Molina (MOH) to Pay Lower Price for California Medicare Buyout

Molina Healthcare, Inc. MOH recently announced its updated purchase agreement related to Bright HealthCare’s California Medicare business acquisition. The purchase price has been adjusted downward on Dec 13, 2023.

The revised net purchase price stands at around $425 million, a decrease from the initial announcement of $510 million. The new price constitutes 23% of the anticipated $1.8 billion premium revenues for the year 2023. The acquisition is scheduled to be finalized around Jan 1, 2024.

MOH anticipates the deal will contribute an additional $1 per share to new store-embedded earnings. This strategic acquisition is poised to complement Molina's existing Medicaid footprint and align seamlessly with its 2024 Medi-Cal plan.

The acquisition of Brand New Day and Central Health Plan of California aims to strengthen its position in the home health sector and position it for serving high-acuity, low-income members. As the world transitions to the post-pandemic era, the demand for high-quality and easily accessible home health services continues to rise.

On the flip side, the divestiture of these assets plays a crucial role in settling Bright HealthCare's outstanding debts. These financial obligations encompass repayments for missed risk adjustment payments under the ACA and repaying amounts owed to lenders following an overdrawing of its credit facility.

The diminished sale price may hinder Bright HealthCare’s plans to meet debt obligations. Earlier this month, a Texas court granted the Department of Insurance the authority to seize the company's assets and compel it into liquidation.

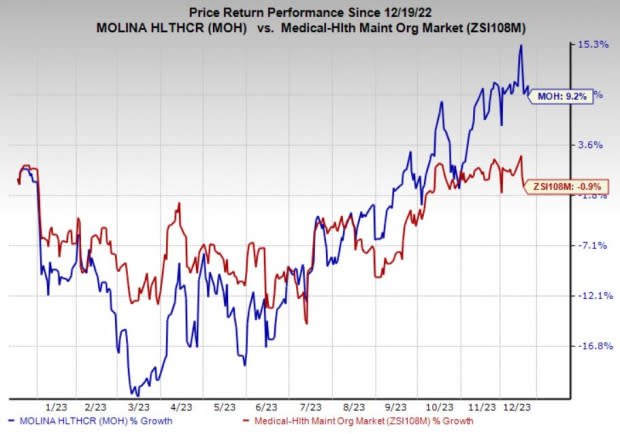

Price Performance

MOH shares have climbed 9.2% in the past year against the 0.9% decrease in the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Molina Healthcare currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are HealthEquity, Inc. HQY, Enovis Corporation ENOV and Motus GI Holdings, Inc. MOTS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HealthEquity’s current-year earnings is pegged at $2.10 per share, indicating 54.4% year-over-year growth. HQY has witnessed seven upward estimate revisions in the past month against none in the opposite direction. It beat earnings estimates in all the past four quarters, with an average surprise of 16.5%.

The Zacks Consensus Estimate for Enovis’ current-year earnings implies a 4.9% increase from the year-ago reported figure. The consensus mark for its current-year revenues is pegged at $1.7 billion. ENOV beat earnings estimates in all the last four quarters, with an average surprise of 11%.

The Zacks Consensus Estimate for Motus GI’s 2023 bottom line suggests a 67.2% year-over-year improvement. MOTS has witnessed one upward estimate revision over the past 30 days against no movement in the opposite direction. It beat earnings estimates in all the last four quarters, with an average surprise of 40.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Motus GI Holdings, Inc. (MOTS) : Free Stock Analysis Report

Enovis Corporation (ENOV) : Free Stock Analysis Report