Molson Coors (TAP) Extends ZOA Energy Deal to Expand Beyond Beer

Molson Coors Beverage Company TAP has extended its partnership with Dwayne "The Rock" Johnson’s ZOA Energy to strengthen its beyond beer portfolio. This move is in sync with TAP’s plans to establish itself as a total beverage company.

The company collaborated with the nonalcoholic energy drink brand for the first time in 2019. ZOA is available at more than 42,000 stores and more than 160,000 points of distribution across the United States and Canada.

With this expansion, ZOA will increase media and marketing investment to drive sales and expand distribution to international markets. Per the deal, Molson Coors will continue to be ZOA’s exclusive distribution partner.

ZOA boasts 138% year-over-year growth, with more than $100 million in sales in 2022. According to Bizjournals, Molson Coors intends to double its media investment in ZOA in 2024.

TAP is on track to grow market share through innovation and premiumization. In a bid to accelerate portfolio premiumization, the company has been aggressively growing its above-premium portfolio for the past few years.

Prior to this, Molson Coors acquired an award-winning whiskey brand, Blue Run Spirits. With the addition of Blue Run, the company is likely to expand its portfolio beyond beer and aid its premiumization strategy.

What Else Should You Know?

This Zacks Rank #3 (Hold) company is on track with its revitalization plan focused on achieving sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. It intends to invest in iconic brands and growth opportunities in the above-premium beer space, and expand in adjacencies and beyond beer without hampering the support for its existing large brands. Some other notable efforts are creating digital competencies for commercial functions, supply-chain-related system capabilities and employees.

Strength in its core brands, particularly Coors Light and Miller Lite, acts as a key growth driver. The company intends to increase investment in convenience store shopper marketing in the second half of this year. Also, favorable volume leverage is expected to partly offset cost increases. This, along with premiumization and lower contract brewing volumes, is anticipated to drive gross margin expansion for the year.

Driven by these factors, 2023 sales are projected to grow year over year in the high-single digits on a constant-currency basis, up from the prior mentioned low-single-digit growth. This will be backed by sturdy demand in the United States, with growth in rates and volumes. Underlying EBT is likely to grow 23-26% year over year compared with the earlier stated low-single-digit growth on a constant-currency basis.

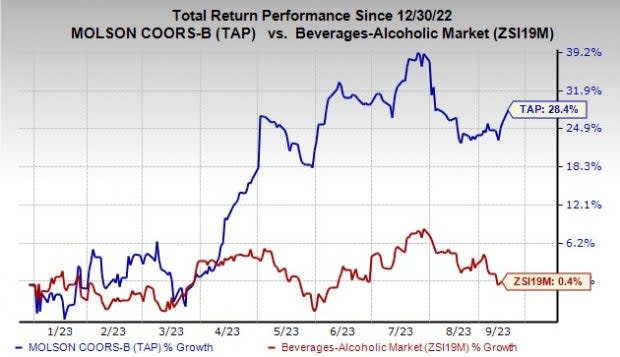

Shares of this company have gained 28.4% in the year-to-date period compared with the industry’s growth of 0.4%.

Image Source: Zacks Investment Research

However, Molson Coors has been witnessing weakened consumer demand across the beer industry due to pricing actions stemming from inflationary pressures. Also, cost inflation, with respect to materials and manufacturing expenses and unfavorable mix, is concerning. Management anticipates the inflation impacts on the cost of goods sold for 2023. Nevertheless, it is likely to moderate in the second half.

Stocks to Consider

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 2.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actual. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

The J. M. Smucker Company SJM, which manufactures and markets branded food and beverage products, presently has a Zacks Rank of 2. SJM has a trailing four-quarter earnings surprise of 14% on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year earnings suggests growth of 6.8% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks. It currently carries a Zacks Rank #2. UTZ’s expected EPS growth rate for three to five years is 11.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal-year sales suggests growth of 3.7% from the year-ago reported numbers. UTZ has a trailing four-quarter earnings surprise of 12.3% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report