Molson Coors (TAP) Focuses on Beyond Beer: Stock to Gain?

Molson Coors Beverage Company TAP has been focused on expanding into adjacent categories through its Beyond Beer approach. The strategy involves looking beyond its core beer portfolio to build powerful brands in fast-growing categories, without hampering the support for its existing large brands. Since its launch, the Beyond Beer strategy has been successful in transforming Molson Coors into a total beverage company, with exposure beyond the beer market.

The company’s aspiration to become a total beverage company positions it to draw consumer interest when they are looking for alternatives. This has been the key reason for the success of the Beyond Beer approach.

Latest Support to Beyond Beer

In the past two months, Molson Coors took another step forward to expand its Beyond Beer portfolio, with a deal in place to acquire Kentucky-based Blue Run in August and the extension of its agreement with ZOA Energy in September.

The company signed an agreement to acquire Blue Run Spirits, a finely crafted bourbon and rye whiskey brand. Blue Run is an award-winning whiskey brand launched in October 2020. This marks Molson Coors’ first acquisition in the spirits category.

As part of this buyout, TAP will expand its existing spirits business to form Coors Spirits Co., which will house Blue Run, Five Trail Blended American Whiskey, Barmen 1873 Bourbon and other future products. Prior to this, Molson Coors launched Five Trail Blended American Whiskey in 2021 and Barmen 1873 Bourbon in 2022.

On Sep 11, Molson Coors extended its partnership with Dwayne "The Rock" Johnson’s ZOA Energy to strengthen its beyond beer portfolio. It collaborated with the non-alcoholic energy drink brand for the first time in 2019. ZOA is available at more than 42,000 stores and more than 160,000 points of distribution across the United States and Canada.

With this expansion, ZOA will increase media and marketing investment to drive sales and expand distribution to the international markets. Per the deal, Molson Coors will continue to be ZOA’s exclusive distribution partner.

Other Things to Drive Stock

The said acquisition and extension deal not only marks the expansion of the company’s Beyond Beer portfolio, it also highlights its premiumization strategy. The company has been committed to growing its market share through innovation and premiumization. With a view to accelerating portfolio premiumization, it has been aggressively growing its above-premium portfolio in the past few years.

Additionally, Molson Coors is on track with its revitalization plan focused on achieving sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities.

Molson Coors delivered on its revitalization plan on a global basis by increasing dollar share in the United States in the second quarter of 2022 for the first time in over a decade. Strength in Coors Light, Miller Lite and Coors Banquet together resulted in total industry share growth in the United States, driven by brand positionings and better marketing. Molson Canadian and Carling beer in the U.K., and national champion brands witnessed significant market share gains.

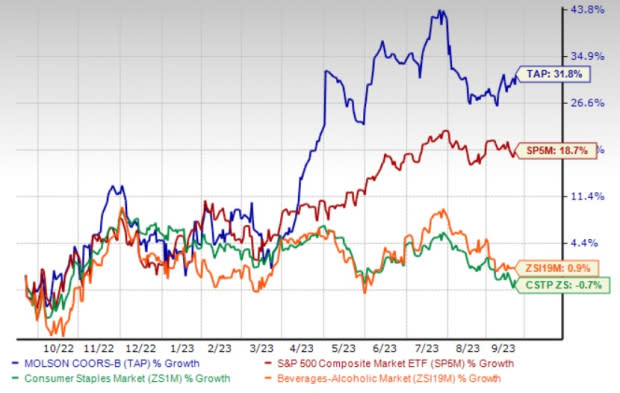

The company’s focus on core competencies has been well-reflected in its share price, with the stock outperforming the industry and the market. Shares of this Zacks Rank #3 (Hold) company have rallied 31.8% in the past year compared with the industry’s growth of 0.9%. The stock also fared better than the sector’s fall of 0.7% and the S&P 500’s growth of 18.7% in the same period.

Image Source: Zacks Investment Research

Further optimism on the stock is reflected by its forward estimates, which suggest notable growth. The Zacks Consensus Estimate for TAP’s 2023 sales and earnings suggests growth of 9.1% and 23.2%, respectively, from the year-ago period’s reported numbers.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Fomento Economico Mexicano FMX, Constellation Brands STZ and PepsiCo Inc. PEP.

Fomento Economico Mexicano, alias FEMSA, currently sports a Zacks Rank #1 (Strong Buy). Shares of FMX have rallied 72.5% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FEMSA’s current financial year’s sales and earnings per share suggests growth of 33.6% and 52.1%, respectively, from the year-ago period’s reported figures. FMX has a trailing four-quarter earnings surprise of 6.1%, on average.

Constellation Brands has a trailing four-quarter earnings surprise of 4.4%, on average. It currently carries a Zacks Rank #2 (Buy). Shares of STZ have risen 10.7% in the past year.

The Zacks Consensus Estimate for Constellation Brands’ current financial-year sales and earnings suggests growth of 6.8% and 8.9%, respectively, from the year-ago period's reported figures.

PepsiCo has a trailing four-quarter earnings surprise of 6.3%, on average. It currently carries a Zacks Rank #2. Shares of PEP have gained 5.8% in the past year.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 6.7% and 10.2%, respectively, from the year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report