Molson Coors (TAP) Q3 Earnings & Sales Beat on Brand Strength

Molson Coors Beverage Company TAP has posted third-quarter 2023 results, wherein the bottom and top lines surpassed the Zacks Consensus Estimate and improved year over year. Results have gained from brand strength, and strong performances across its portfolio and both business units. However, the ongoing macroeconomic environment acted as a deterrent.

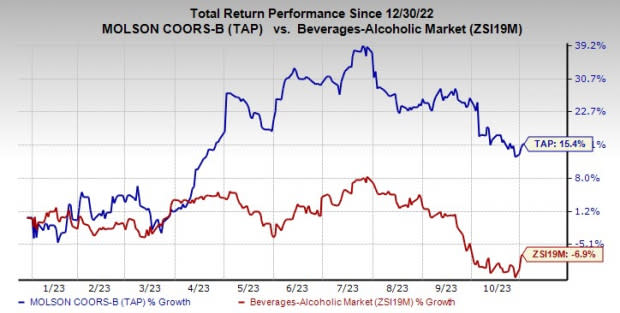

The Zacks Rank #3 (Hold) stock has gained 15.4% in the year-to-date period against the industry’s decline of 6.9%.

Quarterly Details

The company’s adjusted earnings of $1.92 per share jumped 45.5% year over year and surpassed the Zacks Consensus Estimate of $1.53.

Net sales grew 12.4% to $3,298.4 million and beat the Zacks Consensus Estimate of $3,244 million. On a constant-currency basis, net sales rose 11%, driven by a favorable price and sales mix, higher financial volume, and the positive impacts of foreign currency.

Image Source: Zacks Investment Research

Net sales per hectoliter increased 8.9% on a reported basis and 7.6% on a constant-currency basis, driven by a favorable sales and price mix.

Molson Coors’ worldwide brand volumes rose 1.1% to 22.3 million, driven by strength in America, partially offset by the sluggishness in EMEA&APAC. Financial volumes advanced 3.2% to 23.5 million hectoliters due to higher volumes in the Americas, partly offset by increased EMEA&APAC volumes.

The segment’s underlying EBT increased 44% to $525.4 million on a reported basis. On a constant-currency basis, EBT jumped 43.5% due to higher net pricing and rising financial volumes, somewhat offset by cost inflation related to materials and manufacturing expenses, as well as higher MG&A expenses.

Segmental Information

Molson Coors operates under the following geographical segments.

Americas: Net sales in the segment increased 10.8% to $2,633.4 million on a reported basis and rose 11.2% on a constant-currency basis, driven by a positive price and sales mix, as well as higher financial volume, partly offset by unfavorable currency. The metric beat our estimate of $2,575.8 million. Financial volumes rose 6.6% year over year, driven by an increase in U.S. domestic shipments stemming from volume growth in its core brands.

Brand volume for the segment increased 3.6% year over year on a 4.5% rise in the United States, owing to double-digit growth across Coors Light and Coors Banquet, as well as high-single-digit growth in Miller Lite. Canada brand volumes rose 0.2%, driven by strength in the above-premium brands. Meanwhile, Latin America declined 2.5% due to industry softness in some major markets.

Net sales per hectoliter rose 3.9% year over year due to a favorable sales and price mix, and higher net pricing. Underlying EBT improved 32% on a constant-currency basis to $494.1 million. The increase can be attributed to higher pricing, rising financial volumes and lower logistics expenses, offset by cost inflation on materials and higher MG&A expenses.

EMEA&APAC: The segment’s net sales (on a reported basis) rose 19.2% to $670.4 million and improved 10.4% on a constant-currency basis, driven by a favorable price and sales mix, as well as favorable currency, partly offset by a decline in financial volume. The metric surpassed our estimate of $599.7 million. Net sales per hectoliter for the segment advanced 26.1%, resulting from a favorable sales mix, as well as higher pricing.

The segment’s financial volumes fell 5.5%, while the brand volume decreased 5.2% due to declines in Central and Eastern Europe, stemming from inflationary pressures and continued industry softness.

The segment’s underlying EBT increased 67% to $69.1 million on a reported basis and improved 58% on a constant-currency basis, driven by higher net pricing to customers and a favorable sales mix, offset by lower financial volumes and cost inflation, particularly in materials, logistics and manufacturing expenses.

Other Financial Updates

Molson Coors ended the third quarter with cash and cash equivalents of $801.7 million. As of Sep 30, 2023, the company had a total debt of $6,179.9 million, resulting in a net debt of $5,378.2 million.

In the nine months ending Sep 30, 2023, the company provided $1,604.5 million in cash by operating activities, resulting in an underlying free cash flow of $1,121.6 million. For 2023, capital expenditure is likely to be $700 million, plus or minus 5%.

In the nine months ending Sep 30, 2023, the company declared and paid out cash dividends of 41 cents per share, with the CAD equivalent totaling $1.63 per share. Also, TAP repurchased 980,000 shares for $60.9 million in the above-mentioned period. On Sep 29, 2023, management approved a share repurchase program worth up to $2 billion of its Class B common stock for a term of five years.

Molson Coors Beverage Company Price, Consensus and EPS Surprise

Molson Coors Beverage Company price-consensus-eps-surprise-chart | Molson Coors Beverage Company Quote

Outlook

Management has raised the 2023 view. Net sales are projected to grow at the higher end of its earlier view of year-over-year high-single-digit growth on a constant-currency basis. This is mainly due to the recovery in the U.S. beer category, stronger-than-expected brand volume growth and better-than-expected pricing across the global markets, particularly Canada. Underlying EBT is likely to grow 32-36% year over year compared with earlier stated 23-26% growth on a constant-currency basis.

Underlying depreciation and amortization are projected to be $690 million, plus or minus 5%. The company expects an underlying effective tax rate of 21-23%. Consolidated net interest expenses are anticipated to be $210 million, plus or minus 5%, down from the previously communicated $225 million, plus or minus 5%. The underlying free cash flow is likely to be $1.2 billion, plus or minus.

Stocks to Consider

Lamb Weston LW, which offers frozen potato products, currently sports a Zacks Rank #1 (Strong Buy). LW delivered an earnings surprise of 46.2% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 27.8% and 21.8%, respectively, from the year-ago reported numbers.

TreeHouse Foods THS, a private-label food and beverage company, currently sports a Zacks Rank #1. THS has a trailing four-quarter earnings surprise of 31.4%, on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current fiscal-year earnings suggests growth of almost 112% from the year-ago reported figure.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report