Molson Coors (TAP) Rallies 25.1% in 1H23: Things to Note

Molson Coors Beverage Company TAP has been an investors’ favorite on the back of its core brands, as well as the above-premium portfolio. Its revitalization plan and the premiumization of its global portfolio bode well.

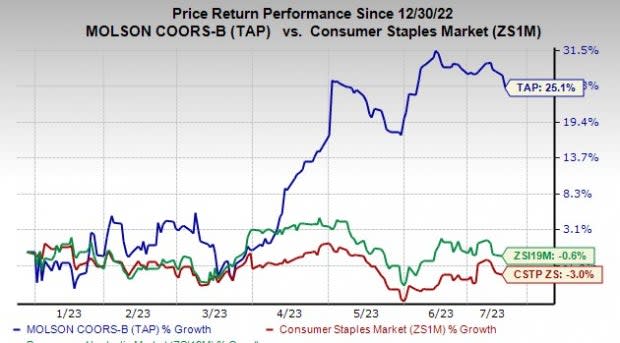

Shares of this Zacks Rank #2 (Buy) company have gained 25.1% in the past six months against the industry and Consumer Staples sector’s declines of 0.6% and 3%, respectively.

Additionally, an uptrend in the Zacks Consensus Estimate echoes the same sentiment. The Zacks Consensus Estimate for TAP’s current financial-year sales and earnings suggests growth of 5.3% and 10.2%, respectively, from the year-ago reported numbers. Earnings estimates for the current financial year have increased 2.5% to $4.52 over the past 30 days.

Image Source: Zacks Investment Research

The company boasts a decent history of earnings surprises in the last four reported quarters, the average beat being 32.1%. Topping it, a Value Score of B and a long-term earnings growth rate of 4.3% reflect its inherent strength.

Let’s Delve Deeper

Molson Coors has been on track with its revitalization plan which aims at sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. The company intends to invest in iconic brands and growth opportunities in the above-premium beer space; expand in adjacencies and beyond beer.

It also plans to create digital competencies for commercial functions, supply-chain-related system capabilities and employees. To facilitate these investments, it plans to generate savings of $150 million by simplifying the structure.

The company is building on the strength of its iconic core brands. Strength in Coors Light, Miller Lite and Coors Banquet resulted in solid industry share growth in the United States, driven by brand positionings and better marketing. Also, Molson Canadian and Carling beer in the U.K., and national champion brands have been witnessing significant market share gains.

With the view to accelerate portfolio premiumization, the company has been aggressively growing its above-premium portfolio in the past few years. It highlighted that it is making efforts to change the shape of its product portfolio and expand in growth areas. Its U.S. above-premium portfolio witnessed sales that outpaced its U.S. economy portfolio, driven by rapid growth of its hard seltzers, the successful launch of Simply Spiked Lemonade, and the continued strength in Blue Moon and Peroni’s.

Molson Coors is comfortably funding shareholder cash distributions at their current level and has sufficient financial health. On its last earnings report, the company highlighted paying cash dividends of 41 cents per share, with the CAD equivalent totaling 55 cents per share.

Going into 2023, net sales are projected to grow year over year in the low-single digits on a constant-currency basis, in line with our estimate of 1.5% growth. Underlying EBT is likely to grow year over year in the low-single digits on a constant-currency basis.

Other Stocks to Consider

We highlighted some other top-ranked stocks from the broader Consumer Staples space, namely Nomad Foods NOMD, Celsius Holdings CELH and Procter & Gamble PG.

Nomad Foods, currently sporting a Zacks Rank #1 (Strong Buy), manufactures and distributes frozen foods. NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current financial-year sales suggests growth of 8% from the prior-year reported number. However, earnings estimates suggest a year-over-year decline of 3.4%.

Celsius Holdings currently flaunts a Zacks Rank #1. CELH specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements.

The Zacks Consensus Estimate for CELH’s current financial-year sales indicates 67.9% growth from the year-ago reported figure, and the same for EPS implies a 154% rise. The company had an earnings surprise of 81.8% in the last reported quarter.

Procter & Gamble currently carries a Zacks Rank of 2. PG has a trailing four-quarter earnings surprise of 1.02%, on average. It has a long-term earnings growth rate of 6.1%.

The Zacks Consensus Estimate for Procter & Gamble’s current financial-year sales and EPS implies growth of 1.3% and 0.9%, respectively, from the year-ago reported numbers. The consensus mark for PG’s EPS has moved up by a penny in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report