Molson Coors (TAP) Stays on Growth Track Amid Inflation Woes

Molson Coors Beverage Company TAP has been in a good spot, courtesy of gains from contributions of its revitalization plan, commitment toward innovation and the premiumization of its global portfolio. The impacts of these initiatives were seen in the second quarter of 2023, wherein revenues and earnings increased year over year, and the bottom line surpassed the Zacks Consensus Estimate. Results gained from the strong performance across its portfolio and both business units.

The company’s adjusted earnings improved 50% year over year, while net sales grew 12%. On a constant-currency basis, net sales rose 12.1%, driven by a favorable price and sales mix, and higher financial volume. Net sales per hectoliter increased 8.7% on a reported basis and 9% on a constant-currency basis, driven by strong net pricing, and a favorable sales mix stemming from the premiumization and geographic mix.

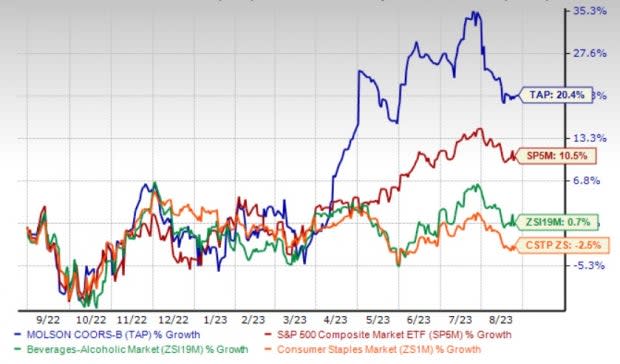

Shares of this Zacks Rank #3 (Hold) company have rallied 20.4% in the past year compared with the industry’s growth of 0.7%. The stock also fared better than the sector’s fall of 2.5% and the S&P 500’s growth of 10.5% in the same period.

The Zacks Consensus Estimate for TAP’s 2023 sales and earnings suggests growth of 9.1% and 23.2%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Let’s Delve Deeper

Molson Coors, one of the largest brewers in the world, is on track with its revitalization plan. The plan is focused on achieving sustainable top and bottom-line growth by streamlining the organization and reinvesting resources into its brands and capabilities.

The company intends to invest in iconic brands and growth opportunities in the above-premium beer space. It also plans to develop digital competencies for employees, supply-chain-related system capabilities and commercial functions. As part of the plan, the company has been expanding in adjacencies and beyond beer without hampering the support for its existing large brands.

To facilitate these investments, Molson Coors plans to generate savings of $150 million by simplifying its structure. The company is also building on the strength of its iconic core brands. Additionally, its cost-saving program, announced in 2020, targets delivering cost savings of $600 million over three years.

Additionally, Molson Coors is committed to growing its market shares through innovation and premiumization. The company has been rapidly expanding its above-premium portfolio over the past few years to accelerate portfolio premiumization.

The company has emphasized that it has been working to reshape its product portfolio and grow in emerging markets. Sales of its U.S. above-premium portfolio have been outperforming those of its U.S. economy portfolio on strength in core brands.

Management raised its 2023 view. Net sales, on a constant-currency basis, are projected to grow year over year in the high-single digits, up from low-single-digit growth mentioned earlier. Constant-currency underlying EBT is likely to grow 23-26% year over year compared with earlier stated low-single-digit growth.

The company plans to increase investment in C-store shopper marketing in the second half of 2023. Also, favorable volume leverage is expected to partly offset cost increases. This, along with premiumization and lower contract brewing volumes, is anticipated to drive gross margin expansion for 2023.

What Holds Molson Coors Back?

Molson Coors has been witnessing cost inflation, with respect to materials and manufacturing expenses, and an unfavorable mix. The cost inflation resulted in about 80% of the rise in COGS in the second quarter, driven by higher materials and manufacturing costs.

Management continues to anticipate the inflation impacts on COGS for 2023. However, it is likely to moderate in the second half. Underlying MG&A expenses are projected to be $100 million higher in the second half than the first half and rise 15% year over year. This will be driven by elevated marketing spend, which is likely to increase $100 million, coupled with increased people-related costs.

Also, TAP has been witnessing weakened consumer demand across the beer industry due to pricing actions. On its second-quarter earnings call, management highlighted the softness in the beer industry. This is likely to affect the company’s performance in the near term. The company’s business in EMEA and APAC is likely to continue witnessing relatively high inflationary pressures.

Management further expected a headwind in relation to the large U.S. contract brewing agreement. The agreement has started to wind down ahead of its termination at the end of 2024. Hence, it anticipates volume declines under this contract to be higher in the fourth quarter, with an impact of 2-3% of America's financial volume.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Fomento Economico Mexicano FMX, Ambev ABEV and PepsiCo Inc. PEP.

Fomento Economico Mexicano, alias FEMSA, currently sports a Zacks Rank #1 (Strong Buy). The company has an expected EPS growth rate of 22.4% for three to five years. Shares of FMX have rallied 82.1% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FEMSA’s current financial year’s sales and earnings per share suggests growth of 31.9% and 58.3%, respectively, from the year-ago period’s reported figures. FMX has a trailing four-quarter negative earnings surprise of 6.1%, on average.

Ambev has a trailing four-quarter earnings surprise of 20.8%, on average. It currently carries a Zacks Rank #2 (Buy). Shares of ABEV have declined 2.4% in the past year.

The Zacks Consensus Estimate for Ambev’s current financial-year sales suggests growth of 4.5% from the year-ago period's reported figure. Meanwhile, the consensus estimate for earnings indicates a decline of 5.6% from the year-ago quarter’s reported figure. ABEV has an expected EPS growth rate of 7% for three to five years.

PepsiCo has a trailing four-quarter earnings surprise of 6.3%, on average. It currently carries a Zacks Rank #2. Shares of PEP have gained 4.2% in the past year.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 6.7% and 10.2%, respectively, from the year-ago period's reported figures. PEP has an expected EPS growth rate of 8.1% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report