Monarch Casino & Resort Inc Reports Mixed Q4 Results Amidst Expansion and Legal Challenges

Net Revenue: Increased by 6.3% year-over-year to $128.2 million in Q4.

Net Income: Decreased by 18.9% year-over-year to $18.2 million in Q4.

Adjusted EBITDA: Grew by 3.4% to $43.0 million in Q4.

Earnings Per Share: Basic EPS at $0.94 and Diluted EPS at $0.93 in Q4, both showing a decrease from the prior year.

Dividend: Declared a cash dividend of $0.30 per share payable on March 15, 2024.

Balance Sheet: Strong with $43.4 million in cash and no outstanding long-term debt post-Q4.

Capital Expenditures: $16.7 million in Q4, funded from operating cash flows.

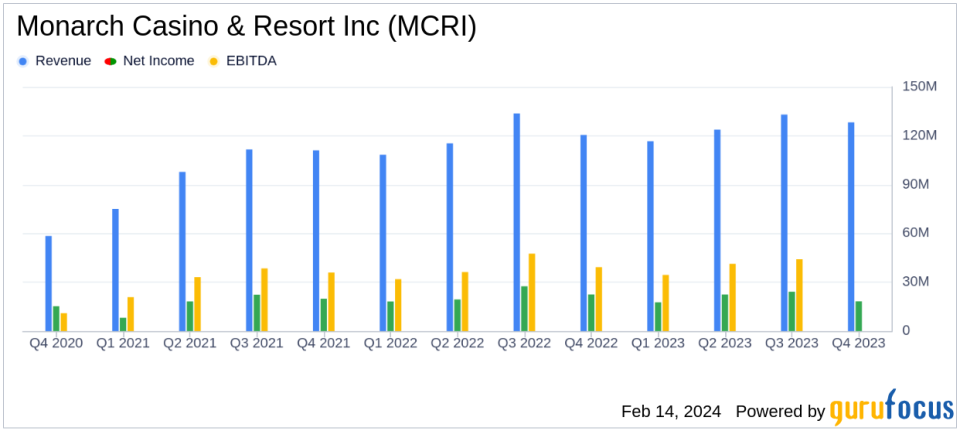

On February 14, 2024, Monarch Casino & Resort Inc (NASDAQ:MCRI) released its 8-K filing, announcing its financial results for the fourth quarter ended December 31, 2023. The company, known for its gaming, dining, and hospitality amenities, operates the Atlantis Casino Resort Spa in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado.

Monarch Casino & Resort Inc reported a 6.3% increase in net revenue to $128.2 million for the quarter, marking a record for the fourth quarter. However, net income saw an 18.9% decrease to $18.2 million, impacted by a higher effective tax rate, legal and consulting costs related to ongoing litigation, and increased depreciation expenses. Despite these challenges, the company's Adjusted EBITDA increased by 3.4% to $43.0 million, another record for the fourth quarter.

Financial Performance and Challenges

MCRI's performance in the fourth quarter reflects a mixed outcome. While revenue growth is a positive sign, the decline in net income highlights the challenges the company faces. The increased effective tax rate and legal costs associated with the Monarch Black Hawk's general contractor litigation have notably affected the bottom line. Additionally, higher depreciation expenses due to ongoing investments in property upgrades have also contributed to the decrease in net income.

The importance of these challenges cannot be understated as they may signal potential problems in cost management and legal risks. However, the company's ability to grow its Adjusted EBITDA amidst these challenges demonstrates a resilient operating model and an ability to convert revenue growth into margin expansion.

Strategic Investments and Dividend Payout

Monarch Casino & Resort Inc's financial achievements, including the growth in net revenue and Adjusted EBITDA, are significant in the competitive Travel & Leisure industry. These achievements indicate the company's ability to attract and retain customers, optimize its operations, and manage expenses effectively. The declaration of a cash dividend of $0.30 per share also reflects confidence in the company's cash flow generation and its commitment to returning value to shareholders.

CEO John Farahi's commentary underscores the company's strategic focus on growth through acquisition and property investments. Farahi stated:

"With a strong balance sheet and no debt, we are favorably positioned to continue investing in our properties and paying cash dividends, and to consider share repurchases under our existing share repurchase authorization. While growth through acquisition is a key focus for us, doing the right transaction is far more important in the long run than simply doing a transaction."

Key Financial Metrics and Outlook

MCRI's balance sheet remains robust with $43.4 million in cash and cash equivalents and the full repayment of its outstanding long-term debt subsequent to the end of the fourth quarter. The company's capital expenditures of $16.7 million during the quarter, directed towards property upgrades and maintenance, were fully funded by operating cash flows, indicating a strong operational footing.

The company's performance and strategic investments suggest a focus on long-term growth and market share expansion, despite the near-term headwinds. The ongoing litigation and competitive pressures in Reno, coupled with staffing challenges in Colorado, will require careful management, but the company's commitment to property enhancements and guest experience improvements positions it well for future success.

For more detailed financial information and future updates on Monarch Casino & Resort Inc, investors and interested parties are encouraged to visit the company's website and follow its filings with the Securities and Exchange Commission.

Explore the complete 8-K earnings release (here) from Monarch Casino & Resort Inc for further details.

This article first appeared on GuruFocus.