Monarch Casino's (MCRI) Q3 Earnings Miss Estimates, Fall Y/Y

Monarch Casino & Resort, Inc. MCRI reported dismal third-quarter 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. The top and the bottom line declined on a year-over-year basis.

Q3 Earnings & Revenues

In the quarter under review, the company reported adjusted earnings per share (EPS) of $1.38, missing the Zacks Consensus Estimate of $1.46. In the year-ago quarter, it generated an adjusted EPS of $1.41.

Quarterly revenues of $133 million missed the consensus mark by 1.7%. In the prior-year quarter, the company reported revenues of $133.7 million. The company’s performance during the quarter was impacted by competitive pressure in Reno and the macroeconomic environment.

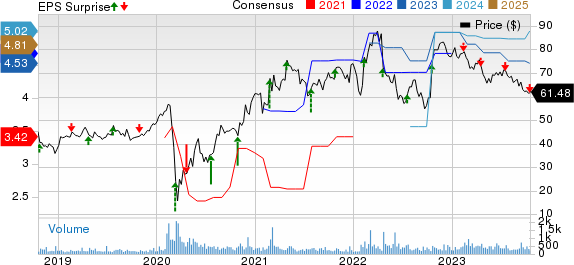

Monarch Casino & Resort, Inc. Price, Consensus and EPS Surprise

Monarch Casino & Resort, Inc. price-consensus-eps-surprise-chart | Monarch Casino & Resort, Inc. Quote

During the third quarter, Casino revenues declined 4% year over year to $73.8 million. Hotel revenues during the quarter came in at $20.6 million compared with $20.8 million reported in the year-ago quarter. Food and beverage revenues during the quarter came in at $33 million compared with $31.3 million reported in the year-ago quarter.

Operating Highlights

During the third quarter, income from operations amounted to $31.9 million compared with $36.4 million reported in the prior-year quarter.

Selling, general and administrative expenses in the third quarter came in at $27.1 million compared with $25.7 million reported in the prior-year period. The upside was due to increased labor, utility and promotional expenses.

During the quarter, Casino operating expenses (as a percentage of casino revenue) came in at 34.5% compared with 33.1% in the prior-year quarter. The upside was driven by increased labor expenses and promotional allowances. Hotel operating expenses (as a percentage of hotel revenues) came in at 34.8% compared with 34.2% reported in the prior-year quarter.

F&B operating expenses (as a percentage of F&B revenues) came in at 70.8% compared with 72.4% reported in the prior-year quarter. The downside was primarily caused by improved cost management and menu price increases.

Adjusted EBITDA in the third quarter came in at $49.2 million compared with $51.7 million reported in the prior-year quarter.

Balance Sheet

As of Sep 30, 2023, cash and cash equivalents totaled $33.9 million compared with $38.8 million as of Dec 31, 2022.

Total stockholders’ equity at the end of the third quarter totaled $502.4 million compared with $481.8 million at the end of second-quarter 2023.

The company declared a quarterly cash dividend of $0.30 per share. The dividend will be payable on Dec 15, 2023, to shareholders of record as of Dec 1, 2023.

Zacks Rank & Key Picks

Monarch Casino currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 34.6% on average. Shares of LYV have increased by 3.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates a rise of 21.6% and 59.4%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW sports a Zacks Rank #1. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have increased by 20.4% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS indicates a rise of 44.5% and 117.9%, respectively, from the year-ago period’s levels.

Choice Hotels International, Inc. CHH carries a Zacks Rank #2 (Buy). CHH has a trailing four-quarter earnings surprise of 3.1% on average. Shares of the company have declined 7.5% in the past year.

The Zacks Consensus Estimate for CHH’s 2023 sales and EPS indicates a rise of 10.8% and 13.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Monarch Casino & Resort, Inc. (MCRI) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report