Monday’s Vital Data: PayPal, Proctor & Gamble and Cleveland-Cliffs

U.S. stock futures are trading higher to open an earnings-filled week. The field of green is a nice change of pace to Friday’s ugly showing. Credit for the optimism lies in large part with the performance of China’s stock market. The Shanghai Composite rallied over 4%, scoring one of its best days in years on the heels of positive comments from President Xi Jinping.

Against this backdrop, futures on the Dow Jones Industrial Average are up 0.37% and S&P 500 futures are higher by 0.40%. Nasdaq-100 futures have added 0.84%.

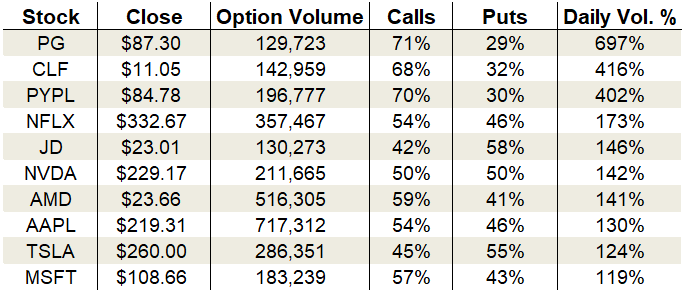

In the options pits, put volume spiked as panic ushered stocks into the weekend. Specifically, about 22.2 million calls and 23.6 million puts changed hands on the session.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Over at the CBOE, the surge in put demand drove the single-session equity put/call volume ratio to 0.82 — its second-highest reading this month. The 10-day moving average held steady at 0.68.

With earnings season now upon us, traders zeroed in on quarterly reports Friday. Proctor & Gamble (NYSE:PG) soared after smashing expectations. Cleveland Cliffs (NYSE:CLF) underwent a volatile trading session after its earnings release. Finally, PayPal (NASDAQ:PYPL) scored a much-needed gain after releasing solid Q3 numbers.

Let’s take a closer look:

Proctor & Gamble (PG)

Consumer goods titan, Proctor & Gamble wowed the Street Friday with a quarter worth celebrating. And celebrate they did. Buyers swarmed, driving PG stock higher by some 8.5% on its most active trading day of the year. Volume swelled to over 30 million shares, or 400% above the average.

The company garnered $16.7 billion in revenue and earnings-per-share of $1.12. Both measures bested analysts’ estimates.

Friday’s boon places an exclamation point on PG stock’s comeback. During the first four months of the year, the stock slid as much as 23%. Since then, the stock has been clawing its way back and with Friday’s pole-vault, the year-to-date losses have now been pared to 5%.

On the options trading front, traders came after calls with a vengeance. Activity swelled to 697% of the average daily volume, with 129,723 total contracts traded. 71% of the trading centered on call options.

With the uncertainty of earnings now past, implied volatility retreated to 19%, which places it at the 51st percentile of the one-year range.

Cleveland-Cliffs (CLF)

Ohio-based mining company, Cleveland-Cliffs experienced a volatile trading session Friday as traders grappled with its latest earnings release and colorful comments from CEO Lourenco Goncalves. While revenue topped estimates, EPS came in light at 64 cents. CLF fell as much as 10% before buyers battled back paring the losses to 3.7%.

The company garnered $16.7 billion in revenue and EPS of $1.12. Both measures bested analysts’ estimates. With the intraday rebound, CLF closed near the rising 50-day moving average and a potential horizontal support level at $11.

On the options trading front, calls won the day. Activity jumped to 416% of the average daily volume, with 142,959 total contracts traded. Calls accounted for 68% of the day’s take.

Implied volatility fell on the day to 53%, which places it at the 41st percentile of the one-year range. That means options are pricing in daily moves of 3.3%.

PayPal (PYPL)

PayPal posted strong Q3 results and was rewarded with an 8% gain on heavy volume. PYPL entered its quarterly report in desperate need of a positive catalyst. Heading into the event, PYPL shares were 17.3% off their recent highs and had fallen below all major moving averages.

The company reported revenue of $3.68 billion, which topped analyst estimates of $3.66 billion. Earnings came in at 58 cents and also beat expectations of 54 cents.

On the options trading front, traders aggressively came after calls. Activity jumped to 402% of the average daily volume, with 196,777 total contracts traded. 70% of the amount came from calls.

Implied volatility dropped on the day to 34%, which places it at the 49th percentile of the one-year range. Option premiums are now pricing in daily moves of 2.1%.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. Want insightful education on how to trade? Check out his trading blog, Tales of a Technician.

More From InvestorPlace

The post Monday’s Vital Data: PayPal, Proctor & Gamble and Cleveland-Cliffs appeared first on InvestorPlace.