Mondelez International Inc (MDLZ) Reports Robust Growth in 2023 Earnings

Net Revenues: Increased by 14.4% for the full year, with Organic Net Revenue growth of 14.7%.

Diluted EPS: Grew by 84.7% to $3.62, with Adjusted EPS up 19.0% on a constant currency basis.

Operating Cash Flow: Reached $4.7 billion, with Free Cash Flow at $3.6 billion, a $0.6 billion increase from the previous year.

Dividend: Shareholders enjoyed a 10% increase in dividend per share.

Divestiture: Completed the sale of the developed market gum business for $1.4 billion.

2024 Outlook: Anticipates an on-algorithm year with revenue growth at the upper end of the 3-5% range.

On January 30, 2024, Mondelez International Inc (NASDAQ:MDLZ) released its 8-K filing, detailing a year of significant financial growth and strategic achievements. Mondelez, a global leader in snacks, with iconic brands such as Oreo and Cadbury, has shown resilience and execution strength across its diverse portfolio.

Performance Highlights

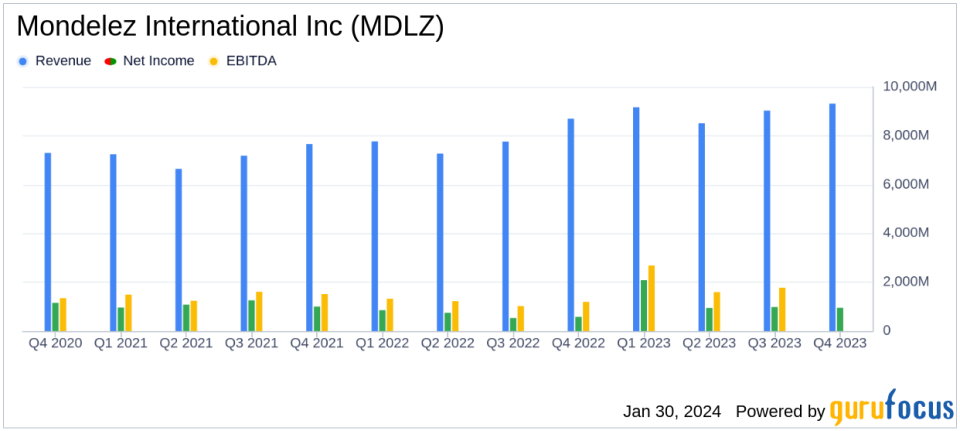

Mondelez's performance in 2023 was marked by a 14.4% increase in net revenues, driven by Organic Net Revenue growth and strategic acquisitions such as Clif Bar and Ricolino. The company's focus on pricing and favorable volume/mix contributed to this growth. Adjusted Gross Profit margin saw a 30 basis point increase to 37.5%, reflecting effective cost management and productivity gains.

Operating income surged by 55.7%, with the margin expanding to 15.3%, up 410 basis points. This was primarily due to favorable mark-to-market gains, lower acquisition-related costs, and a gain on divestiture. Adjusted Operating Income also grew, with a 10 basis point increase in margin to 15.9%.

Diluted EPS for the year stood at $3.62, an 84.7% increase, largely due to Adjusted EPS growth, gains on marketable securities, and favorable mark-to-market impacts. Adjusted EPS rose by 19.0% on a constant currency basis, driven by strong operating gains and lower interest expenses.

Financial Tables and Metrics

Key financial metrics such as Free Cash Flow, which increased by $0.6 billion to $3.6 billion, underscore the company's efficient capital management and robust cash generation capabilities. The Return of Capital to shareholders amounted to $3.7 billion, reflecting the company's commitment to delivering shareholder value.

From a balance sheet perspective, Mondelez ended the year with a solid financial position, including $1.8 billion in cash and cash equivalents. The company's total debt decreased by $3.5 billion, resulting in a net debt reduction of $3.4 billion, further strengthening its financial stability.

Challenges and Outlook

Despite facing challenges such as geopolitical uncertainty and input cost inflation, Mondelez navigated the complexities with strategic pricing actions and cost management. The company's 2024 outlook remains positive, expecting Organic Net Revenue growth of 3 to 5 percent and high single-digit Adjusted EPS growth on a constant currency basis.

Mondelez's performance in 2023 reflects its ability to adapt and thrive in a dynamic global market. With a strong portfolio of brands and a focus on innovation and growth, the company is well-positioned to continue delivering value to its stakeholders in the years ahead.

Explore the complete 8-K earnings release (here) from Mondelez International Inc for further details.

This article first appeared on GuruFocus.