Mondelez (MDLZ) Appears Appetizing, Gains More Than 15% in a Year

Mondelez International, Inc.’s MDLZ growth trajectory has been enhanced through prudent acquisitions and divestitures to refine its portfolio and emphasize core areas. The company has also been reaping benefits from its proactive pricing strategies.

These upsides have been helping this snack food and beverage products company stay resilient amid cost-related headwinds. Mondelez expects organic net revenue growth of more than 12% for 2023, wherein it envisions adjusted earnings per share growth of more than 12% on a constant-currency basis.

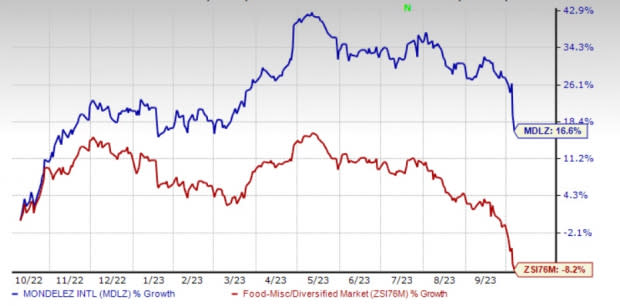

The Zacks Rank #2 (Buy) stock has rallied 16.6% in the past year against the industry’s decline of 8.2%.

Image Source: Zacks Investment Research

What’s Backing MDLZ?

Mondelez has consistently shown dedication to expanding its business through acquisitions. The acquisition of Ricolino (completed in the third quarter of 2023) is expected to double the size of MDLZ's Mexican operations, and the purchase of Clif Bar (in August 2022) has bolstered the company's market presence. These acquisitions made meaningful contributions to net revenues in the second quarter of 2023. Additionally, the integration of Chipita S.A. and Grenade (in 2022) underscores Mondelez's commitment to expanding its product offerings. The company's acquisition spree, further underlined by Gourmet Food Holdings and Hu Master Holdings, has diversified its portfolio and enhanced its distribution capabilities.

On the other hand, Mondelez is committed to increasing focus on areas with higher growth potential through meaningful divestitures. On Oct 2, the company concluded the divestiture of its developed-market gum business in the United States, Canada and Europe (excluding Portugal) to Perfetti Van Melle Group. The divestiture marks another step toward MDLZ’s commitment to strengthening its core categories, including chocolates, biscuits and baked snacks.

The company’s core categories — chocolates and biscuits — have historically depicted resilience to economic downturns and pricing actions. Consumers in developed countries consider chocolates and biscuits as affordable indulgences and one of the most-valued snacking products.

Both these categories registered double-digit growth in the second quarter. Management is focused on expanding these categories and expects solid volume momentum for both these categories as it moves forward in 2023. In fact, Mondelez aims to generate 90% of its revenues from these core categories.

Addressing Cost Challenges

Mondelez has been contending with cost inflation. In the second quarter of 2023, the adjusted gross profit margin contracted by 50 basis points (bps) to 37.5% due to increased raw material and transportation costs. Furthermore, inflated input costs partially impacted the adjusted operating income margin. In its second-quarter 2023 earnings release, Mondelez stated that it still expects a double-digit increase in inflation stemming from the continued elevated cost of packaging, ingredients and labor.

Nonetheless, Mondelez’s hands-on pricing strategies have been helping it counter these challenges. The favorable outcomes of these initiatives were evident in the organic net revenue growth achieved in the second quarter of 2023. During the quarter, the top and bottom lines increased year over year and beat the Zacks Consensus Estimate.

Mondelez's strategic expansion efforts, coupled with its commitment to core snacking categories and cost-control measures, position the company strongly for consistent growth in a dynamic business environment.

3 Other Picks

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently flaunts a Zacks Rank #1 (Strong Buy). CELH delivered an earnings surprise of 100% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported numbers.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2. KHC has a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 2.2% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report