Mondelez's (MDLZ) Focus on Buyouts & Core Categories Bodes Well

Mondelez International, Inc. MDLZ looks well-placed due to its expansion endeavors, especially acquisitions. The company has been particularly focused on the chocolate and biscuit categories.

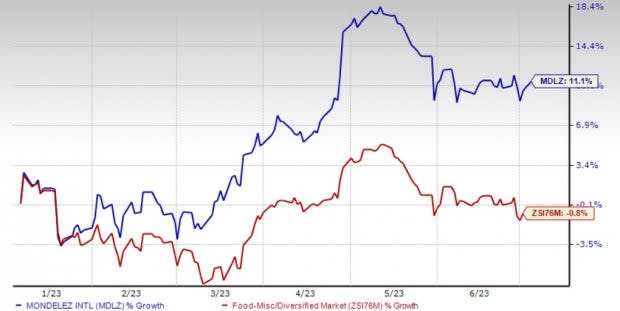

These factors, along with efficient pricing actions, have been working well for this Zacks Rank #3 (Hold) company amid elevated cost concerns. Shares of the company have rallied 11.1% in the past six months against the industry’s decline of 0.8%.

Let’s delve deeper.

Prudent Acquisitions Aid

Mondelez has been keen on expanding its business through acquisitions and alliances. The company closed the Ricolino buyout in the third quarter of 2022, which is expected to double the size of its Mexico business.

Further, in August 2022, it closed the buyout of Clif Bar. Mondelez acquired the Chipita S.A. business in January 2022, which is a major producer of sweet and salty snacks in Central and Eastern Europe. Contributions from the Ricolino, Clif Bar and Chipita buyouts boosted net revenues in the first quarter of 2023.

Prior to this, in 2021, Mondelez took over a renowned sports performance and active nutrition brand — Grenade. The company acquired the Australia-based food company — Gourmet Food Holdings — which operates in the premium biscuit and cracker category.

Moreover, Mondelez completed the acquisition of Hu Master Holdings, the parent company of Hu Products on Jan 4, 2022. MDLZ’s focus on undertaking acquisitions to gain scale in its categories and distribution capabilities bodes well.

Image Source: Zacks Investment Research

Focus on Core Categories

Mondelez has been expanding its snacking category in particular. As consumers prefer snacking over traditional meals, the company’s core categories — chocolates and biscuits — have historically depicted resilience to economic downturns and pricing actions. Consumers in developed countries consider chocolates and biscuits as affordable indulgences and one of the most-valued snacking products.

The company’s core chocolate and biscuits categories remain sustainable in both developed and emerging markets. Both these categories registered double-digit growth in the first quarter of 2023. Management is focused on expanding these categories as they have considerable scope for growth (in terms of penetration and per capita consumption). Mondelez intends to generate around 90% of its revenues through these two core categories in the long run.

Cost Woes to be Countered?

Mondelez has been battling cost inflation for a while now. In the first quarter of 2023, the adjusted gross profit margin contracted by 170 basis points (bps) to 37.1% due to increased raw material and transportation costs.

Also, the adjusted operating income margin contracted by 60 bps to 17.2% due to inflated input costs. In its first-quarter 2023 earnings release, MDLZ stated that it expects another year of double-digit inflation stemming from the continued elevated costs of packaging, energy, ingredients and labor.

However, the company has been undertaking robust pricing actions to offset cost inflation. Favorable pricing and volumes contributed to organic net revenue growth in the first quarter. For 2023, Mondelez expects organic net revenue growth of more than 10%. Management anticipates adjusted earnings per share (EPS) growth on a constant-currency basis of more than 10%.

Solid Staple Stocks

Some better-ranked consumer staple stocks are Nomad Foods NOMD, Celsius Holdings CELH and Lamb Weston LW.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1 (Strong Buy). NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current fiscal-year sales suggests growth of around 8% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently sports a Zacks Rank #1. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 30% and 117.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report