MoneyLion Inc (ML) Reports Record Revenue and Adjusted EBITDA for FY 2023

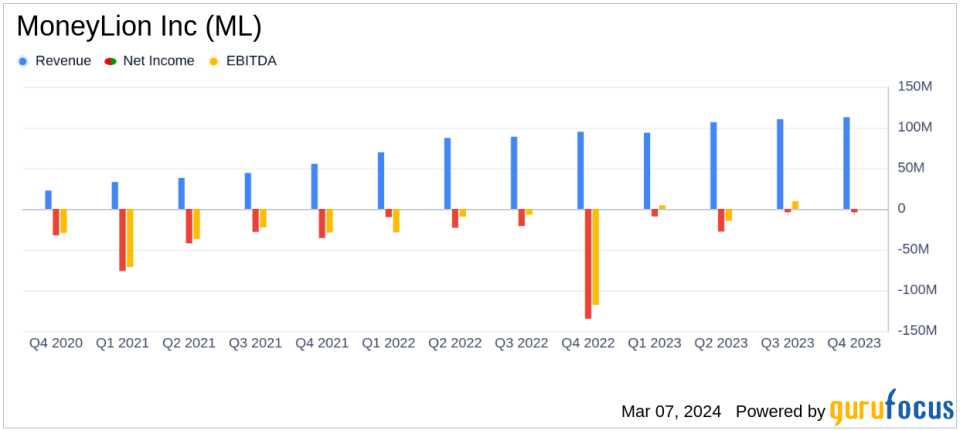

Revenue: FY 2023 revenue increased by 24% to $423.4 million.

Gross Profit Margin: Improved to 60% in FY 2023 from 57% in FY 2022.

Net Loss: FY 2023 net loss of $45.2 million, with a reduced Q4 net loss of $4.2 million.

Adjusted EBITDA: Record $46.4 million in FY 2023, with Q4 contributing $16.5 million.

Customer and Product Growth: Total Customers and Total Products grew by 115% and 79% respectively.

Q1 2024 Guidance: Revenue expected to be between $115 to $118 million with Adjusted EBITDA of $15 to $18 million.

On March 7, 2024, MoneyLion Inc (NYSE:ML) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a mobile banking and financial membership platform, reported a record revenue of $423.4 million for FY 2023, marking a 24% increase year-over-year. This growth reflects MoneyLion's commitment to providing personalized, all-in-one digital financial solutions.

MoneyLion's gross profit margin saw a positive shift, rising from 57% in FY 2022 to 60% in FY 2023. However, the company recorded a net loss of $45.2 million for the year, with a reduced net loss of $4.2 million in Q4 2023. Despite these losses, MoneyLion achieved a record Adjusted EBITDA of $46.4 million for the year, with the fourth quarter contributing $16.5 million.

Financial Performance and Strategic Growth

Dee Choubey, MoneyLions co-founder and CEO, highlighted the company's strongest year ever, with record revenue, customer additions, margin expansion, and a significant improvement in Adjusted EBITDA. Choubey expressed confidence in the company's position for accelerating growth in 2024, emphasizing structural advantages and a focus on profitability.

"We are positioned for accelerating growth in 2024 as we capitalize on the large opportunity in front of us. Our structural advantages as a marketplace make us a must-have partner for any financial services provider," said Choubey.

Rick Correia, MoneyLions CFO, provided guidance for the first quarter of 2024, expecting revenue between $115 to $118 million and Adjusted EBITDA of $15 to $18 million, indicating a positive outlook for the upcoming quarter.

Key Financial Highlights

The company's financial achievements are underscored by significant growth in Total Customers and Total Products, which grew by 115% and 79% respectively. Total Originations also saw a substantial increase, growing by 30% year-over-year to $644 million for Q4 2023 and by 27% to $2.3 billion for the full year.

MoneyLion's balance sheet reflects a solid financial position, with cash and restricted cash totaling $94.5 million at the end of FY 2023. The company's efforts in customer acquisition and product expansion have contributed to its robust revenue growth, despite the challenges of a net loss.

MoneyLion's performance in FY 2023 demonstrates its ability to scale its business while navigating the complexities of the financial technology industry. The company's focus on expanding its customer base and product offerings, coupled with its strategic vision for growth, positions it well for future success.

For more detailed information on MoneyLion Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from MoneyLion Inc for further details.

This article first appeared on GuruFocus.