MongoDB (MDB): A Hidden Gem in the Software Industry?

MongoDB Inc (NASDAQ:MDB) has recently seen a daily gain of 4.11%, despite a 3-month loss of 12.79%. The company's per-share loss stands at $3.46. But the question remains: is the stock significantly undervalued? Join us as we delve into a comprehensive analysis of MongoDB's valuation, financial strength, profitability, and growth prospects.

A Snapshot of MongoDB Inc (NASDAQ:MDB)

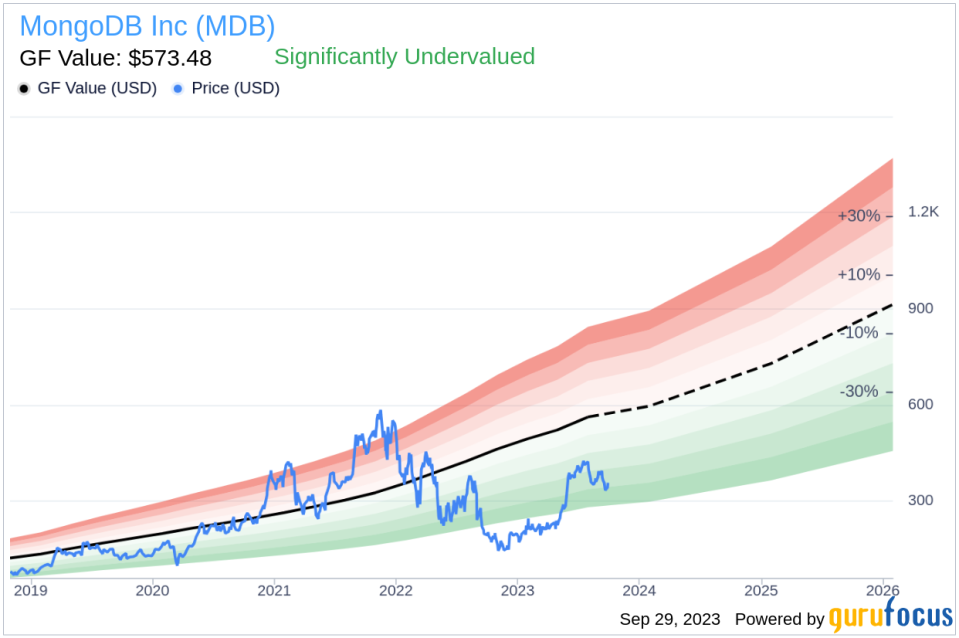

Founded in 2007, MongoDB is a document-oriented database company with nearly 33,000 paying customers and well past 1.5 million free users. The company provides both licenses and subscriptions as a service for its NoSQL database. Compatible with all major programming languages, MongoDB's database can be deployed for a variety of use cases. The company's current stock price is $357.21, with a market cap of $25.50 billion. However, our exclusive GF Value estimates MongoDB's fair value at $573.48, indicating that the stock could be significantly undervalued.

Understanding MongoDB's GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It's calculated based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future estimates of business performance. If the stock price is significantly above the GF Value Line, the stock may be overvalued and its future return is likely to be poor. On the other hand, if the stock price is significantly below the GF Value Line, the stock may be undervalued and its future return will likely be higher.

Based on this analysis, MongoDB appears to be significantly undervalued. This implies that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

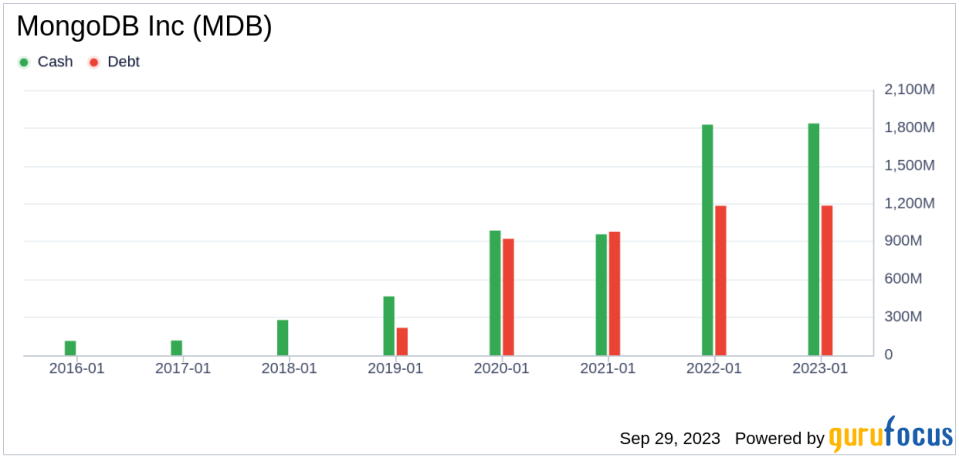

MongoDB's Financial Strength

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. To mitigate this risk, it's essential to review a company's financial strength before purchasing shares. Factors such as the cash-to-debt ratio and interest coverage can provide valuable insights into the company's financial health. MongoDB has a cash-to-debt ratio of 1.6, which ranks worse than 57.99% of 2752 companies in the Software industry. The overall financial strength of MongoDB is 5 out of 10, indicating fair financial strength.

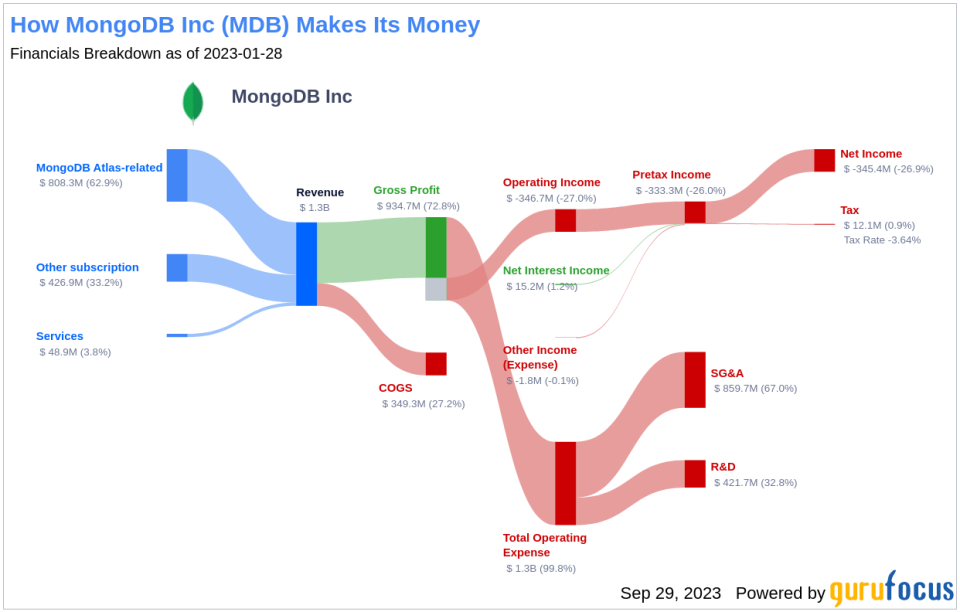

Profitability and Growth of MongoDB

Companies that have been consistently profitable over the long term offer less risk for investors. Higher profit margins usually indicate a better investment compared to a company with lower profit margins. MongoDB, however, has been profitable 0 over the past 10 years. Over the past twelve months, the company had a revenue of $1.50 billion and a Loss Per Share of $3.46. Its operating margin is -18.39%, which ranks worse than 72.78% of 2785 companies in the Software industry. Overall, the profitability of MongoDB is ranked 3 out of 10, indicating poor profitability.

Growth is a crucial factor in the valuation of a company. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. MongoDB's 3-year average annual revenue growth rate is 35.4%, which ranks better than 88.12% of 2415 companies in the Software industry. However, the 3-year average EBITDA growth rate is -21%, which ranks worse than 82.61% of 2007 companies in the Software industry.

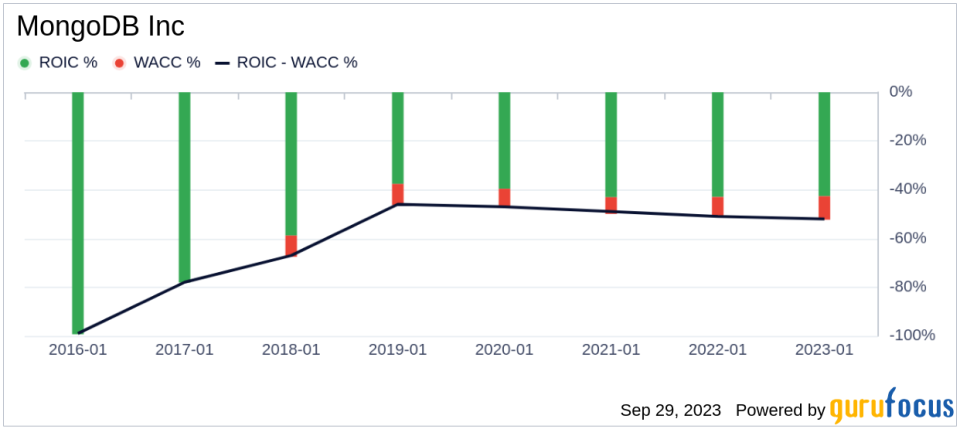

Return on Invested Capital (ROIC) vs. Weighted Average Cost of Capital (WACC)

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. During the past 12 months, MongoDB's ROIC was -35.46 while its WACC came in at 11.84.

Conclusion

In summary, MongoDB's stock appears to be significantly undervalued. The company's financial condition is fair, but its profitability is poor. Its growth ranks worse than 82.61% of 2007 companies in the Software industry. To learn more about MongoDB stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.