Monolithic Power (MPWR) Soars 80% YTD: Will the Trend Last?

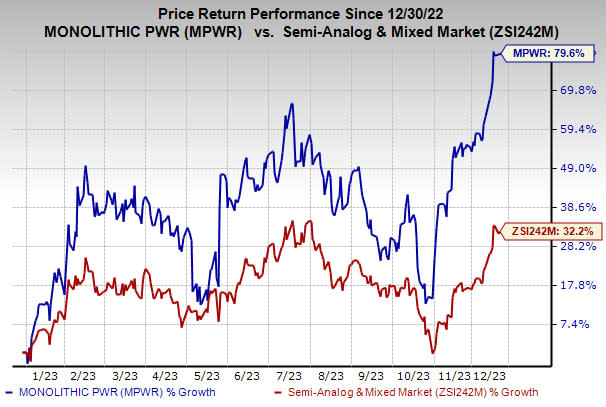

Shares of semiconductor firm Monolithic Power Systems, Inc. MPWR have climbed 79.6% year to date, driven by solid end-market demand across its portfolio on the back of a flexible business model and solid cash flow. With healthy fundamentals, this Zacks Rank #3 (Hold) stock appears primed for further appreciation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Based in Kirkland, WA, Monolithic Power designs, develops and markets high-performance power solutions. The company focuses on the market for high-performance analog and mixed-signal integrated circuits (ICs) that are widely utilized in industrial applications, cloud computing, telecommunication infrastructures, automotive and consumer applications.

Automotive is one of the foremost industries that is benefiting from the emergence of IoT and AI applications. The increasing demand for analog ICs and sensors bodes well for semiconductor component providers like Monolithic Power. Management has stated that the company is winning increasing dollar content in the automotive market.

Moreover, its deep-rooted partnerships with leading auto suppliers will likely boost the top line. Monolithic Power has a strong growth opportunity due to its robust product portfolio that targets in-car connectivity and infotainment, advanced driver assistance system and rapid adoption of LED lighting in cars and vehicles.

Apart from automotive, Monolithic Power is investing in markets like industrial, server and communications that have strong growth potential over the long term. The increasing adoption of cloud computing is driving demand for servers, which bodes well for the company’s power management solutions.

We expect Monolithic Power to benefit from the ongoing Grantley to Purley platform conversion in the server market, which significantly increases memory bandwidth performance by incorporating additional memory channels. Higher dollar content in new servers based on Purley will drive top-line growth. Management also anticipates cloud computing to be a notable growth driver, particularly due to increasing demand for solid state drives and servers.

In addition, Monolithic Power projects e-commerce as a solid growth driver. The company is engaged in developing its e-commerce platform, which will allow customers to input their specific needs. The company aims to leverage AI software to predict performance for the consumer’s desired product. Monolithic Power expects to deliver Amazon-like consumer experience through its e-commerce platform. This will not only expand the customer base but also help the company rapidly penetrate small and medium businesses.

It has a long-term earnings growth expectation of 10.1% and delivered an earnings surprise of 0.6%, on average, in the trailing four quarters.

Key Picks

United States Cellular Corporation USM, sporting a Zacks Rank #1, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve the efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

InterDigital, Inc. IDCC: Headquartered in Wilmington, DE, InterDigital is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #1 stock has a long-term earnings growth expectation of 17.4% and has surged 122.6% over the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. Apart from a strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Deutsche Telekom AG DTEGY, carrying a Zacks Rank #2 (Buy), is likely to benefit from the accretive post-merger integration of T-Mobile US Inc. and Sprite in the United States, in which it owns about 43% stake. The removal of forced cable TV access in multiple dwelling units in Germany through telecom legislation is likely to help Deutsche Telekom expand its broadband market.

Moreover, an aggressive fiber rollout strategy across the country is expected to augment its domestic market hold. The Zacks Consensus Estimate for current-year earnings for Deutsche Telekom has been revised 3.4% upward over the past year. It has a long-term earnings growth expectation of 8.5%. The stock has gained 16.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Deutsche Telekom AG (DTEGY) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report