Monolithic Power (MPWR) Tops Q4 Earnings & Revenue Estimates

Monolithic Power Systems, Inc. MPWR reported healthy fourth-quarter 2023 results, with the bottom and top lines beating the Zacks Consensus Estimate.

Net Income

On a GAAP basis, net income fell to $96.9 million or $1.98 per share from $119.1 million or $2.45 per share in the prior-year quarter. The decline was primarily due to an increase in operating expenses.

Non-GAAP net income was $140.9 million or $2.88 per share compared with $154 million or $3.17 per share in the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate by 3 cents.

For 2023, GAAP net income was $427.4 million or $8.76 per share compared with $437.7 million or $9.05 per share in 2022. Excluding stock-based compensation of $149.7 million, net deferred compensation plan expense of $1.1 million, amortization of purchased intangible assets of $0.1 million and $3.6 million for related tax effects non-GAAP net income amounted to $574.6 million or $11.78 per share compared with $599.9 million or $12.41 per share in 2022.

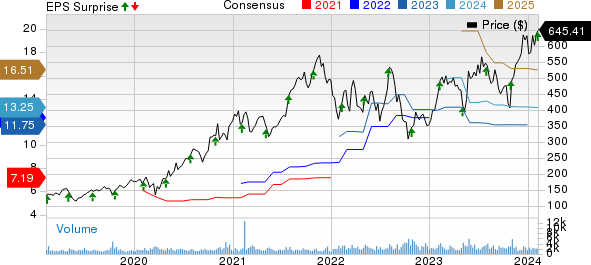

Monolithic Power Systems, Inc. Price, Consensus and EPS Surprise

Monolithic Power Systems, Inc. price-consensus-eps-surprise-chart | Monolithic Power Systems, Inc. Quote

Revenues

Quarterly revenues for Monolithic Power were $454 million compared with $460 million a year ago. The top line surpassed the Zacks Consensus Estimate by 0.4%.

For 2023, the company experienced a 1.5% top-line expansion, with net sales increasing to $1,821.1 million from $1,794.1 million in 2022. Despite revenue decline in the Industrial, Communications and Consumer markets, healthy growth trends in the Automative, Enterprise Data and Storage and Computing segments positively impacted the top-line performance.

During the quarter, Storage and Computing revenues decreased to $117.3 million from $120.8 million in the prior-year quarter. For 2023, revenues grew to $491.1 million from $452.5 million in 2022. This 8.5% increase was primarily driven by higher sales of products for enterprise notebooks and storage applications.

In the fourth quarter, Enterprise data saw massive growth of $128.8 million compared with $68.4 million in the prior-year quarter. For 2023, revenues from the segment increased 28.5% to $323 million. Increased sales of power management solutions for AI applications contributed to the impressive growth.

Revenues from the Automative segment grew 31.5% to $394.7 million in 2023 from $300 million in 2022. The growth was primarily attributable to increased sales of highly integrated applications supporting advanced driver assistance systems, the digital cockpit and lighting applications. For the fourth quarter, it fell to $89.7 million from $97.3 million a year ago.

As 4G and 5G infrastructure sales decreased, the Communications segment witnessed a decline of 18.5% to 204.9 million year over year for 2023. It recorded revenues of $40.9 million in the fourth quarter compared with $64.2 million in the prior-year quarter.

In the December quarter, Industrial revenues were down to $33.3 million from $56 million in previous year's quarter. It fell 21.2% year over year to $172.7 million in 2023 from $219.1 million in 2022. The drop reflected lower sales in applications for industrial automation, security and power sources.

Revenues from the Consumer segment witnessed a 26.6% decline to $234.7 million year over year in 2023. For the quarter, revenues were $43.7 million compared with $53 million in prior year quarter.

By product family, revenues in DC to DC surged to $427.8 million in the fourth quarter from $432.5 million in the prior-year quarter. The year’s revenues increased to $1,718.6 million from $1,696.5 million in 2022.

For the fourth quarter, Lighting Control revenues were marginally down to $26.1 million from $27.5 million. However, 2023’s revenues totaled $102.4 million compared with $97.5 million in 2022.

Other Details

Non-GAAP gross margin contracted 280 basis points from the year-ago quarter to 55.7%. The reduction was mainly due to the sales mix.

Non-GAAP operating expenses were $96.7 million, up from $94.8 million in the prior-year quarter. Non-GAAP operating income fell 10.3% year over year to $156.1 million.

Cash Flow & Liquidity

As of Dec 31, 2023, cash and cash equivalents amounted to $527.8 million and long-term liabilities were $88.6 million compared with respective tallies of $288.6 million and $73.4 million as of Dec 31, 2022.

Outlook

MPWR remains cautious about near-term business conditions as competition in the supply chain persists. For the first quarter of 2024, the company projects revenues within the range of $437 million to $457 million. Non-GAAP gross margin is estimated between 55.4% and 56.0%. On a non-GAAP basis, operating expenses are expected to be between $101.8 million and $103.8 million.

Zacks Rank & Stocks to Consider

Monolithic Power currently carries a Zacks Rank #4 (Sell). ,

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

InterDigital, Inc. IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #2 (Buy) stock has a long-term earnings growth expectation of 17.4% and has surged 75.3% in the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. The addition of technologies related to sensors, user interface and video to its already strong portfolio of wireless technology solutions is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Arista Networks, Inc. ANET, carrying a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance cloud experience. Arista delivered an average earnings surprise of 12% in the trailing four quarters.

The company holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. It is increasingly gaining market traction in 200 and 400-gig high-performance switching products. It remains well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently carrying a Zacks Rank #1, delivered a trailing four-quarter average earnings surprise of 18.99%. In the last reported quarter, it delivered an earnings surprise of 19.64%.

NVIDIA is the world leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report