Monolithic Power Systems Inc (MPWR) Reports Mixed Q4 and Full-Year 2023 Results; Increases Dividend

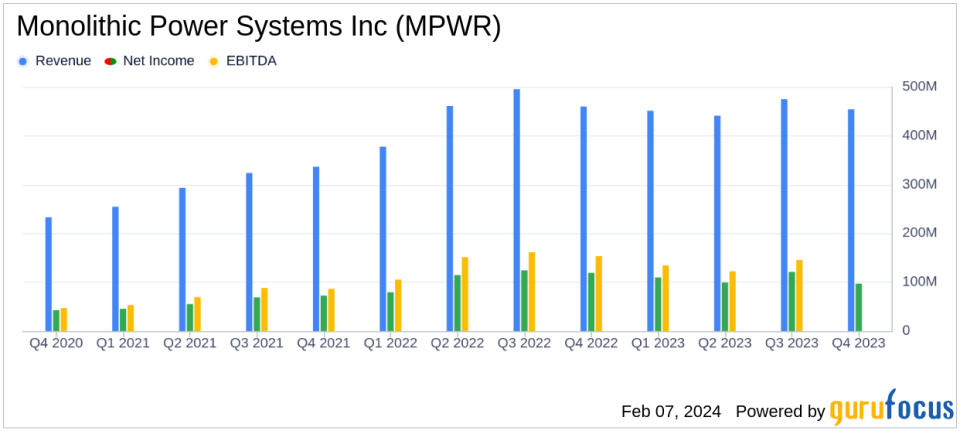

Revenue: Q4 revenue decreased by 1.3% year-over-year to $454.0 million.

Gross Margin: GAAP gross margin declined to 55.3% in Q4 from 58.2% in the previous year.

Operating Income: GAAP operating income for Q4 fell to $109.6 million from $136.9 million year-over-year.

Net Income: GAAP net income for Q4 was $96.9 million, a decrease from $119.1 million in the same period last year.

Dividend: Quarterly cash dividend increased from $1.00 per share to $1.25 per share.

Full-Year Performance: Full-year revenue slightly increased by 1.5% to $1,821.1 million.

Stock Performance: Non-GAAP adjustments include significant stock-based compensation expenses.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 7, 2024, Monolithic Power Systems Inc (NASDAQ:MPWR) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year ended December 31, 2023. The company, known for its high-performance, semiconductor-based power electronics solutions, also announced an increase in its quarterly cash dividend, signaling confidence in its financial stability and commitment to shareholder returns.

Monolithic Power Systems operates as a fabless semiconductor company, leveraging third-party foundries for manufacturing while focusing on power management solutions across various sectors, including computing, automotive, industrial, communications, and consumer markets. The company's fabless model and proprietary BCD process technology have been central to its strategy of reducing total energy consumption in end systems.

Financial Performance and Challenges

The company reported a slight year-over-year decrease in quarterly revenue, down to $454.0 million, and a modest full-year revenue growth of 1.5%. The decline in quarterly revenue and gross margin, which fell to 55.3% from 58.2% the previous year, reflects the challenges faced by the semiconductor industry, including market volatility and supply chain disruptions. These challenges are significant as they impact the company's profitability and ability to maintain cost efficiencies.

Financial Achievements and Industry Significance

Despite the revenue dip, Monolithic Power Systems achieved a notable increase in its quarterly dividend, from $1.00 to $1.25 per share, underscoring its financial health and the ability to generate shareholder value. This move is particularly important in the semiconductor industry, where investor confidence is often tied to consistent and predictable returns.

Income Statement and Balance Sheet Highlights

Key financial metrics from the income statement show a decrease in GAAP operating income to $109.6 million for Q4, down from $136.9 million in the same quarter the previous year. GAAP net income also decreased to $96.9 million, or $1.98 per diluted share, compared to $119.1 million, or $2.45 per diluted share, in the prior year's quarter. The balance sheet remains solid, with the company able to increase its dividend payout to shareholders.

Commentary from the CEO

"While we continue to be cautious about near-term business conditions, we believe our long-term growth strategy remains intact, and we can swiftly adapt to market changes as they occur," said Michael Hsing, CEO and founder of MPS.

Analysis of Company Performance

Monolithic Power Systems' performance in Q4 and the full year of 2023 reflects the broader challenges faced by the semiconductor industry, including softening demand and pricing pressures. However, the company's ability to maintain a strong gross margin and increase its dividend despite these headwinds speaks to its operational efficiency and strategic positioning. The slight full-year revenue growth indicates resilience in the face of market fluctuations, and the company's focus on innovation and energy-efficient solutions may continue to drive long-term growth.

For detailed financial figures and further information, investors and interested parties are encouraged to review the full 8-K filing and consider participating in the earnings webinar hosted by MPS.

Value investors and potential GuruFocus.com members seeking to understand the nuances of Monolithic Power Systems' financial health will find a comprehensive analysis of the company's earnings report on GuruFocus.com, where they can also explore a wealth of investment tools and resources.

Explore the complete 8-K earnings release (here) from Monolithic Power Systems Inc for further details.

This article first appeared on GuruFocus.