Is Monolithic Power Systems Inc (MPWR) Modestly Undervalued?

Monolithic Power Systems Inc (NASDAQ:MPWR) has recently experienced a daily gain of 3.44% and a three-month gain of 15.64%. The company's Earnings Per Share (EPS) stand at 9.32. The question we seek to answer is: Is the stock modestly undervalued? This article provides a thorough valuation analysis of Monolithic Power Systems (NASDAQ:MPWR), offering insights into its financial strength and intrinsic value.

A Snapshot of Monolithic Power Systems Inc (NASDAQ:MPWR)

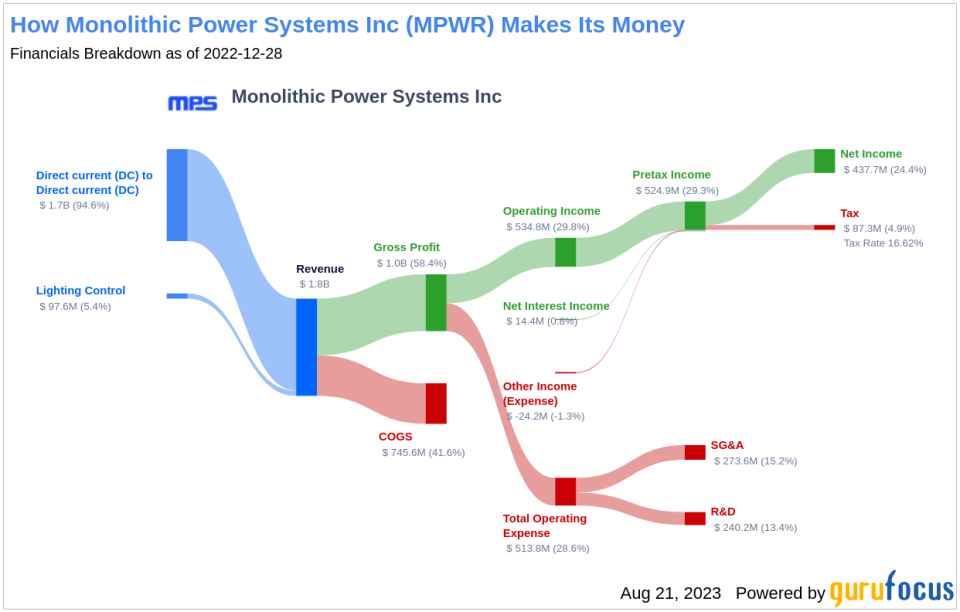

Monolithic Power Systems is a renowned analog and mixed-signal chipmaker that specializes in power management solutions. The firm's mission is to reduce total energy consumption in end systems, serving markets such as computing, automotive, industrial, communications, and consumer. The company partners with third-party chip foundries for its proprietary BCD process technology, following a fabless manufacturing model.

As of August 21, 2023, Monolithic Power Systems' stock price is $498.89, with a market cap of $23.80 billion. Its sales stand at $1.80 billion, with an operating margin of 28.72%. Comparatively, the GF Value, an estimation of the fair value of the stock, is $661.74, suggesting that the stock might be modestly undervalued.

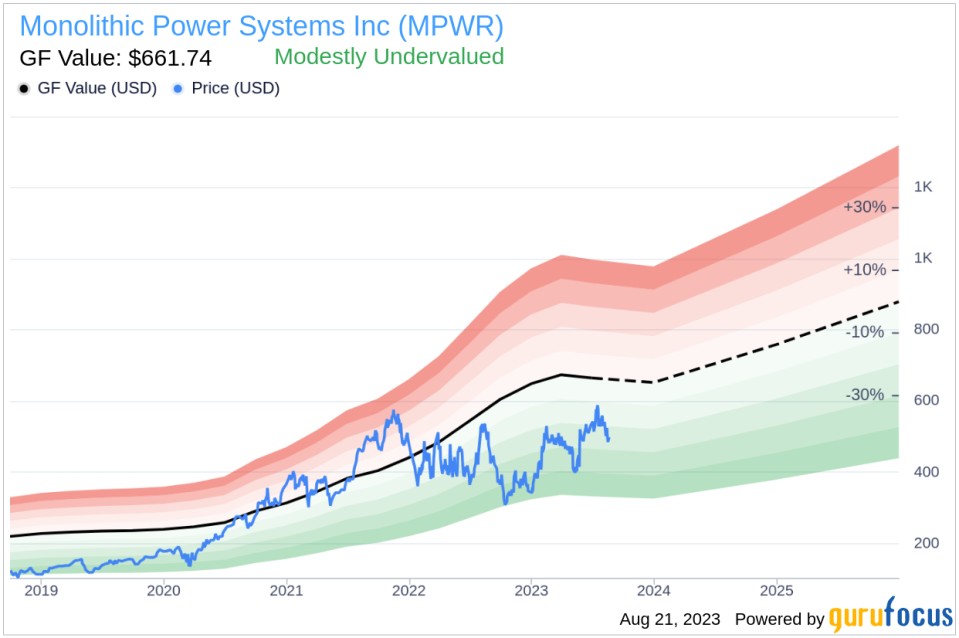

The GF Value of Monolithic Power Systems (NASDAQ:MPWR)

The GF Value is a proprietary measure of the intrinsic value of a stock. It considers historical trading multiples, an adjustment factor from GuruFocus based on past returns and growth, and future business performance estimates. This GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

Monolithic Power Systems' stock is considered modestly undervalued according to GuruFocus' valuation method. If the stock's share price is significantly above the GF Value Line, it might be overvalued and thus yield poor future returns. Conversely, if the share price is significantly below the GF Value Line, the stock could be undervalued and likely to offer high future returns. Given Monolithic Power Systems' current price and market cap, the stock seems modestly undervalued.

As Monolithic Power Systems is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

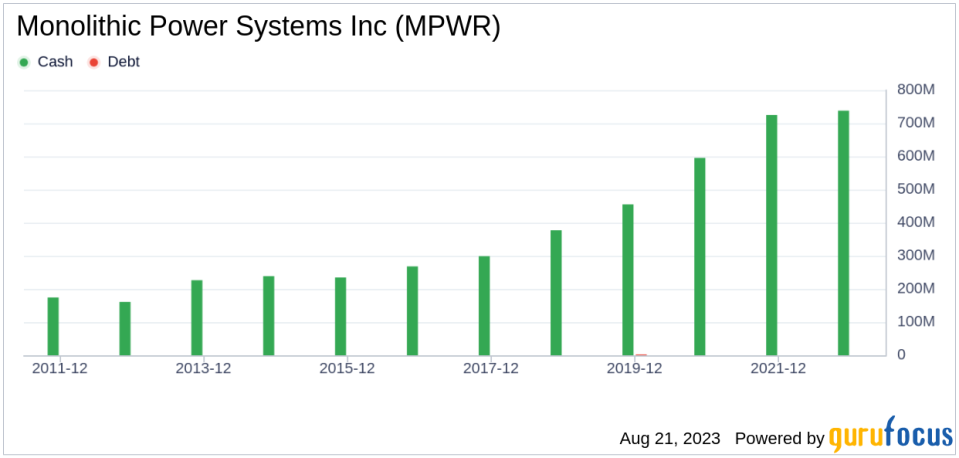

Financial Strength of Monolithic Power Systems

Investing in companies with robust financial strength reduces the risk of permanent loss. The cash-to-debt ratio and interest coverage are effective indicators of a company's financial strength. Monolithic Power Systems boasts a cash-to-debt ratio of 10,000, ranking better than 99.88% of 865 companies in the Semiconductors industry. The company's overall financial strength is rated 10 out of 10, indicating strong financial health.

Profitability and Growth of Monolithic Power Systems

Investing in profitable companies, especially those with consistent profitability over the long term, is typically less risky. Monolithic Power Systems has been profitable for 10 out of the past 10 years. The company's operating margin is 28.72%, ranking better than 92.2% of 936 companies in the Semiconductors industry. The profitability of Monolithic Power Systems is ranked 10 out of 10, signifying strong profitability.

Growth is a crucial factor in a company's valuation. A faster-growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Monolithic Power Systems is 39.3%, ranking better than 90.98% of 865 companies in the Semiconductors industry. The 3-year average EBITDA growth rate is 65.3%, ranking better than 87.63% of 768 companies in the Semiconductors industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted cost of capital (WACC) provides another perspective on its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Monolithic Power Systems' ROIC for the past 12 months is 42.26, and its WACC is 10.55.

Conclusion

In conclusion, Monolithic Power Systems' stock appears to be modestly undervalued. The company exhibits strong financial health and profitability. Its growth ranks better than 87.63% of 768 companies in the Semiconductors industry. For more insights into Monolithic Power Systems, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.