Monolithic Power Systems (MPWR): A Hidden Gem or a Mirage? Exploring Its Market Valuation

Monolithic Power Systems Inc (NASDAQ:MPWR), a key player in the analog and mixed-signal chipmaker industry, has seen a daily loss of -2.36% and a 3-month loss of -1.44%. Despite the recent downturn, the company's Earnings Per Share (EPS) stand at a respectable 9.32. These figures raise an intriguing question: Is MPWR's stock modestly undervalued? This article delves into a comprehensive valuation analysis to answer this question.

A Snapshot of Monolithic Power Systems Inc (NASDAQ:MPWR)

Monolithic Power Systems is a leading analog and mixed-signal chipmaker, specializing in power management solutions. The company's mission is to reduce total energy consumption in end systems, serving diverse markets like computing, automotive, industrial, communications, and consumer end markets. With a fabless manufacturing model, Monolithic Power Systems partners with third-party chip foundries to host its proprietary BCD process technology.

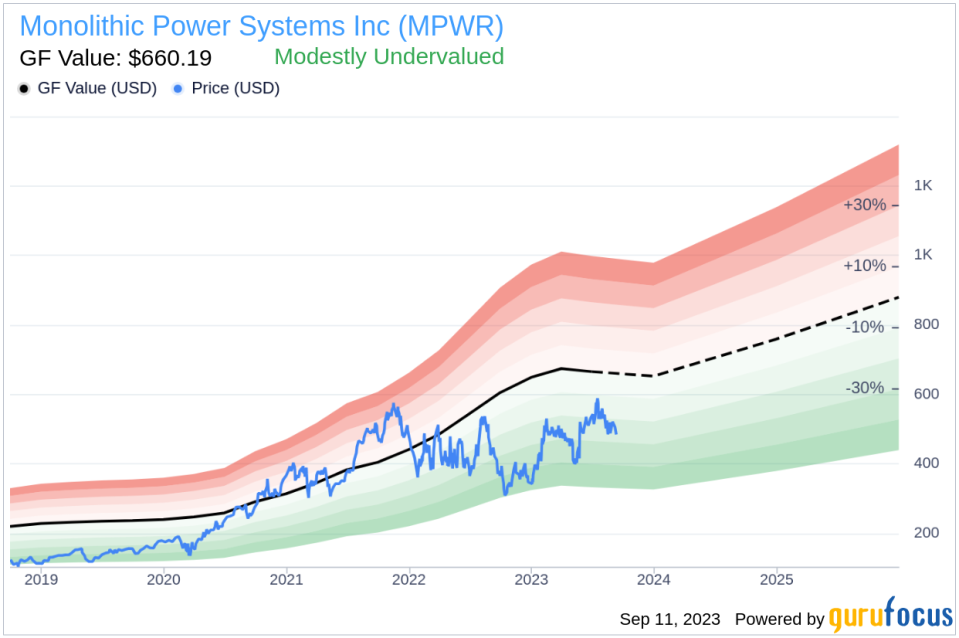

Despite the recent market fluctuations, Monolithic Power Systems' stock price stands at $489.05, with a market cap of $23.40 billion. When compared to its GF Value of $660.19, the stock appears to be modestly undervalued, paving the way for a deeper exploration of the company's intrinsic value.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor derived from the company's past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If the stock price significantly deviates from the GF Value Line, it indicates that the stock is either overvalued or undervalued, impacting its future return.

For Monolithic Power Systems (NASDAQ:MPWR), the GF Value suggests that the stock is modestly undervalued. Given this, the long-term return of its stock is likely to be higher than its business growth. This potential for higher returns makes Monolithic Power Systems an attractive prospect for value investors.

Financial Strength: A Key Determinant of Investment Risk

Investing in companies with poor financial strength can lead to a high risk of permanent capital loss. To mitigate this risk, it's crucial to assess a company's financial strength before investing. Key metrics like the cash-to-debt ratio and interest coverage can provide valuable insights into a company's financial health. Monolithic Power Systems boasts a cash-to-debt ratio of 10000, ranking better than 99.89% of 894 companies in the Semiconductors industry. With an overall financial strength rating of 10 out of 10, Monolithic Power Systems appears to be in robust financial health.

Profitability and Growth: Indicators of Investment Safety and Value Creation

Investing in profitable companies, especially those with consistent long-term profitability, is generally less risky. A company with high profit margins is typically a safer investment than those with low profit margins. Monolithic Power Systems has been profitable for 10 years and has an operating margin of 28.72%, ranking better than 92.43% of 938 companies in the Semiconductors industry. This strong profitability underscores the company's investment safety.

Growth is a critical factor in a company's valuation. Faster-growing companies create more value for shareholders, especially if the growth is profitable. Monolithic Power Systems' growth rates for 3-year average annual revenue and EBITDA are 39.3% and 65.3%, respectively. These figures rank better than most companies in the Semiconductors industry, highlighting the company's strong value creation potential.

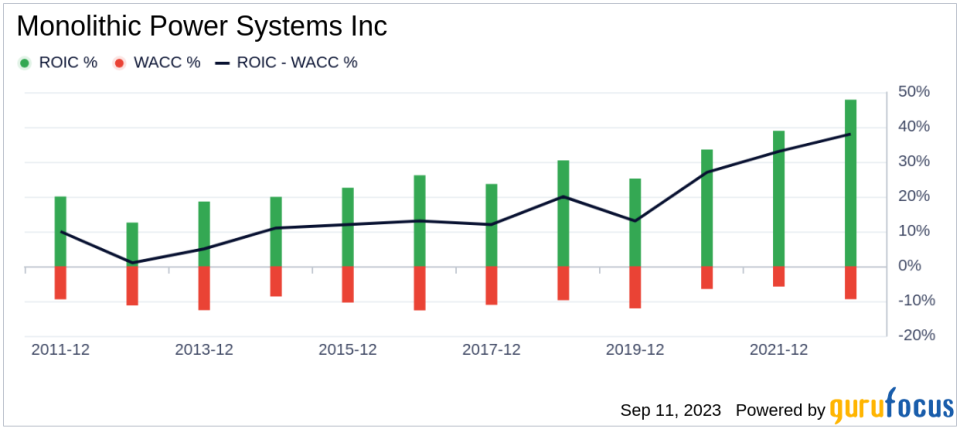

Profitability Analysis: ROIC vs. WACC

Comparing a company's Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) can provide valuable insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while WACC is the average rate that a company is expected to pay to finance its assets. For Monolithic Power Systems, the ROIC is 42.26, significantly higher than its WACC of 10.98, indicating strong profitability.

Conclusion

In conclusion, Monolithic Power Systems (NASDAQ:MPWR) appears to be modestly undervalued. The company's strong financial condition, high profitability, and robust growth make it an attractive investment prospect. To learn more about Monolithic Power Systems' stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, explore the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.