Monro Inc (MNRO) Reports Decline in Q3 Fiscal 2024 Sales Amidst Challenging Market Conditions

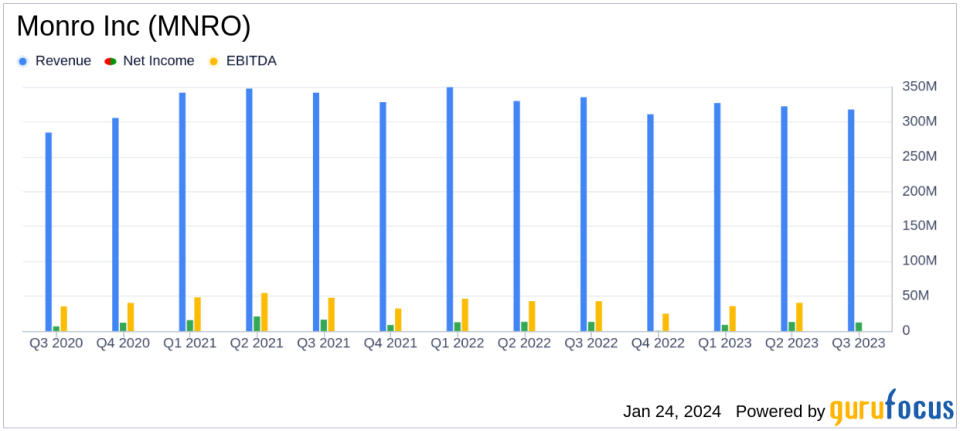

Sales Decrease: Q3 sales fell by 5.2% year-over-year to $317.7 million.

Gross Margin Improvement: Gross margin increased by 170 basis points from the prior year.

Net Income and EPS: Net income decreased to $12.2 million with diluted EPS of $0.38, down from $0.41 in the same quarter last year.

Share Repurchase: Monro repurchased 1.5 million shares at an average price of $28.50 during the quarter.

Store Count: The company maintained its store count with 1,296 company-operated stores and 51 franchised locations.

On January 24, 2024, Monro Inc (NASDAQ:MNRO), a leading provider of automotive undercar repair and tire services, released its 8-K filing, detailing financial results for the third quarter ended December 23, 2023. The company, known for its extensive network of service stations and tire stores, faced a challenging quarter with a 5.2% decrease in sales compared to the same period last year, attributing the decline to milder weather and a consumer base deferring high-ticket tire purchases.

Financial Performance and Challenges

Monro Inc's third-quarter performance was marked by a decrease in comparable store sales by 6.1%, with declines across various service categories, most notably a 9% drop in tire sales. Despite these challenges, the company achieved a gross margin increase, primarily due to lower material and technician labor costs, which partially offset higher distribution and occupancy costs. Operating income, however, decreased to $21.4 million, or 6.7% of sales, from $23.8 million, or 7.1% of sales in the prior year period.

Net income for the quarter was reported at $12.2 million, a decrease from $13.0 million in the prior year, with diluted earnings per share (EPS) falling from $0.41 to $0.38. Adjusted diluted EPS, a non-GAAP measure, was $0.39 for the quarter, compared to $0.43 in the previous year. The company's balance sheet remains strong with cash and cash equivalents of approximately $24 million and significant availability on its revolving credit facility.

Strategic Initiatives and Outlook

Monro Inc's President and CEO, Mike Broderick, commented on the company's strategic initiatives to navigate the current economic environment, focusing on gross margin expansion and cost structure optimization. Despite a preliminary comparable store sales decline of approximately 6% for fiscal January, the company expects diluted EPS to be higher compared to the prior year, driven by productivity improvements and tire assortment optimization.

Despite a tough macro-economic environment, the resiliency of our business model and the actions that weve taken allowed us to expand gross margin in the quarter, said Mike Broderick, President and Chief Executive Officer.

Monro Inc did not provide specific financial guidance for fiscal 2024 but emphasized its commitment to restoring gross margins to pre-COVID levels and achieving double-digit operating margins over the long term. The company continues to execute its share repurchase program, having repurchased approximately 1.5 million shares during the quarter.

Investor and Market Considerations

Value investors may find Monro Inc's share repurchase program and gross margin expansion indicative of a company actively managing its capital allocation and cost structure in a challenging market. The company's ability to maintain its store count and focus on strategic acquisitions and store openings could signal potential for future growth. However, investors should also consider the impact of consumer spending trends and macroeconomic factors on Monro Inc's performance moving forward.

For a more detailed analysis and updates on Monro Inc's financial performance, investors and interested parties are encouraged to join the earnings conference call and webcast scheduled for January 24, 2024.

Explore the complete 8-K earnings release (here) from Monro Inc for further details.

This article first appeared on GuruFocus.