Monro (NASDAQ:MNRO) Reports Sales Below Analyst Estimates In Q2 Earnings

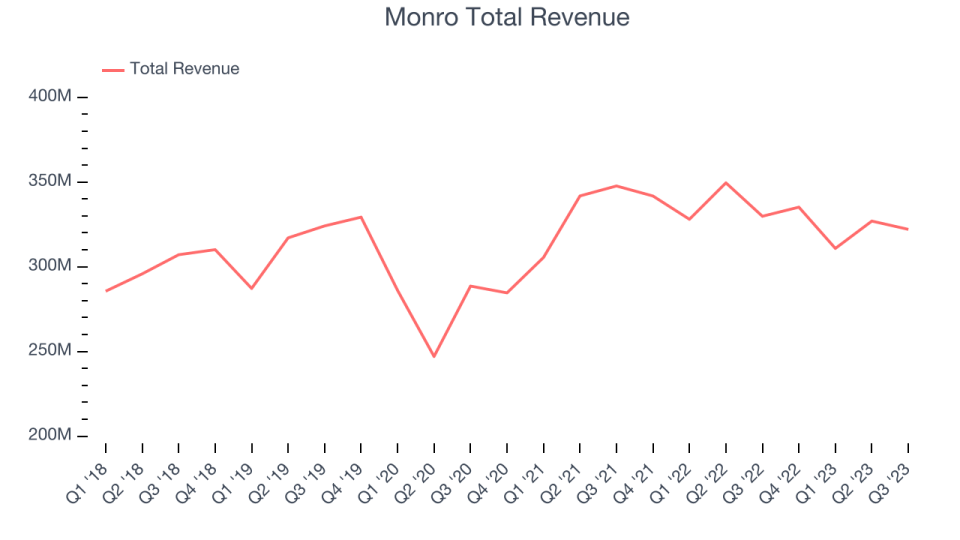

Auto services provider Monro (NASDAQ:MNRO) fell short of analysts' expectations in Q2 FY2024, with revenue down 2.34% year on year to $322.1 million. Turning to EPS, Monro's GAAP profit of $0.40 per share was flat year on year.

Is now the time to buy Monro? Find out by accessing our full research report, it's free.

Monro (MNRO) Q2 FY2024 Highlights:

Revenue: $322.1 million vs analyst estimates of $331.3 million (2.79% miss)

EPS: $0.40 vs analyst estimates of $0.37 (9.59% beat)

Gross Margin (GAAP): 35.7%, in line with the same quarter last year

Same-Store Sales were down 2.3% year on year (miss vs. expectations of roughly 1% growth)

Store Locations: 1,375 at quarter end, decreasing by 2 over the last 12 months

“Our second quarter comparable store sales decline of approximately 2% reflects topline results that were challenged. This was due to consumers deferring tire purchases as persistent inflationary pressures impacted purchases of higher-ticket items across the retail spectrum. This was clearly evidenced by an industry-wide slowdown in tire unit sales in the regions of the country where a vast majority of our store footprint is concentrated. This led to pressured store traffic, which was not supportive to sales of our higher-margin service categories in the quarter. While our tire units were down approximately 10%, leveraging the strength of our manufacturer-funded promotions allowed us to optimize our assortment for improved tire profitability in the quarter. And, while continued consumer trade down dynamics led to a higher proportion of lower-margin opening price point tires within overall industry unit sales, we remained focused on maintaining a healthy mix of opening price point tires in the quarter. Encouragingly, based on retail sell-out data from Torqata, a subsidiary of American Tire Distributors, we maintained our tire market share in our higher-margin tiers. We mitigated this industry-wide slowdown with actions to reduce non-productive labor costs, including overtime hours in our stores. Despite a tough macro-economic environment, the resiliency of our business model allowed us to expand gross margin and maintain our year-over-year profitability even on lower tire sales volumes. While our preliminary comp store sales for fiscal October are down approximately 5%, our stores are properly staffed and ready for the back-half of the year. We will remain relentlessly focused on achieving comp sales growth through accelerating growth in our 300 small or underperforming stores, maintaining a balanced approach between our tire and service categories with competitive pricing to drive store traffic and continuously improving our customer experience. We will also strive to expand our gross margins through properly training our Teammates to maximize their productivity. Given the current pressures on the consumer, we are also laser focused on maximizing profitability through prudent cost control, which includes right sizing our fixed costs and rationalizing unproductive labor. While we take these actions, we will not cut productive labor at the sacrifice of our standards and to the detriment of our long-term service model. In addition, we will create cash by optimizing inventory and leveraging the strength of our vendor partners for better availability, quality and cost of parts and tires in our stores”, said Mike Broderick, President and Chief Executive Officer.

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's annualized revenue growth rate of 1.12% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store count dropped, signaling that growth was driven by more sales at existing, established stores.

This quarter, Monro reported a rather uninspiring 2.34% year-on-year revenue decline, missing analysts' expectations. Looking ahead, the analysts covering the company expect sales to grow 5.38% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Monro's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by 1.97% year on year. Given its declining store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores, which is sometimes a side effect of reducing the total number of stores.

In the latest quarter, Monro's same-store sales fell 2.3% year on year. This decline was a reversal from the 1.3% year-on-year increase it posted 12 months ago. A one quarter hiccup isn't material for the long-term prospects of a business, but we'll keep a close eye on the company.

Key Takeaways from Monro's Q2 Results

With a market capitalization of $775.7 million and more than $9.05 million in cash on hand, Monro can continue prioritizing growth.

Monro missed revenue estimates driven by a decline in same store sales growth that came in below Wall Street Consensus. Gross margin also missed. On the other hand, it was encouraging to see Monro beat analysts' EPS expectations this quarter. The company did not provide formal guidance in the earnings release. Overall, this was a mixed quarter for Monro with mediocre revenue growth. The stock is up 1.13% after reporting and currently trades at $24.98 per share.

Monro may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.