Monster Beverage Corp (MNST) Delivers Strong Q4 and Full-Year 2023 Results

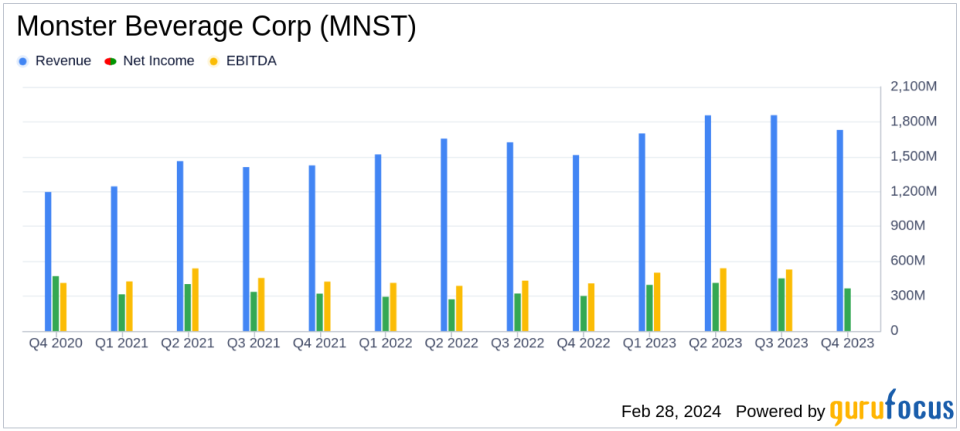

Net Sales: Q4 net sales increased 14.4% to $1.73 billion; full-year net sales rose 13.1% to $7.14 billion.

Gross Profit Margin: Q4 gross profit margin improved to 54.2%; full-year gross margin increased to 53.1%.

Net Income: Q4 net income surged 21.6% to $367.0 million; full-year net income jumped 36.9% to $1.63 billion.

Earnings Per Share (EPS): Q4 EPS rose 22.3% to $0.35; full-year EPS increased 38.0% to $1.54.

Share Repurchase: During Q4, MNST repurchased approximately 0.8 million shares for $43.2 million.

On February 28, 2024, Monster Beverage Corp (NASDAQ:MNST) released its robust financial results for the fourth quarter and full year of 2023, demonstrating significant growth in net sales and net income. The company's detailed financial performance can be reviewed in their 8-K filing.

Monster Beverage is a dominant player in the energy drink market, known for its Monster Energy, Monster Ultra, Java Monster, and Juice Monster brands. The company also owns other energy drink brands such as Reign, NOS, Burn, and Mother, and has expanded into the alcoholic beverage market with the acquisition of a craft brewer in 2022. Monster Beverage outsources manufacturing and packaging but controls branding and innovation, with distribution through the global Coca-Cola system under a 20-year agreement established in 2015. Coca-Cola holds a 19.5% stake in Monster Beverage.

Financial Highlights and Challenges

Monster Beverage's Q4 net sales rose to $1.73 billion, a 14.4% increase, despite adverse foreign currency changes. The Monster Energy Drinks segment saw a 15.1% increase in net sales, while the Alcohol Brands segment grew by 30.6%. The company's gross profit margin improved to 54.2%, attributed to pricing actions, decreased freight-in costs, and lower input costs. However, operating expenses increased to $504.4 million, including impairment charges related to the Alcohol Brands segment due to challenges in the craft beer and seltzer categories.

For the full year, net sales climbed to $7.14 billion, a 13.1% increase, with a gross profit margin of 53.1%. Net income for the year soared by 36.9% to $1.63 billion, with EPS rising to $1.54. The company's effective tax rate for the year was 21.2%, down from 24.2% in the previous year.

Strategic Moves and Future Outlook

Monster Beverage's leadership expressed satisfaction with the company's growth and the successful integration of the Bang Energy acquisition. They highlighted the importance of innovation, which contributed to record sales in 2023, and outlined plans for new product launches in 2024. The company also emphasized its goal of expanding The Beast Unleashed throughout most of the United States and launching Nasty Beast, a new hard tea.

The company's share repurchase program continued in Q4, with the purchase of approximately 0.8 million shares. As of February 27, 2024, approximately $642.4 million remained available for repurchase under the authorized programs.

Monster Beverage's financial health is evident in its balance sheet, with a significant increase in cash and cash equivalents to $2.3 billion as of December 31, 2023, up from $1.3 billion the previous year. The company's total assets rose to $9.7 billion, while total stockholders' equity increased to $8.2 billion.

Value investors may find Monster Beverage's strong financial performance, strategic brand management, and ongoing innovation appealing. The company's ability to navigate market challenges while delivering growth in revenue and net income positions it as a potentially attractive investment opportunity.

For a more detailed analysis and to stay updated on Monster Beverage Corp's financial journey, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Monster Beverage Corp for further details.

This article first appeared on GuruFocus.