Monster (NASDAQ:MNST) Misses Q4 Sales Targets

Energy drink company Monster Beverage (NASDAQ:MNST) fell short of analysts' expectations in Q4 FY2023, with revenue up 14.4% year on year to $1.73 billion. It made a GAAP profit of $0.35 per share, improving from its profit of $0.29 per share in the same quarter last year.

Is now the time to buy Monster? Find out by accessing our full research report, it's free.

Monster (MNST) Q4 FY2023 Highlights:

Revenue: $1.73 billion vs analyst estimates of $1.76 billion (1.5% miss)

EPS: $0.35 vs analyst expectations of $0.38 (9.1% miss)

Gross Margin (GAAP): 54.2%, up from 51.8% in the same quarter last year

Market Capitalization: $58.39 billion

Hilton H. Schlosberg, Vice Chairman and Co-Chief Executive Officer, said, “We continue to see sound growth in the energy drink market globally. We are pleased to report another quarter of solid revenue growth, with record sales for our fourth quarter and 2023 financial year. The quarter and the 2023 financial year were again impacted by unfavorable foreign currency exchange rates."

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Monster is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

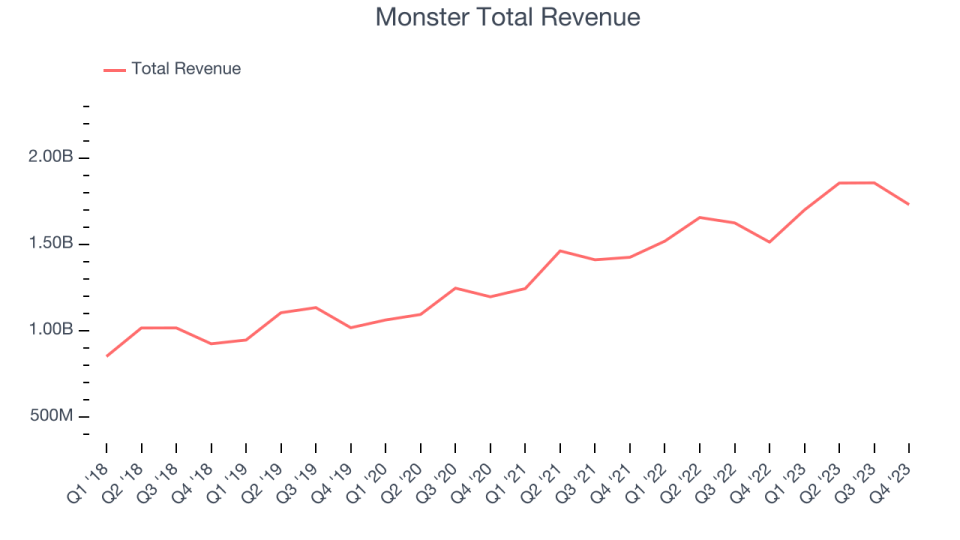

As you can see below, the company's annualized revenue growth rate of 15.8% over the last three years was solid for a consumer staples business.

This quarter, Monster's revenue grew 14.4% year on year to $1.73 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 12% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

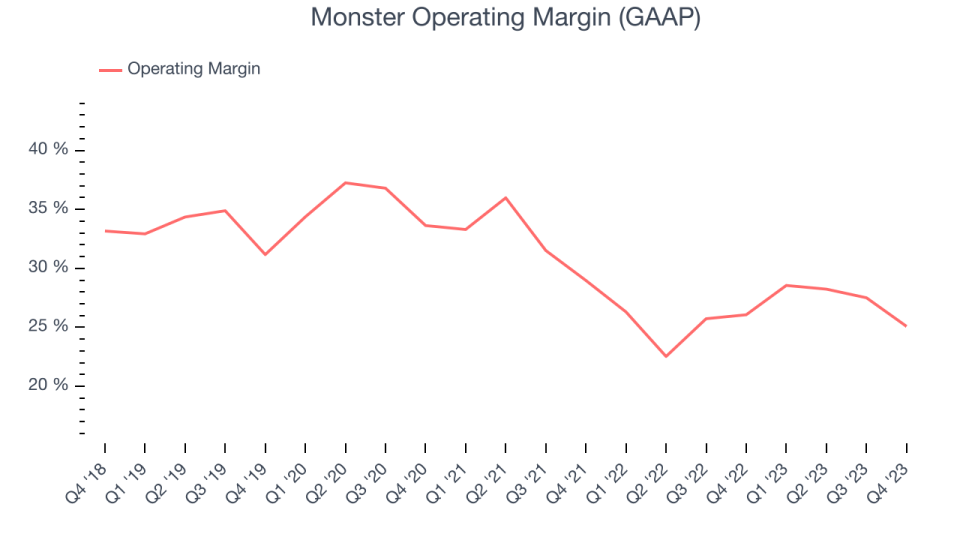

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q4, Monster generated an operating profit margin of 25.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Monster has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 26.3%. On top of that, its margin has risen by 2.2 percentage points on average over the last year, showing the company is improving its fundamentals.

Key Takeaways from Monster's Q4 Results

It was encouraging to see Monster slightly top analysts' gross margin forecasts this quarter thanks to a better-than-expected pricing and freight-related cost environment. On the other hand, its operating margin and EPS missed Wall Street's estimates. Its Strategic Brands segment, mainly energy drink brands acquired from The Coca-Cola Company, also performed poorly as revenue dropped 1.3% year-on-year, falling short of projections. A silver lining was that the company announced its integration of Bang Energy, which it acquired in July 2023, is now fully complete. Overall, this was a mixed quarter for Monster. The stock is flat after reporting and currently trades at $55.7 per share.

Monster may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.