Montage Resources (MR) to Post Q1 Earnings: What Awaits?

Montage Resources Corporation MR is set to release first-quarter 2020 results after the closing bell on Thursday, May 7. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 4 cents per share on revenues of $137.7 million.

Let’s delve into the factors that might have influenced the upstream operator’s performance in the March quarter. But it’s worth taking a look at Montage Resources’ previous-quarter performance first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, the Irving, TX-based Appalachian Basin-focused company comprehensively beat the consensus mark on strong production and continued cost improvements. Montage Resources reported adjusted net income per share of 89 cents that surpassed the Zacks Consensus Estimate by 128.2%. The company’s quarterly revenues of $174.1 million brushed past the Zacks Consensus Estimate of $172 million.

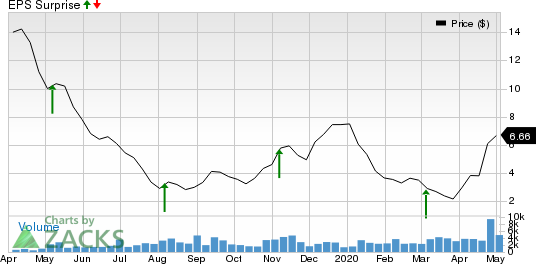

As far as earnings surprises are concerned, Montage Resources is on an excellent footing, having gone past the Zacks Consensus Estimate in each of the last four reports, with the average positive surprise being 294.3%. This is depicted in the graph below:

Montage Resources Corporation Price and EPS Surprise

Montage Resources Corporation price-eps-surprise | Montage Resources Corporation Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for first-quarter earnings per share remained same over the last seven days. However, the estimated figure indicates a 94.3% drop from the year-ago reported earnings. Meanwhile, the Zacks Consensus Estimate for revenues suggests a 2.7% decrease from the prior-year reported figure of $141.5 million.

Factors to Consider This Quarter

Montage Resources is focused on natural gas-driven drilling. As such, its acreage in the Marcellus and Utica shale plays are expected to have placed it well for significant output growth in the to-be-reported quarter. The Zacks Consensus Estimate for first-quarter average daily production is pegged at 621,296 thousand cubic feet equivalent (Mcfe), indicating a 52.5% surge from 407,500 Mcfe a year ago. Montage Resources has given its preliminary guidance at 611,000 Mcfe per day. Investors should know that the company’s total production comprises almost 78% natural gas.

However, the positive impact of volume growth might have been offset by lower price realizations. Montage Resources’ 'gassier' nature of its volume mix exposes it to the vagaries of year-over-year price drop. While the company has hedged a substantial portion of its 2020 production at attractive prices, the sharp pullback in gas prices is expected to have impacted profitability.

The Zacks Consensus Estimate for average natural gas price realization (excluding the impact of derivatives) for the to-be-reported quarter stands at $1.78 per thousand cubic feet, implying a 40.9% decline from $3.01 reported a year earlier.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Montage Resources is likely to beat estimates in the March quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company stands at 0.00%.

Zacks Rank: Montage Resources has a Zacks Rank of 3.

The above combination acts as a spoiler as it leaves surprise prediction inconclusive.

Stocks to Consider

While earnings beat looks uncertain for Montage Resources, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this season:

Canadian Natural Resources Limited CNQ has an Earnings ESP of +36.36% and a Zacks Rank #3. The company is scheduled to release earnings on May 7.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Comstock Resources, Inc. CRK has an Earnings ESP of +2.63% and is Zacks #3 Ranked. The firm is scheduled to release earnings on May 6.

NOW Inc. DNOW has an Earnings ESP of +30.00% and is Zacks #3 Ranked. The firm is scheduled to release earnings on May 6.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Eclipse Resources Corporation (MR) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

NOW Inc. (DNOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research