Montreal’s Resale Market Starts 2024 on Strong Note

Montreal Area Real Estate Market

Montreal Census Metropolitan Area (CMA)

Marked increase in sales from January 2023, particularly in the suburbs, indicating a recovery in activity which is expected to continue.

The number of properties for sale is also rising despite greater transactional activity, reflecting better market fluidity.

Prices are increasing on an annual basis; however, the trend is towards stability on a consecutive monthly basis in a more balanced market context.

L'ILE-DES-SOEURS, Quebec, Feb. 06, 2024 (GLOBE NEWSWIRE) -- The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its residential real estate market statistics for the month of January 2024. The most recent market statistics for the Montreal Census Metropolitan Area (CMA) are based on the real estate brokers’ Centris provincial database.

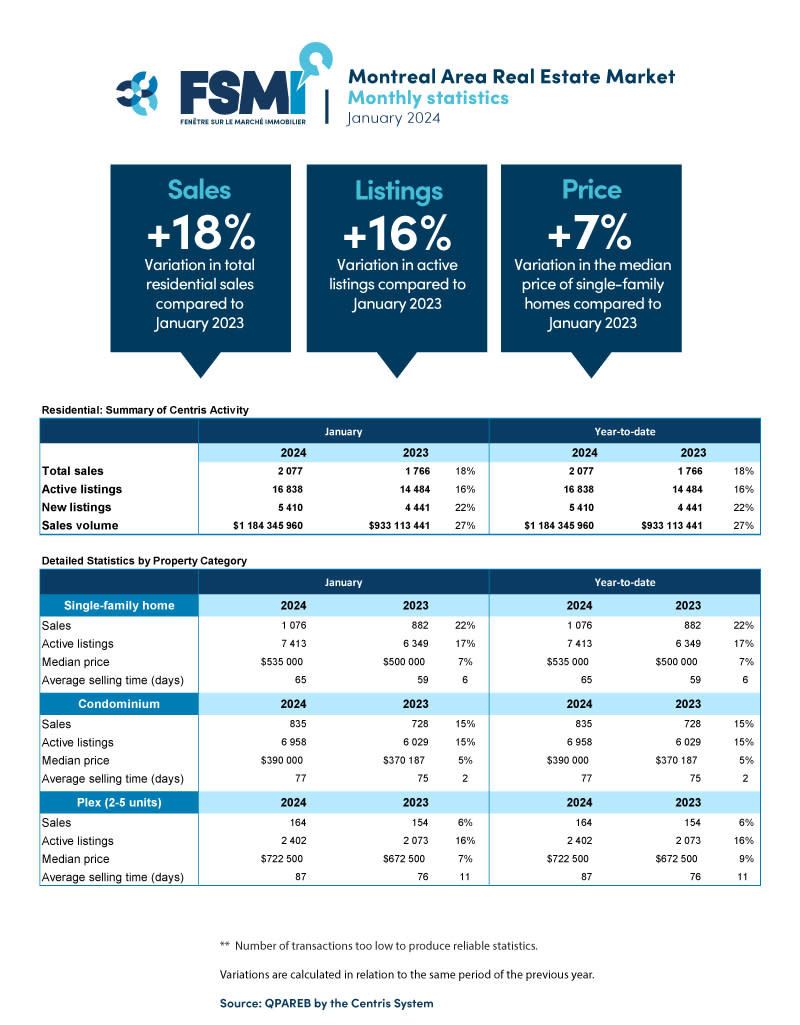

Residential sales in the Montreal CMA territory stood at 2,077 in January 2024. This is a marked increase of 18 per cent, or 311 transactions, compared to the same period last year. Note that this level of transactional activity is lower than the historical average recorded for this time of year since the Centris system began compiling market data in 2000.

“The solid performance of sales for the start of the year is essentially attributable to more encouraging prospects regarding interest rates. Since late 2023, economists agree that the up cycle in interest rates is behind us and that a reverse process should begin in 2024. This widely shared analysis has been reflected in the bond markets and, for all practical purposes, in a significant decline in fixed mortgage rates. This has been beneficial for the real estate market,” notes Charles Brant, QPAREB Market Analysis Director.

“However, there are several headwinds to a more decisive resumption of transactional activity. We are referring to the sharp slowdown in economic activity and the resulting uncertainties that influence the propensity of households to purchase a home. That being said, a change of course by the Bank of Canada suggests a first cut in interest rates later this year. This change in the Bank of Canada’s approach, while not necessarily impacting January’s statistics, is seen as a particularly positive signal in advance of the busy spring season, both on the part of buyers and sellers.”

January highlights

Residential property sales are up in all of the Montreal CMA’s main metropolitan areas. The South Shore of Montreal, with 541 transactions, stands out with an increase of 36 per cent compared to January of last year. The North Shore of Montreal (519 sales), Laval (200 sales) and Saint-Jean-sur-Richelieu (58 sales) follow with respective increases in sales of 19 per cent, 18 per cent and 14 per cent. The Island of Montreal (679 sales) and Vaudreuil-Soulanges (80 sales) posted increases of 8 per cent and 1 per cent.

Transactional activity by property category varied between +6 per cent and +22 per cent for the period. The number of single-family homes sold reached 1,076, up significantly by 22 per cent compared to the same period last year. Condominium sales were up 15 per cent to reach 835 transactions. Small income properties, with 164 sales, rose by 6 per cent.

Active listings increased significantly during the month of January, up 16 per cent from a year ago to reach 16,838 listings in the Montreal CMA. This increase in listings was observed across all property categories. Note that this level of transactional activity is lower than the historical average recorded for this time of year since the Centris system began compiling market data in 2000.

The average selling time for small income properties was 87 days, 11 days longer than the same period a year ago. Condominiums and single-family homes follow at 77 days and 65 days, respectively. This is 3 days more for condominiums and 7 days more for single-family homes.

All median prices were up when compared to those of last year. The median price of condominiums stood at $390,000, an increase of 5 per cent. Single-family homes sold at a median price of $535,000, an increase of

7 per cent compared to last year. With a median price of $722,500, plexes also saw a 7 per cent jump for the period.On a consecutive monthly basis, median prices remained relatively unchanged compared to December 2023. While small income properties experienced a slight positive variation compared to the previous month

(+3 per cent), the median price of condominiums and single-family homes remained stable (0 per cent in both cases).On an annual basis, median prices for single-family homes in the main metropolitan areas of the Montreal CMA varied between 0 per cent and +17 per cent. There were significant increases in median prices for the Island of Montreal (+17 per cent), Saint-Jean-sur-Richelieu (+13 per cent) and Vaudreuil-Soulanges (+13 per cent). The North Shore of Montreal and the South Shore of Montreal both follow with growth of 10 per cent and 6 per cent, respectively. The median price was stable in Laval (0 per cent).

Additional information:

Detailed and cumulative statistics for the province and regions

If you would like additional information from the Market Analysis Department, such as specific data or regional details on the real estate market, please write to us.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Quebec’s residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination, and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and a regional office in Saguenay. It has two subsidiaries: Société Centris inc. and the Collège de l’immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About Centris

Centris is a dynamic and innovative technology company in the real estate sector. It collects data and offers solutions that are highly adapted to the needs of professionals. Among these solutions is Centris.ca, the most visited real estate website in Quebec.

For more information:

Ariane Boulé

Morin Relations Publiques

media@qpareb.ca

Image bank (credit QPAREB) available free of charge.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/46b7756e-aab5-43bc-ae58-5032c10eb00d