Moody's (MCO) Stock Up on Q1 Earnings Beat, Raised 2021 View

Moody's MCO reported first-quarter 2021 adjusted earnings of $4.06 per share, which handily surpassed the Zacks Consensus Estimate of $2.80. Also, the bottom line grew 49% from the year-ago quarter.

Shares of Moody’s have rallied 2.7% in the pre-market trading as investors cheered solid quarterly performance and improved 2021 outlook. A full day’s trading session will provide a better picture.

Results benefited from solid bold issuance volume, which led to strong revenue growth. Also, the company’s liquidity position was robust during the quarter. However, higher operating expenses acted as headwind.

After taking into consideration certain non-recurring items, net income attributable to Moody's Corporation was $736 million or $3.90 per share, up from $488 million or $2.57 per share in the prior-year quarter.

Revenues Improve, Costs Up

Revenues of $1.6 billion beat the Zacks Consensus Estimate of $1.42 billion. Also, the top line jumped 24% year over year. Foreign currency translation favorably impacted the top line by 3%.

Total expenses were $747 million, up 7% from the prior-year quarter. Also, foreign currency translation negatively impacted operating expenses by 3%.

Adjusted operating income of $914 million surged 41%. Adjusted operating margin was 57.1%, up from 50.3% a year ago.

Robust Segment Performance

Moody’s Investors Service revenues soared 30% year over year to $1 billion. Foreign currency translation favorably impacted the segment’s revenues by 3%.

Corporate finance revenues increased, driven by solid leveraged loan and speculative grade bond activity in the United States and EMEA. Also, financial institutions’ revenues grew, primarily backed by favorable mix of infrequent U.S. securities firms and insurance companies.

Further, public, project and infrastructure finance revenues rose from the year-ago level, reflecting refinancing in the utilities sector. Moreover, structured finance revenues were up mainly driven by significant increase in collateralized loan obligation refinancing activity and commercial mortgage-backed securities issuance.

Moody’s Analytics revenues grew 14% year over year to $564 million. Foreign currency translation favorably impacted the segment’s revenues by 4%.

The segment recorded growth in research, data and analytics revenues, as well as Enterprise Risk Solutions revenues.

Strong Balance Sheet

As of Mar 31, 2021, Moody’s had total cash, cash equivalents and short-term investments of $2.9 billion, up from $2.7 billion on Dec 31, 2020. Further, it had $6.3 billion of outstanding debt and $1 billion in additional borrowing capacity under the revolving credit facility.

Share Repurchase Update

During the quarter, Moody's repurchased 0.5 million shares for $132 million.

Upbeat 2021 Guidance

Following solid first-quarter 2021 performance, Moody’s raised full-year guidance.

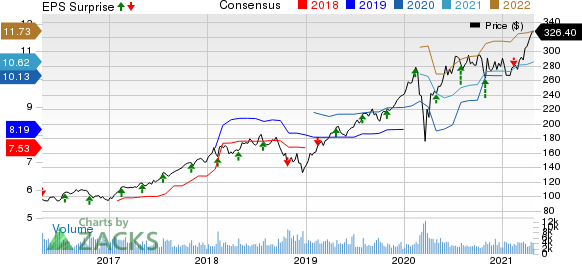

The company now expects adjusted earnings in the range of $11.00-$11.30 per share, up from prior expectation of $10.30-$10.70 per share. The Zacks Consensus Estimate for the bottom line for 2021 is $10.62, which is below the company’s adjusted earnings guidance.

On GAAP basis, earnings are now projected within $10.40-$10.70 per share. Earlier, the company had expected GAAP earnings in the range of $9.70-$10.10 per share.

Moody’s projects revenues to increase in the high-single-digit percent range, up from the prior anticipation of growth in the mid-single-digit percent range.

Our Take

Moody’s remain well positioned for growth on the back of a strong market position, strength in diverse operations and strategic acquisitions. However, steadily increasing operating expenses are likely to hurt its financials to some extent.

Moodys Corporation Price, Consensus and EPS Surprise

Moodys Corporation price-consensus-eps-surprise-chart | Moodys Corporation Quote

Currently, Moody’s carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Sallie Mae’s SLM first-quarter 2021 earnings per share of $1.77 (on core basis) handily surpassed the Zacks Consensus Estimate of $1. Also, the bottom line compared favorably with 79 cents reported in the prior-year quarter.

Blackstone’s BX first-quarter 2021 distributable earnings of 96 cents per share surpassed the Zacks Consensus Estimate of 72 cents. Moreover, the figure represents a significant rise from 46 cents recorded in the prior-year quarter.

KeyCorp’s KEY first-quarter 2021 earnings of 61 cents per share easily surpassed the Zacks Consensus Estimate of 49 cents. Also, the bottom line improved substantially from 12 cents earned in the prior-year quarter.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moodys Corporation (MCO) : Free Stock Analysis Report

SLM Corporation (SLM) : Free Stock Analysis Report

Blackstone Group IncThe (BX) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research