Morgan Stanley (MS) Faces $750M Lawsuit by Private Equity Firms

A lawsuit has been filed in the New York state court against Morgan Stanley MS by private equity firms Certares Management LLC and Knighthead Capital Management LLC. The firms claim that MS used deceptive practices in relation to a credit agreement investment for a luxury high-speed rail line.

The firms are seeking at least $750 million in damages from Morgan Stanley. Certares and Knighthead claim that MS illicitly restructured a deal by which they invested in a loan to Miami-based Brightline Holdings.

Brightline, also a defendant in the lawsuit, is a Fortress Investment Group-backed company that is currently developing a Los Angeles-Las Vegas rail line.

Per the suit, in late 2022 and early 2023, Morgan Stanley convinced the private equity firms to invest around $280 million in the loan by highlighting a “make-whole” provision that would guarantee them a certain amount based on future interest if the loan were repaid early.

However, Morgan Stanley misrepresented and concealed the terms of the deal that were later used to sanction a preferred-share issue by a subsidiary of Brightline.

The firms claim that the issue should have triggered the deal’s prepayment make-whole provision, and hence, they are asking for an order that requires Brightline to prepay the loan and make the make-whole payments.

Notably, Certares and Knighthead claimed that they invested in the loan through their jointly managed CK Opportunities Fund. The fund was launched during the pandemic to focus on distressed assets in the travel and tourism industry.

The firms claim that Morgan Stanley went out of its way to hide revisions to the original credit agreement allowing the share issue.

The lawsuit suggests that Morgan Stanley was motivated to deceive the private equity firms by its desire to secure future lucrative investment-banking business with Brightline and its private equity owners at Fortress. This includes handling municipal debt transactions for Brightline that could generate ample fees for Morgan Stanley.

In addition to the above-mentioned claims, Certares said that it faced retaliation from Morgan Stanley for objecting to its actions. Last month, MS declined to participate in another unrelated financing deal with Certares because of the Brightline dispute.

The plaintiffs said, “This kind of retaliation is unfair and unbecoming of a global financial institution.”

Morgan Stanley has said that it does not believe in the claims and, hence, would defend itself vigorously.

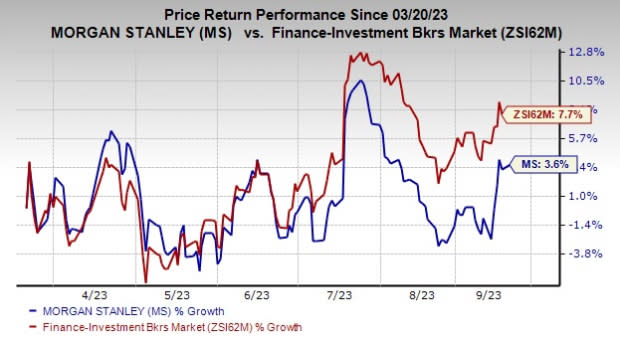

Over the past six months, shares of Morgan Stanley have gained 3.6% compared with the industry’s rise of 7.7%.

Image Source: Zacks Investment Research

Currently, MS carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Misconduct by Other Firms

Last month, The Goldman Sachs Group, Inc. GS was charged with a civil penalty of $5.5 million, per the Commodity Futures Trading Commission’s (“CFTC”) order. The order required GS to cease and desist from committing future violations of the Commodity Exchange Act and CFTC’s record-keeping provisions.

Per CFTC’s findings, GS violated the provisions of a previous order, and failed to appropriately record and retain certain audio files.

In November 2019, Goldman was levied with a civil penalty of $1 million for failure to record the phone lines of its trading and sales desk in January and February 2014 for 20 calendar days. CFTC’s order required the company to cease and desist from further violations of record-keeping regulations.

However, post the 2019 order, Goldman continued to have record-keeping failures, which were in violation of the cease-and-desist provisions. It failed to record and retain audio calls due to failure in its hardware and software systems.

In another case, Mitsubishi UFJ Morgan Stanley Securities Co., a joint venture brokerage, which is 60% owned by Mitsubishi UFJ Financial Group, Inc. MUFG and 40% owned by Morgan Stanley, was sued by retail investors in Japan over the sale of the Additional Tier 1 (AT1) bonds issued by Credit Suisse.

Investors claim that they were not properly informed of the risks involved in the instrument.

Notably, in an effort to address customer demand for portfolio diversification, Mitsubishi UFJ Morgan Stanley Securities sold Credit Suisse’s riskiest bonds earlier this year.

However, when UBS Group AG acquired Credit Suisse, bondholders lost everything because $17 billion of the securities were wiped out. Thus, on behalf of 66 plaintiffs, a lawsuit was filed in the Tokyo District Court, wherein investors demanded 5.2 billion yen ($36 million) in compensation from Mitsubishi UFJ Morgan Stanley Securities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

Mitsubishi UFJ Financial Group, Inc. (MUFG) : Free Stock Analysis Report