Morgan Stanley Says These 3 Stocks Are Top Picks for 2024

There’s just over a month left of 2023, which makes this a good time to figure out what lies in store for investors in 2024. Fortunately, we don’t have to rely on ourselves for this, as the equity strategy team at Morgan Stanley is on the job.

The team, led by chief investment officer Mike Wilson, agrees that there are clouds on the horizon over the near-term namely because earnings forecasts are down, economic data is weaker, and the recent stock market rally seems limited in scope with essentially a group of 7 mega-cap tech firms accounting for most of the S&P 500’s 19% year-to-date gains.

However, over the medium-term, Wilson is confident that as the next year progresses, “near-term uncertainty should give way to an earnings recovery,” with the strategist believing there’s a “richer opportunity set under the surface of the market.” While Wilson notes the risk tied to individual stocks is still high, he thinks it is suggestive of a “stock-picking environment.”

But which stocks should those be? Here the Morgan Stanley analysts can lend a helping hand. They have been singling out some top picks for 2024 and so we decided to give them a closer look. With help from the TipRanks database, we can also find out what the rest of the Street makes of their prospects. Here are the details.

Don’t miss

RBC Sees S&P 500 Reaching 5,000 in 2024; Here Are 2 Stocks to Play the Bounce

TipRanks’ ‘Perfect 10’ List: These 3 Top-Rated Stocks Hit All the Right Marks

Buy these 2 solar stocks, analyst says, forecasting at least 90% upside potential

Delta Airlines (DAL)

We’ll start with one of the airline industry’s legacy carriers, Delta Airlines. This isn’t just a major player in air travel, it is also an important blue-chip stock and a component of the S&P 500 index. Delta is based in Georgia, and its primary operational hub is located in Atlanta. The airline boasts more than 100,000 employees, operates more than 4,000 flights per day world-wide, and can take passengers to upwards of 280 destinations in the Americas, Europe, Asia, Africa, and Australia.

In addition to its Atlanta hub, Delta has offices and hubs in numerous cities around the world, including New York, Detroit, and Los Angeles, Mexico City, London, Amsterdam, Paris, Seoul, and Tokyo. Delta has been recognized as the most on-time airline in the North American market, and expects to carry more than 200 million total passengers for this year.

Like every airline, Delta is highly sensitive to fuel costs, and has cast a worried look at oil prices – which have been rising this year. The increased cost of fuel oil, and of electricity, are reflected in increased refined product costs, including jet fuels. To ameliorate that, Delta is actively involved in developing next-generation solutions toward sustainable air travel.

Nevertheless, in its last quarterly report, from 3Q23, Delta beat the forecasts – an important achievement during a year that featured headwinds. Higher fuel prices and falling consumer sentiment had been expected to bite into Delta’s results – but the $15.5 billion at the top line was a company record for Q3, and beat the forecast by $360 million. At the bottom line, Delta realized non-GAAP earnings per share of $2.03, 8 cents better than had been expected.

Morgan Stanley analyst Ravi Shanker, an airline expert, covers Delta – and he starts off by listing a set of factors that provided support in the earnings report. Shanker wrote, “The strong brand, premium customer demand, metered growth plans, exposure to corporate/international tailwind, partial fuel hedge from the refinery, controlled cost esp. with maintenance costs pulled forward, all put DAL on a path to $7+ EPS in 2024 and potentially $10+ by 2027 (which we expect will be announced at the mid 2024 investor day). At a historical multiple of 8-10x, we think DAL stock should be at least doubled, if not tripled from current levels.”

While the turbulence of the low-end Domestic demand and capacity debates continues to rage, DAL’s earnings power seems to be putting them at a different cruising altitude altogether,” Shanker goes on to add. “Unless consumer demand for travel were to suddenly collapse, we believe the market should gravitate towards DAL’s compounding growth story (esp. with a now-restored dividend and near investment-grade balance sheet).”

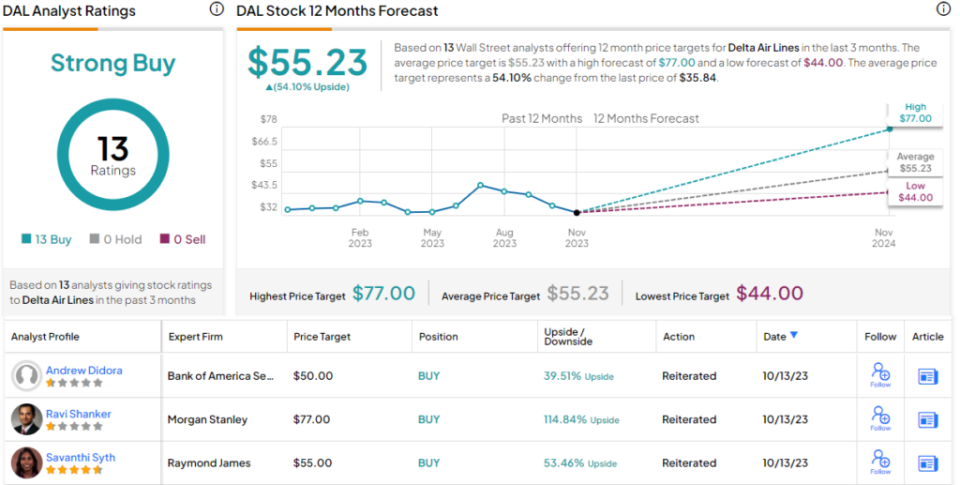

Looking ahead, Shanker puts an Overweight (Buy) rating on Delta’s shares, with a $77 price target that implies a robust gain of 115% for the next 12 months. (To watch Shanker’s track record, click here.)

He’s not alone in his bullish view, either. Delta’s stock features a unanimous Strong Buy consensus rating, based on 13 recent positive analyst reviews. The stock is selling for $35.84, and its $55.23 average price target suggests a potential one-year upside of nearly 54%. (See Delta’s stock forecast.)

Keysight Technologies (KEYS)

Next on our list is Keysight Technologies, a tech firm that provides the tools and instruments behind our tech. Keysight is an important designer and manufacturer of electronic test and measurement equipment and the software that controls it. The company’s product lines include most of the instruments that electronic assembly lines and research labs are likely to need, including oscilloscopes, analyzers, meters, power generators, wireless connectors, and network connectors. The company’s test equipment can be built at benchtop, modular, or field work scales, and covers an enormous array of applications.

Those applications include the communications, automotive, aerospace, healthcare, semiconductor, and finance industries, among many others. Basically, any industry that needs digital apps, network connections, or electronic devices will need testing equipment – and Keysight is there to provide.

Keysight’s own scope, the range and diversity of its product lines and target markets, have given the company a degree of resilience against downturns, although that is not foolproof. Keysight is still subject to ‘boom and bust’ cycles.

For now, the company’s shares have been falling, and guidance published with Keysight’s quarterly results earlier this year failed to impress Wall Street. The stock’s price is down 20% this year. That may be changing, however, as the company’s fiscal 4Q23 beat the expectations across the board – and management said that it was ready for a recovery despite challenging macro-conditions.

At the bottom line, Keysight reported earnings of $1.99 per share by non-GAAP measures. While down from the year-ago print of $2.14 per share, this current result beat the forecast by 12 cents per share. The earnings were derived from total revenues of $1.31 billion. That top line figure was down 9% year-over-year but came in $10 million better than had been anticipated.

The quarterly report caught the attention of analyst Meta Marshall. Covering this stock for Morgan Stanley, Marshall noted the solid Q4 print, and drew investors’ attention to supporting factors, writing, “We were encouraged on FQ4 results by the sequential pickup in orders across both business segments and commentary that there was sequential stability in wireless orders and incremental strength in demand for network and data center applications. Additionally, even as we lower our EISG (electronic industrial solutions group) outlook slightly for FY25, the weakness is largely in general electronics, with signs of life on the semi side of the business as fab pushouts and inventory gets worked through. While ESI inclusion to be more complicated than thought and EISG cuts slightly more than expected, we still think this represents an attractive entry point and this should be the last cut given the diversity of growth drivers, keeping it our top pick.”

For Marshall, this adds up to an Overweight (Buy) rating, with a $165 price target to point toward a gain of 21% on the one-year horizon. (To watch Marshall’s track record, click here.)

Looking at the consensus breakdown, based on 7 Buys, 1 Hold and Sell, each, the stock claims a Moderate Buy consensus rating. The shares are trading for $136.35 and the $155.22 average price target suggests they will increase by 14% in the year ahead. (See Keysight’s stock forecast.)

Natera (NTRA)

We’ll wrap up our list of Morgan Stanley’s top picks with Natera, a biotech firm working with cfDNA, or cell-free DNA testing. This is a class of minimally invasive DNA tests, based on blood draws, that focus the test on naturally occurring free DNA fragments that can be found floating in the bloodstream. Natera is able to capture those fragments, and can use them to conduct various types of genetic testing.

Many different kinds of DNA can be found in the bloodstream at various times, including tumor, fetal, or donor DNA, and Natera’s cfDNA can measure all of these genetic factors for testing purposes. The company’s tests are useful in oncology, women’s health, and organ health, with particular applications in working out cancer diagnoses and treatments as well as organ transplantation and follow-up. The result is better health decisions, based on accurate tests and more individualized care plans.

Prominent among Natera’s tests are the Signatera platform, with is a tumor-specific assay testing for individualized cancer treatments, and the Prospera platform series, which has become a best-in-class rejection assessment testing prior to organ transplantation and is applicable to kidney, heart, and lung procedures. In addition, the company’s Renasight panel can test up to 385 genes associated with chronic kidney disease (CKD).

There is a solid market for less invasive and more accurate medical testing, and Natera has a sound niche in that market. The company’s last earnings report, for 3Q23, showed forecast-beating results. Revenue came in at $268.3 million, $9.2 million better than expected and up an impressive 27% year-over-year. The company’s earnings number, a GAAP bottom-line EPS of 95 cents, was 1 penny better than the forecast.

The combination of sound earnings and in-demand products form the base for Morgan Stanley’s Tejas Savant’s coverage of Natera’s stock. The analyst lays out the strengths of the firm’s testing platforms, and writes, “NTRA remains our favorite SMID-cap name to own, with robust testing volumes already demonstrating significant contributions via Signatera (MRD/IO monitoring, and expansion into new cancer types, with eventual inclusion in NCCN guidelines for CRC representing another source of potential upside) and Prospera (kidney, and now heart, with lung down the road), with further upside presented by Altera (tissue biopsy panel with a ~$6B TAM) and Renasight (particularly following the RenaCARE readout). In addition, the Women’s Health base business continues to handily capture market share, with penetration in average risk NIPT and potential guideline inclusion for microdels and expanded carrier screening providing drivers of additional upside to an already catalyst-rich story.”

Casting an eye to the future, the Morgan Stanley analyst goes on to say, “Longer term, we see NTRA as a best-in-class differentiated platform play, with its early efforts in CRC, and eventually multi-cancer screening (a ~$50B TAM), providing multiple high-value shots-on-goal not currently in Street forecasts.”

Savant rates the shares as Overweight (Buy) backed with a price target of $68 to suggest a 23.5% one-year upside potential. (To watch Savant’s track record, click here.)

The Street’s analysts give this stock’s Strong Buy consensus rating some solid backing, with 11 recent reviews breaking down 10 to 1 in favor of Buys over Holds. The $70.40 average price target implies a 28% one-year increase from the current trading price of $55.04 (See Natera’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.