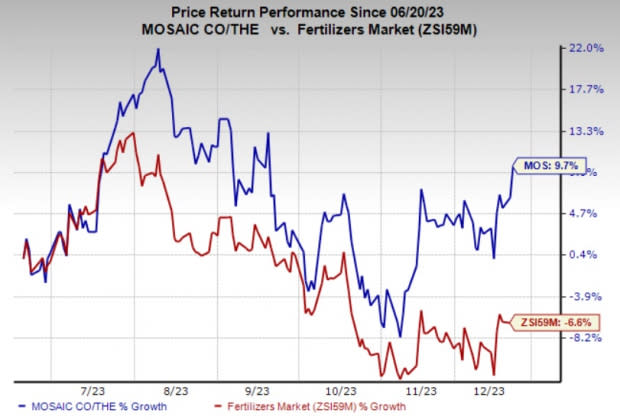

Mosaic (MOS) Shares Up 10% in 6 Months: What's Driving It?

The Mosaic Company's MOS shares have gained 9.7% over the past six months. The company has also outperformed its industry’s decline of 6.6% over the same time frame. Moreover, it has topped the S&P 500’s roughly 8.1% rise over the same period.

Let’s take a look into the factors behind this Zacks Rank #3 (Hold) stock’s price appreciation.

Image Source: Zacks Investment Research

Strong Demand, Cost Actions Drive Mosaic

Mosaic is benefiting from strong demand for phosphate and potash. Higher agricultural commodity prices and attractive farm economics are driving demand for fertilizers globally. Farmer economics remains attractive in most global growing regions on strong crop demand, affordable inputs, and favorable weather.

Demand for grains and oilseeds remains high along with strong farm economics. Strong agricultural commodity pricing trends and improved farmer affordability are likely to drive demand for fertilizers in the balance of 2023. Strong demand is expected to support the company’s sales volumes.

Mosaic is also taking actions to reduce costs amid a still-challenging operating environment. Its actions to improve its operating cost structure through transformation plans are expected to boost profitability.

The company also remains committed to carrying out investments with high returns with moderate capital expenditures, such as the expansion of MicroEssentials capacity at its Riverview facility, constructing a new blending and distribution center in Palmeirante, Brazil and executing the construction of a purified phosphoric acid plant for sale in North America. The company expects total capital expenditures to be $1.3-$1.4 billion for 2023 including roughly $500 million in growth investments.

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and Hawkins, Inc. HWKN.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 56% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current-year earnings has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained around 35% in the past year.

Hawkins has a projected earnings growth rate of 21% for the current year. It currently carries a Zacks Rank #2 (Buy). Hawkins has a trailing four-quarter earnings surprise of roughly 27.5%, on average. HWKN shares have rallied around 91% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Mosaic Company (MOS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report