Mosaic (MOS) Shares Pop 15% in 3 Months: What's Driving It?

The Mosaic Company's MOS shares have shot up 14.8% over the past three months. The company has also outperformed its industry’s rise of 7.9% over the same time frame. Moreover, it has topped the S&P 500’s roughly 4.8% rise over the same period.

Let’s take a look into the factors behind this Zacks Rank #3 (Hold) stock’s price appreciation.

Image Source: Zacks Investment Research

Strong Demand, Cost Actions Drive Mosaic

Mosaic is gaining from strong demand for phosphate and potash amid headwinds from weak fertilizer prices. Higher agricultural commodity prices and attractive farm economics are driving demand for fertilizers globally. Farmer economics remains attractive in most global growing regions on strong crop demand, affordable inputs, and favorable weather.

Demand for grains and oilseeds remains high along with strong farm economics. Strong agricultural commodity pricing trends and improved farmer affordability are likely to drive demand for fertilizers in the balance of 2023. Strong demand is expected to support the company’s sales volumes.

The company also remains committed to carrying out investments with high returns with moderate capital expenditures, such as the expansion of MicroEssentials capacity at its Riverview facility, constructing a new blending and distribution center in Palmeirante, Brazil, executing the construction of a purified phosphoric acid plant for sale in North Americ, and installing a Hydrofloat flotation system at Esterhazy's K2 mill. The estimated total capital expenditures for 2023 are $1.3-$1.4 billion.

Moreover, Mosaic strives to maintain a healthy balance sheet. It aims to return substantial free cash flow to shareholders in 2023.

The company is also taking actions to reduce costs amid a still-challenging operating environment. Its actions to improve its operating cost structure through transformation plans are expected to boost profitability.

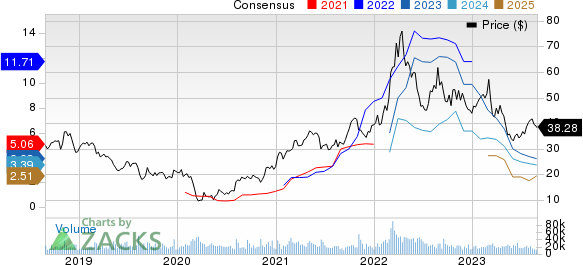

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, Hawkins, Inc. HWKN and PPG Industries, Inc. PPG.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 71% in a year.

Hawkins currently carrying a Zacks Rank #1. It has a projected earnings growth rate of 18.9% for the current year.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 51% in a year.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 3.6% upward over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 7.3%, on average. PPG shares have gained around 9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report